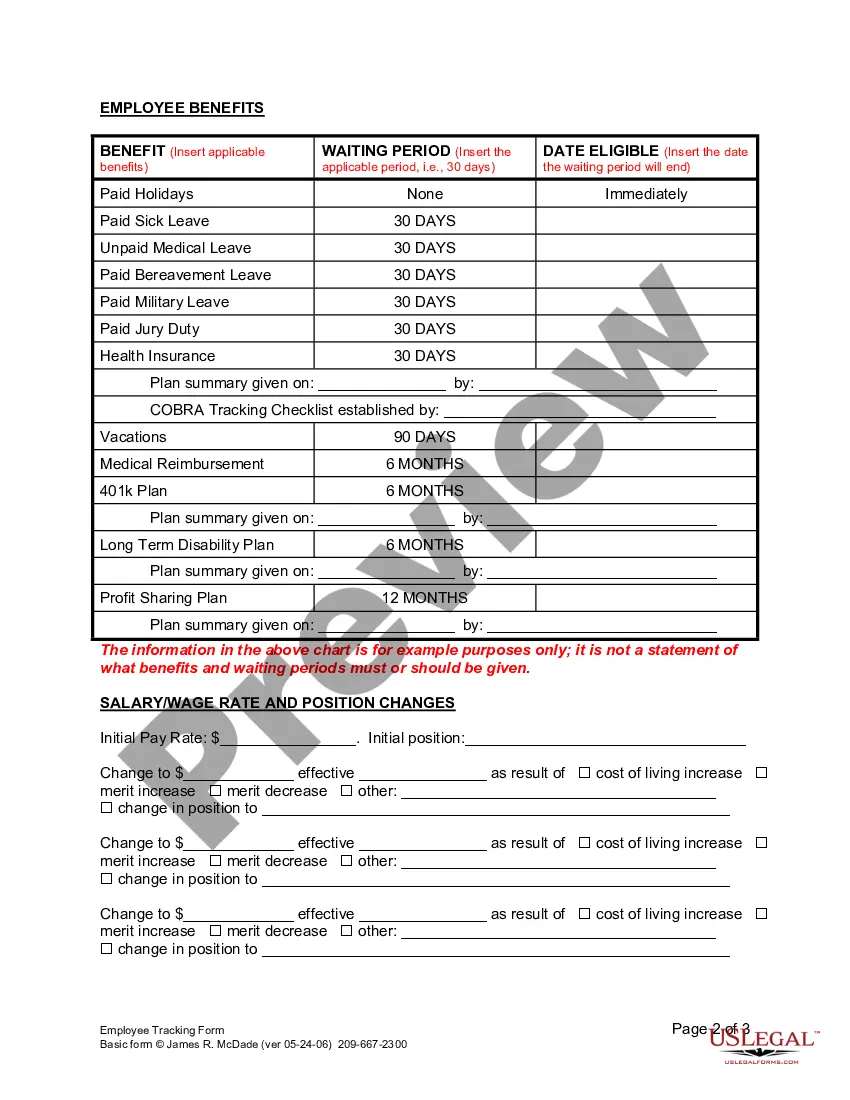

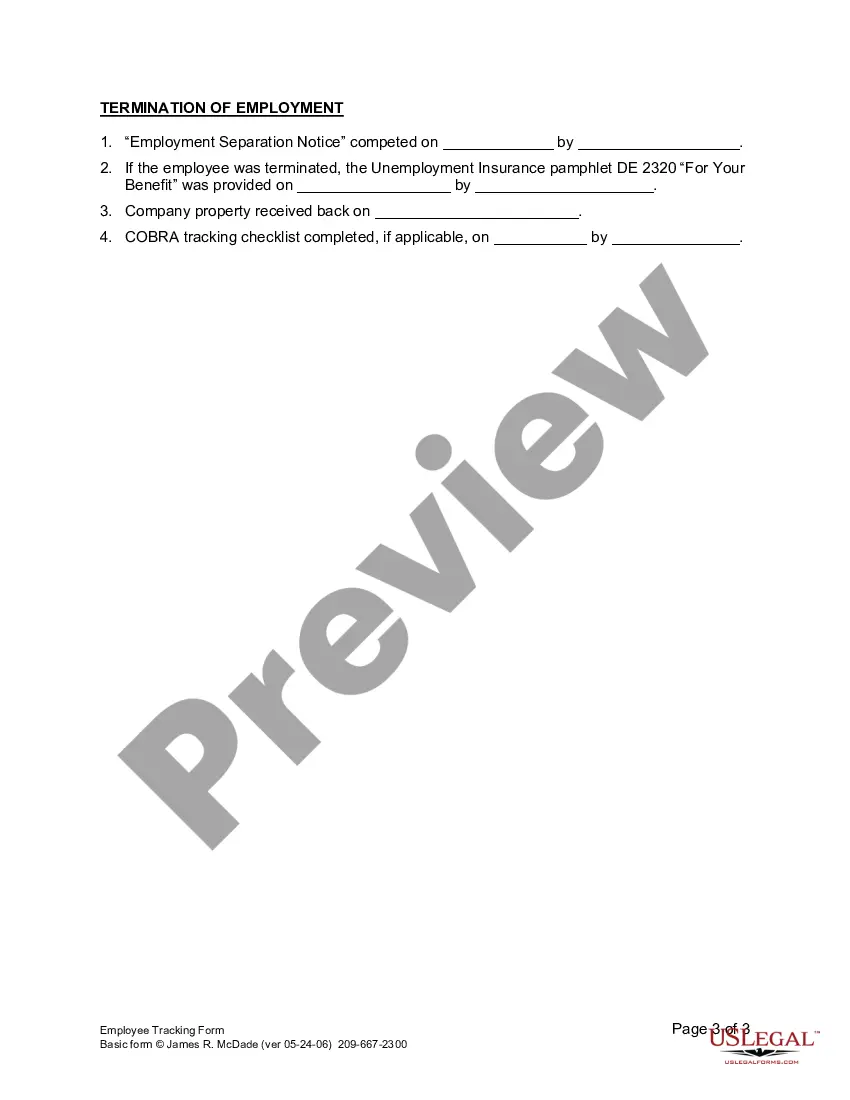

Employers use this form to track the completion of initial orientation and the qualifying for benefits of a new employee.

Employee Tracking Form Withholding

Description

Form popularity

FAQ

The form W-8BEN is used by foreign individuals to certify their foreign status for U.S. tax purposes. This form helps reduce withholding tax on income earned in the United States. If you deal with international employees, using the employee tracking form withholding can help you manage compliance and ensure accurate tax withholding.

Claiming yourself on VA-4 can be beneficial as it allows you to adjust your state tax withholding. By understanding your tax obligations and utilizing the employee tracking form withholding, you can ensure the correct amount is withheld to avoid any surprises at tax time. It's wise to analyze your overall financial scenario before making a claim.

Choosing between 0 or 1 on your W-4 affects how much tax is withheld from your paycheck. Claiming 0 typically results in more tax being withheld, while claiming 1 may reduce withholding. Assess your financial situation to decide what best suits you, and consider using an employee tracking form withholding to keep an eye on your tax situation.

The employee withholding form is a document that allows employees to communicate their withholding preferences to their employer. This form ensures the right amount of federal income tax is withheld from each paycheck. Properly completing this form is essential for effective employee tracking form withholding.

Yes, you can complete form W-4V online through various tax preparation platforms. These platforms often streamline the process, allowing for easy submission and adjustment of your withholding preferences. Utilizing an employee tracking form withholding can help monitor how changes in your withholding affect your paycheck.

Allowances and exemptions are related but not the same. Allowances reduce taxable income, while exemptions claim a specific amount that can lower tax liability. When filling out the employee tracking form withholding, it's crucial to know the difference to ensure proper tax withholding.

Reporting foreign wages on your US tax return involves including your total income in US dollars on Form 1040. You must also claim any foreign tax credits or exclusions applicable to your situation. Using our user-friendly platform, you can effectively handle employee tracking form withholding while keeping your tax records organized and compliant.

Employees working in the US need to complete a W-4 form, which determines the amount of federal income tax withheld from their paychecks. If you have adjustments in your tax situation or multiple jobs, submitting a W-4 form helps you manage your withholding effectively. For enhanced accuracy in tax reporting, utilize our platform to streamline processes related to employee tracking form withholding.

Foreign withholding refers to tax deductions on payments made to non-residents for services or interest earned within a country. This process ensures that the local tax authority receives tax revenue before funds leave their jurisdiction. As a US taxpayer, you may need to complete an employee tracking form withholding to report any foreign withholding accurately on your tax returns.

The withholding tax in the Bahamas is a tax deducted at the source before income reaches an individual or entity. This tax primarily applies to certain income types, such as dividends and interest payments. For US citizens and residents, understanding withholding tax can assist in accurately filling out an employee tracking form withholding, ensuring compliance with both US and Bahamian tax regulations.