Employers use this form to establish a production bonus pay program for non-exempt employees when a labor budget is assigned to the job.

Bonus Per Employee Within 90 Days

Description

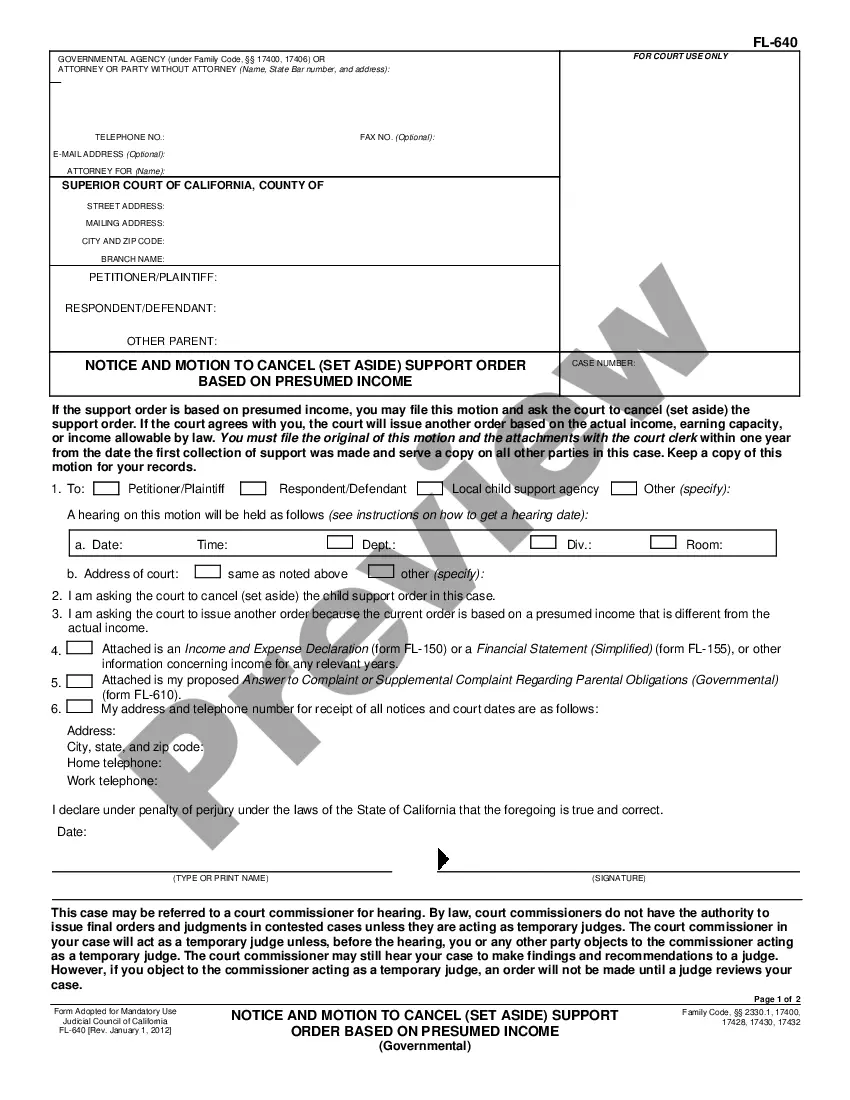

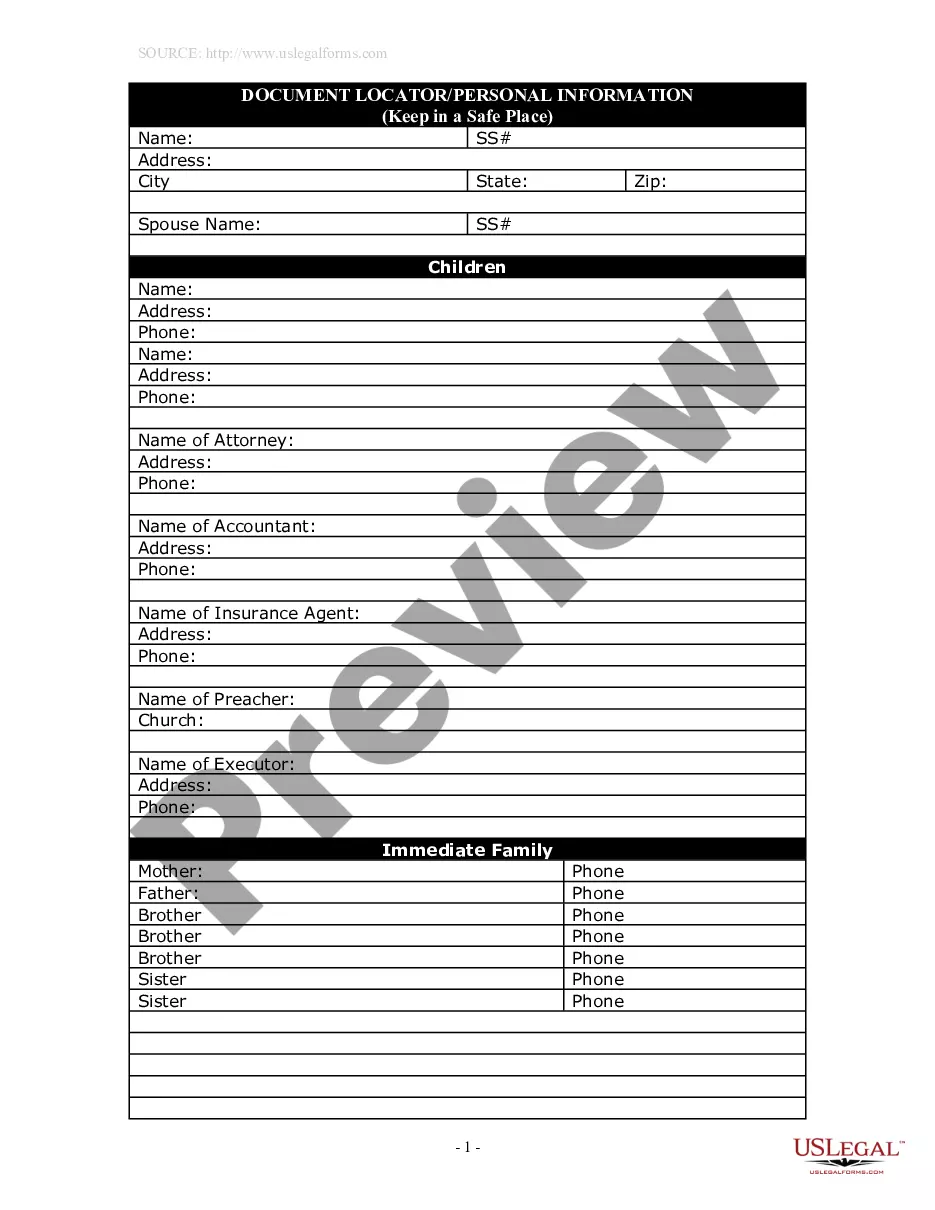

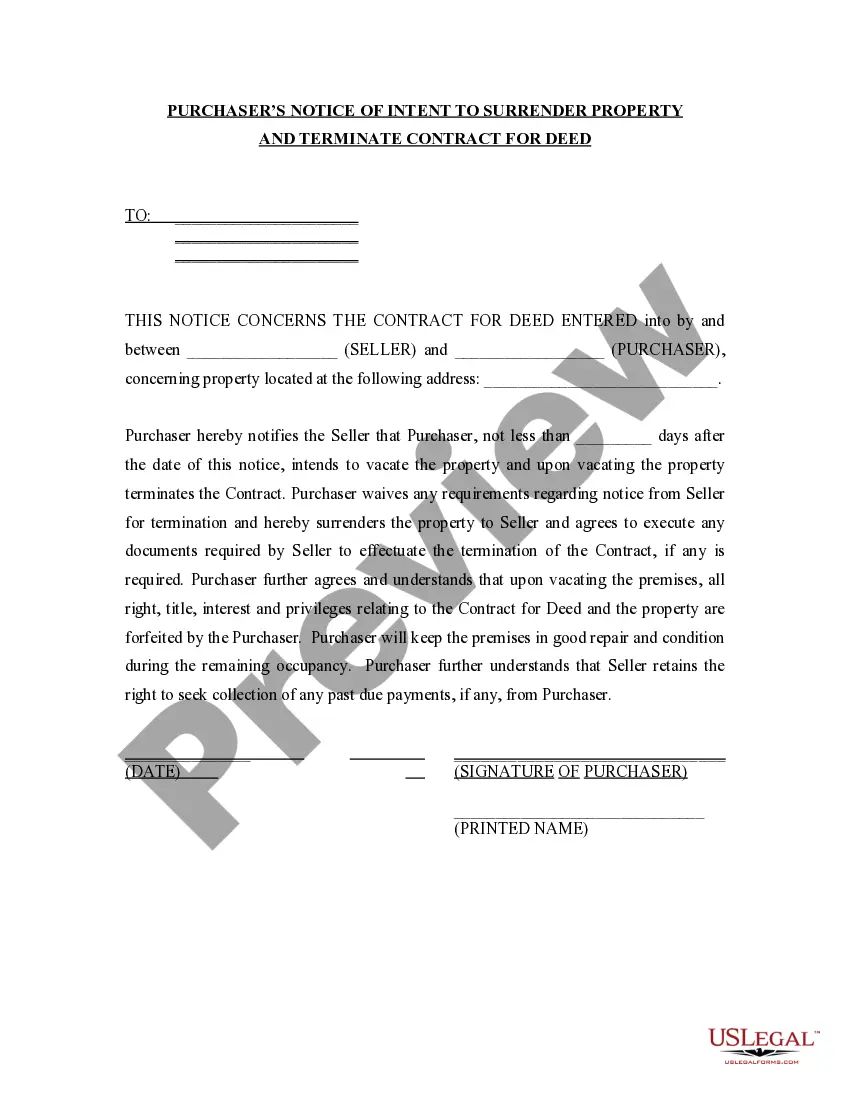

How to fill out California Production Bonus Pay Agreement For Construction?

Obtaining legal document samples that meet the federal and local laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Bonus Per Employee Within 90 Days sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life scenario. They are simple to browse with all files organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when acquiring a Bonus Per Employee Within 90 Days from our website.

Obtaining a Bonus Per Employee Within 90 Days is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Examine the template utilizing the Preview option or via the text outline to make certain it meets your needs.

- Browse for a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Bonus Per Employee Within 90 Days and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

The Act Applies to all Factories and every other establishments, which employs twenty or more workmen. The Payment of Bonus Act, 1965 provides for a minimum bonus of 8.33 percent of wages.

Do the 90 days include work days, calendar days, or something else entirely? Under the law, the 90 days are just that?90 consecutive calendar days. That means weekends and holidays are swept up in the final count.

Examples of calculation of bonus Formula: Basic Salary*8.33% = Bonus per month. Formula: Basic Salary*8.33% = Bonus per month. You can find the attachment on the Payment of Bonus Act, 1965 here. Also read:

The key to distributing bonuses fairly is setting clear performance goals for employees prior to the beginning of any period for which bonuses are awarded. These should be in line with what the employee does on a daily basis, as well as aligned with overall business goals.

Under the law, the 90 days are just that?90 consecutive calendar days. That means weekends and holidays are swept up in the final count. If the 91st day falls on a non-workday, coverage needs to be switched on before that day or on the exact weekend or holiday the 91st falls on.