Rates For Commercial Real Estate Loans

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Creating legal documents from the ground up can frequently feel a bit daunting.

Certain cases may require extensive research and significant financial investment.

If you're looking for an easier and more affordable method of preparing Rates For Commercial Real Estate Loans or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters.

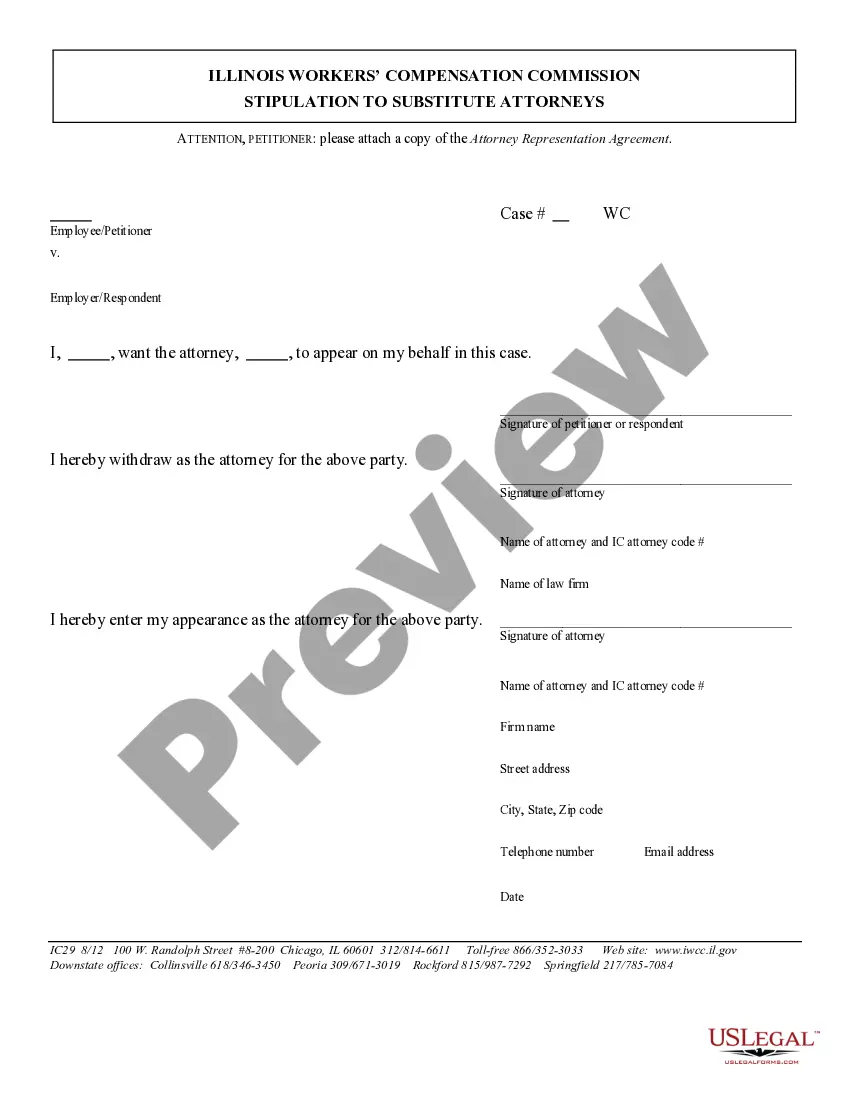

However, before diving directly into downloading Rates For Commercial Real Estate Loans, consider these suggestions: Review the document preview and descriptions to confirm you are on the correct form. Ensure the form you select adheres to the regulations and laws of your state and county. Choose the appropriate subscription option to acquire the Rates For Commercial Real Estate Loans. Download the document. Then complete, verify, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us now and make document execution a seamless and straightforward process!

- With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared for you by our legal professionals.

- Utilize our platform whenever you need a dependable and trustworthy service through which you can effortlessly locate and download the Rates For Commercial Real Estate Loans.

- If you're familiar with our site and have previously created an account with us, simply Log In to your account, find the template, and download it or re-download it at any time in the My documents section.

- Not signed up yet? No problem.

- It requires minimal time to register and browse the library.

Form popularity

FAQ

What is an Acceptable Loan to Value Ratio? Most commercial real estate loan programs allow a maximum loan to value ratio of 75-80%, but some programs differ from this range. Special federal loan programs (e.g. HUD/FHA 223(f)) allow ratios of 83.3-90%. Some private loans will only permit 65-70%.

Some CRE loans have fixed rates, which means the interest rate remains the same throughout the loan's term. However, many commercial real estate loans have variable interest rates. An adjustable interest rate is linked to a market index that swings. The interest rate reset date is specified in the mortgage note.

Banks use the federal funds target rate to determine their loan rates. The prime rate is the federal funds target rate plus three. When the Federal Reserve takes action and raises or lowers the federal funds target rate, the prime rate also changes.

A good interest rate for a small business loan is between 6% and 17%. However, you could expect to pay 35% or higher with a bad credit business loan. Shop around to find the best rate for your credit profile. Make sure to include extra costs like origination and servicing fees.

Today's Commercial Mortgage Rates Multifamily5 Year10 YearCMBS8.02%7.67%Commercial5 Year10 YearBANK7.29%7.36%CMBS8.17%7.82%3 more rows