Employers who provide housing as part of the employment arrangement use this form. It addresses the value of the housing for tax purposes and which, if any, utilities must be paid by the employee.

Housing Agreement With An Employee

Description

How to fill out California Housing Benefit Agreement?

There’s no additional justification to squander time looking for legal documents to meet your local state standards.

US Legal Forms has compiled all of them in a single location and enhanced their availability.

Our platform offers over 85k templates for any business and personal legal matters categorized by state and purpose.

Utilize the Search bar above to find another sample if the current one is not suitable. Click Buy Now next to the template name when you discover the right one. Select the most appropriate subscription plan and create an account or sign in. Process your payment for the subscription using a card or via PayPal to continue. Choose the file format for your Housing Agreement With An Employee and download it to your device. Print the form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing official paperwork under federal and state laws is quick and easy with our platform. Try US Legal Forms today to keep your documentation organized!

- All forms are correctly drafted and validated for authenticity, ensuring you can trust in acquiring a current Housing Agreement With An Employee.

- If you are familiar with our service and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents at any time by opening the My documents tab in your profile.

- If you’ve never used our service before, the procedure will require a few more steps to finalize.

- Here’s how new users can acquire the Housing Agreement With An Employee from our collection.

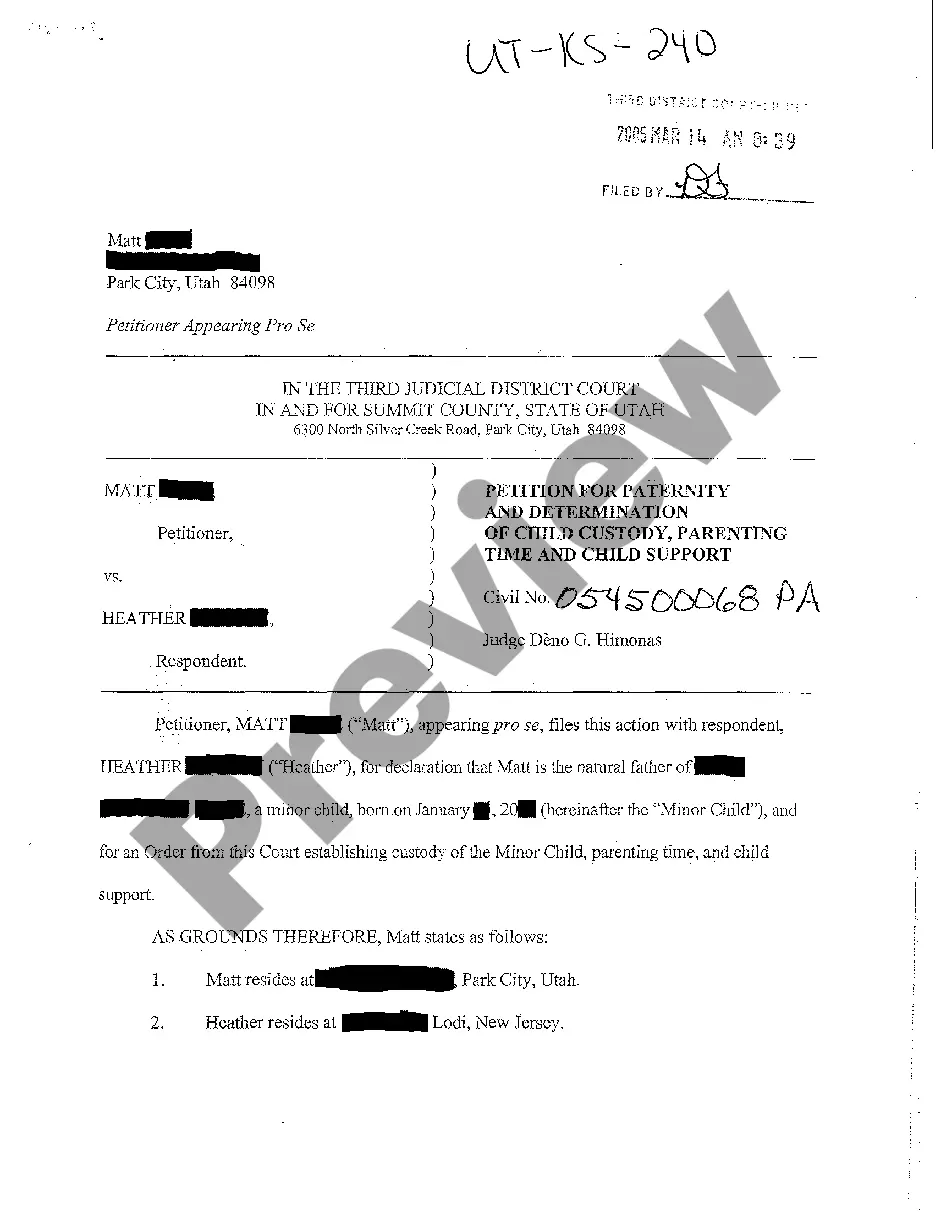

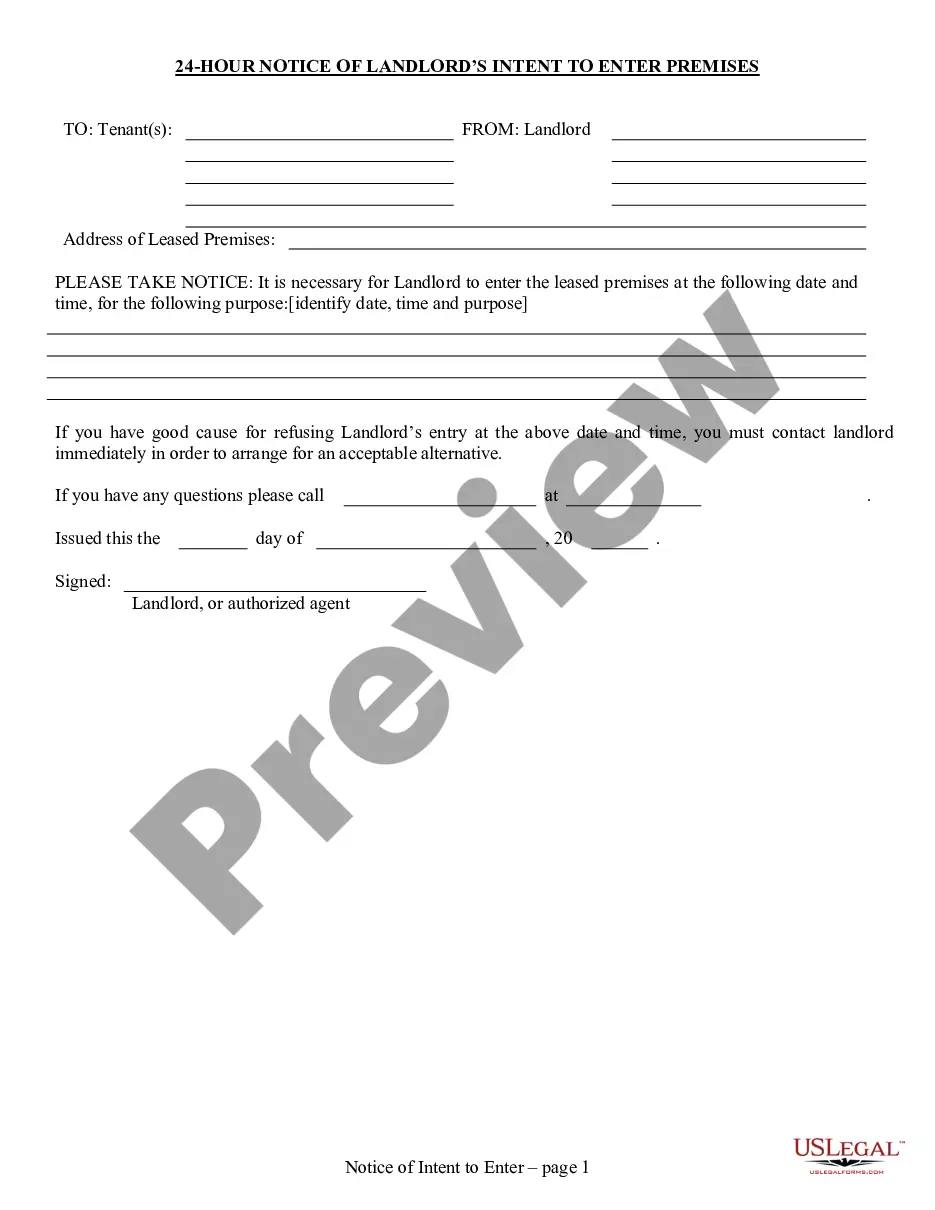

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Common contents of a rental agreement include:Names of the landlord and tenant and/or their agents.Description of the property.Amount of rent and due dates for payment, grace period, late charges.Mode of rent payment.Methods to terminate the agreement prior to the expiration date and charges if any.More items...?15-Mar-2022

The Tamil Nadu Regulation of Rights and Responsibilities of Landlords and Tenants Act, 2017, (TNRRRL) mandates a written rent agreement and its registration, irrespective of agreement's tenure. Registration of rent agreement is mandatory in Tamil Nadu even if the rental period is less than 12 months.

NEW DELHI: A rent agreement is a legal document, also known as contract between the landlord (owner of the property) and tenant for a fixed period of time, that contains the pre-discussed norms and conditions under which the tenant has the temporary possession of the property.

Learn about our editorial policies. Some businesses pay housing expensesthe IRS calls them lodging expensesfor employees. Depending on the circumstances, certain housing and living benefits can be taxable to the employee, and sometimes these benefits can be a deductible business expense for your company.

To ensure the process of registering the rent agreement becomes easier for both the parties, the government has also launched a portal, . The portal will act as a point of registration for both the parties. Here both the parties will be able to create a registration number.