Termination Notice For Tenants

Description

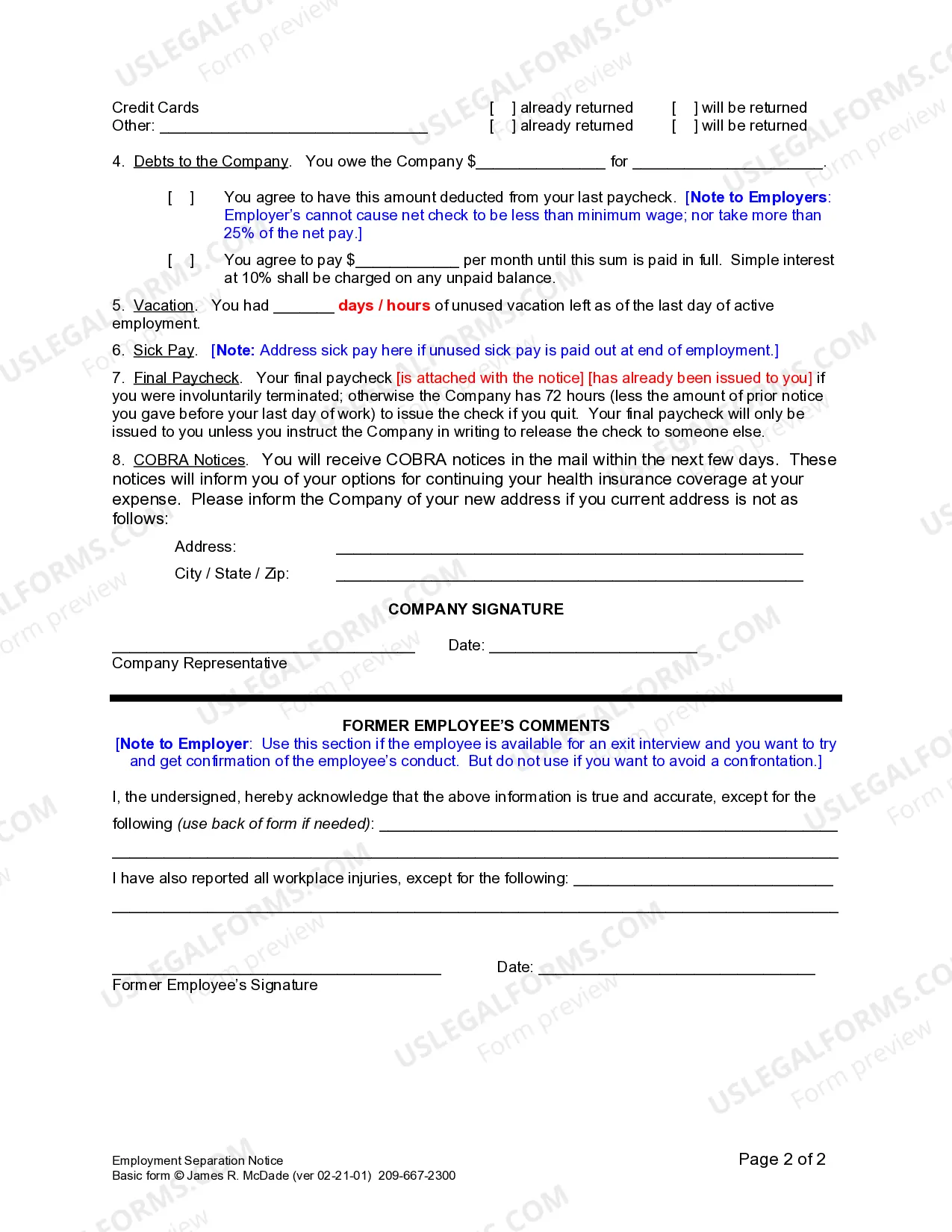

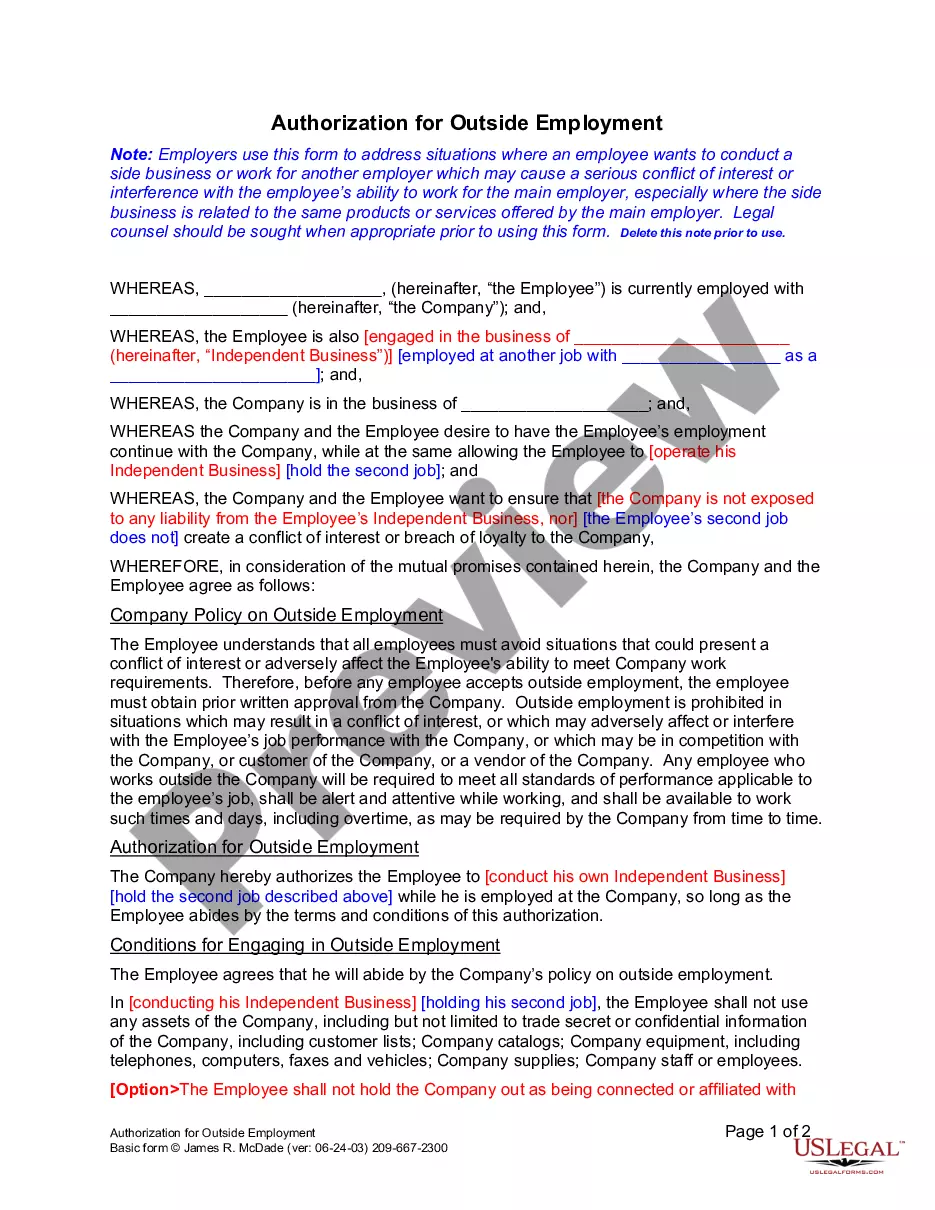

How to fill out California Employment Separation Notice?

Managing legal paperwork can be perplexing, even for the most seasoned experts.

If you are in search of a Termination Notice For Tenants and lack the time to dedicate to finding the appropriate and updated version, the procedures may become overwhelming.

US Legal Forms addresses any requirements you might possess, from individual to corporate documentation, all in one place.

Utilize advanced tools to complete and manage your Termination Notice For Tenants.

Here are the steps to follow after downloading the form you require: Verify that this is the correct document by previewing it and reviewing its details.

- Access a valuable resource library of articles, guides, and handbooks pertinent to your circumstances and requirements.

- Conserve time and effort in locating the paperwork you require, and utilize US Legal Forms' sophisticated search and Review tool to discover Termination Notice For Tenants and acquire it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check out the My documents tab to review the documents you have previously downloaded and to organize your folders as you wish.

- If you’re new to US Legal Forms, create a free account and gain unlimited access to all benefits of the library.

- Implement a powerful web form repository to handle these circumstances efficiently.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible to you at any moment.

- Have the opportunity to utilize state- or county-specific legal and business documents.

Form popularity

FAQ

Purpose of Schedule OR-21 An upper-tier PTE that is a member of an electing PTE will also use Form OR-21 to pass its share of the lower-tier entity's distributive proceeds, addition, and tax credit through to the upper-tier PTE's individual owners. Form OR-21 is filed on a calendar-year basis only.

Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. Enter the business name, federal employer identification number (FEIN), and address in the ?Employer use only? section of Form OR-W- 4.

Payment and other information OQOregon Department of Revenue PO Box 14800, Salem, OR 97309-0920Schedule BOregon Department of Revenue PO Box 14800, Salem, OR 97309-0920WROregon Department of Revenue PO Box 14260, Salem, OR 97309-5060STT-1Oregon Department of Revenue PO Box 14800, Salem, OR 97309-09203 more rows

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

2023 Form OQ - Oregon Quarterly Tax ReportUse this form to determine how much tax is due each quarter for State Income Tax Withholding, Statewide Transit Tax, TriMet and Lane Transit district taxes, Unemployment Insurance, Paid Leave Oregon, and Workers' Benefit Fund.

Sole Proprietorship - The owner's parents, spouse, and children under the age of 18 wages are not subject. Partnership - The partners' wages are not subject. All other employees' wages are subject. Limited Liability Company - The LLC members' wages are not subject.

Forms OR-40, OR-40-P, and OR-40-N can be found at .oregon.gov/dor/forms or you can contact us to order it.

Coupons are mailed in December to employers who do not remit electronically. Form OQ, Oregon Quarterly Combined Tax Report is used to determine how much tax is due each quarter for state unemployment and withholding; the Workers' Benefit Fund; and TriMet and Lane Transit excise taxes.