Tax Deduction For Debt Forgiveness

Description

How to fill out California Authorization For Deduction From Pay For A Specific Debt?

Regardless of whether it's for commercial reasons or personal concerns, everyone must confront legal issues at some stage in their life.

Completing legal documents necessitates meticulous care, beginning with choosing the suitable form template.

With a comprehensive US Legal Forms catalog at your disposal, you need not waste time sifting through the internet for the appropriate sample. Leverage the library’s user-friendly navigation to locate the right template for any circumstance.

- For example, if you select an incorrect version of a Tax Deduction For Debt Forgiveness, it will be rejected once submitted.

- Thus, it is essential to find a trustworthy source of legal documents such as US Legal Forms.

- Should you need to acquire a Tax Deduction For Debt Forgiveness template, follow these straightforward steps.

- Retrieve the form you require using the search function or catalog browsing.

- Review the form’s details to ensure it corresponds with your case, state, and locality.

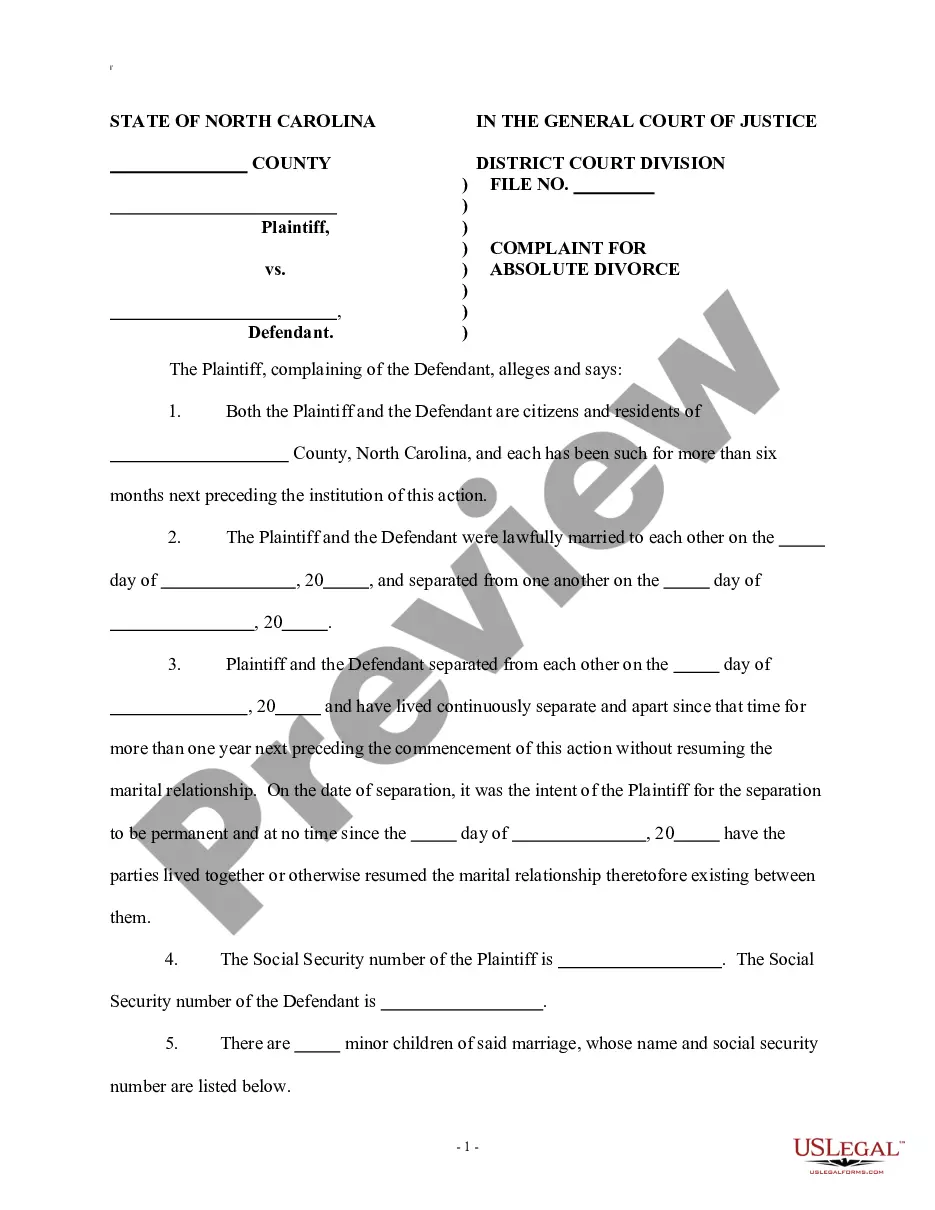

- Click on the form's preview to view it.

- If it is not the correct document, return to the search feature to find the Tax Deduction For Debt Forgiveness form you need.

- Obtain the template if it fits your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can purchase the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Tax Deduction For Debt Forgiveness.

- Once it is saved, you can fill out the form using editing software or print and complete it manually.

Form popularity

FAQ

Even if you can exclude a forgiven debt from your taxable income, you may still get a 1099-C form. If this happens, you'll use Form 982 to report the amount to exclude from your gross income based on your circumstances. Once you know how much canceled debt to include as income, you will put that amount on Form 1040.

After a debt is canceled, the creditor may send you a Form 1099-C, Cancellation of Debt showing the amount canceled and date of cancellation. Contact the creditor if you receive a 1099-C reflecting incorrect information.

Generally, if you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt.

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. If taxable, you must report the canceled debt on your tax return for the year in which the cancellation occurred.

In most situations, if you receive a Form 1099-C, "Cancellation of Debt," from the lender that forgave the debt, you'll have to report the amount of cancelled debt on your tax return as taxable income.