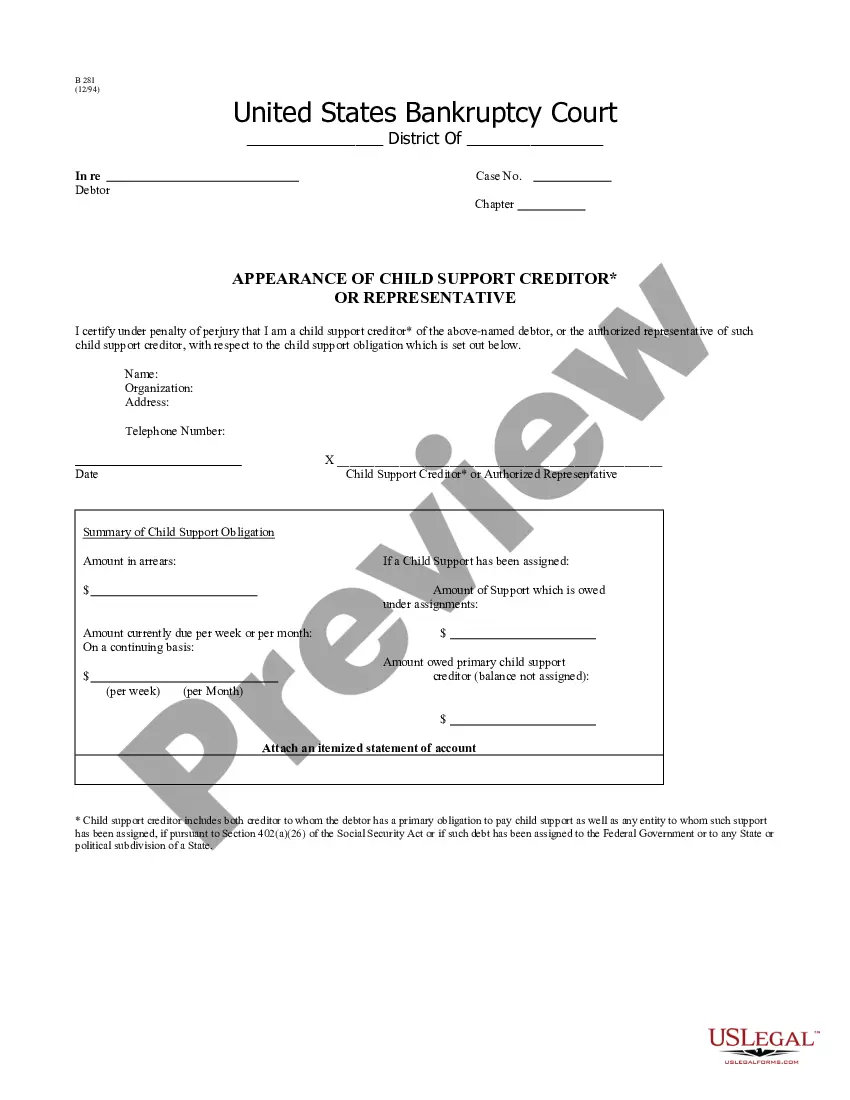

California Guideline Child Support Withholding

Description

How to fill out California Non-Guideline Child Support Findings Attachment?

Bureaucracy requires exactness and correctness.

Unless you deal with completing documents like California Guideline Child Support Withholding regularly, it may result in some confusion.

Choosing the appropriate template right from the start will guarantee that your document submission proceeds smoothly and avoid any troubles of re-submitting a file or performing the same task from the beginning.

If you're not a subscribed user, finding the necessary template will require a few additional steps: Find the template using the search bar, Confirm that the California Guideline Child Support Withholding you have found is applicable for your region, Review the preview or view the description containing details about using the sample, If the result matches your search, click the Buy Now button, Choose the correct option among the available subscription plans, Sign in to your account or create a new one, Finalize the purchase using a credit card or PayPal, Receive the form in the file format of your choice. Locating the right and updated samples for your paperwork is a mere matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your form handling.

- You can always find the appropriate template for your paperwork in US Legal Forms.

- US Legal Forms is the largest online collection of forms housing over 85 thousand samples for various domains.

- You can acquire the latest and most suitable version of the California Guideline Child Support Withholding by simply searching for it on the website.

- Search for, store, and save templates in your profile, or consult the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can easily get, keep in one place, and browse through the templates you save to access them with just a few clicks.

- While on the site, click the Log In button to sign in.

- Then, navigate to the My documents page, where your document history is maintained.

- Browse through the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

Yes, there is a time limit to file for child support in California. Generally, a parent can seek support anytime before the child turns 18 or 19 if they are still in high school. Keep in mind that the timing for filing back child support claims may vary. To ensure you meet all deadlines, using uslegalforms can help you track necessary dates and provide guidance.

In California, child support payments are generally not considered taxable income. Recipients do not need to report child support as income on their tax returns. However, any back child support owed may have its own implications. For clarity on your tax situation, explore resources or consult a professional.

To file for back child support in California, gather all relevant documentation, such as proof of income and records of unpaid support. You will need to fill out specific forms to initiate the process. Submitting these forms through the court promptly is crucial. For a seamless experience, consider using uslegalforms, which simplifies the filing procedure.

In California, you can typically claim child support arrears dating back to when the support order was established. The court might allow you to collect unpaid amounts going back several years. It's important to stay informed about the specific time limits that apply to your situation. Utilizing uslegalforms can help clarify these details and assist you in filing your claims.

Yes, you can file for back child support in California. If you have missed payments, the California guideline child support withholding process allows you to seek a court order for those unpaid amounts. You may need to provide documentation of the missed payments and show that they are due. Consider using resources like uslegalforms to guide you through the necessary paperwork.

Guideline child support in California refers to the standard calculation used to determine the amount of child support obligations based on the income of both parents and the time each parent spends with the child. This system aims to provide a fair and reasonable support amount, ensuring children receive the necessary resources from both parents. Understanding the intricacies of California guideline child support withholding can help parents meet their obligations efficiently.

In California, the limit for child support withholding typically aligns with federal guidelines, which do not allow more than 50% of disposable earnings to be withheld for child support if the parent is supporting another family. For parents who are not supporting another family, this limit can be as high as 60%. Understanding these limits is crucial to ensure compliance and avoid penalties. For further guidance, US Legal Forms provides resources and tools to assist you in understanding withholding limits.

The new guidelines for child support in California reflect adjustments to income and living expenses that affect support calculations. These guidelines account for various factors, including shared parenting responsibilities and reasonable living costs in specific regions. Adapting to these new regulations can be challenging; however, platforms such as US Legal Forms offer tools and information to help you navigate these new guidelines effectively.

The new child support law in California modifies certain aspects of how support is calculated and enforced. It aims to ensure that the financial needs of children are met while being fair to both parents. Under these changes, factors like income adjustments and medical expenses are taken into account. Staying informed about these changes is vital, and resources like US Legal Forms can help you understand how they affect your situation.

In California, the standard child support percentage is set by guidelines based on the income of both parents. Generally, the percentage is 20% of gross income for one child, 25% for two children, and decreases slightly for additional children. It is essential to know these percentages as they help determine the financial responsibilities of each parent. Using platforms like US Legal Forms can assist you in navigating these calculations effectively.