Small Estate In Texas

Description

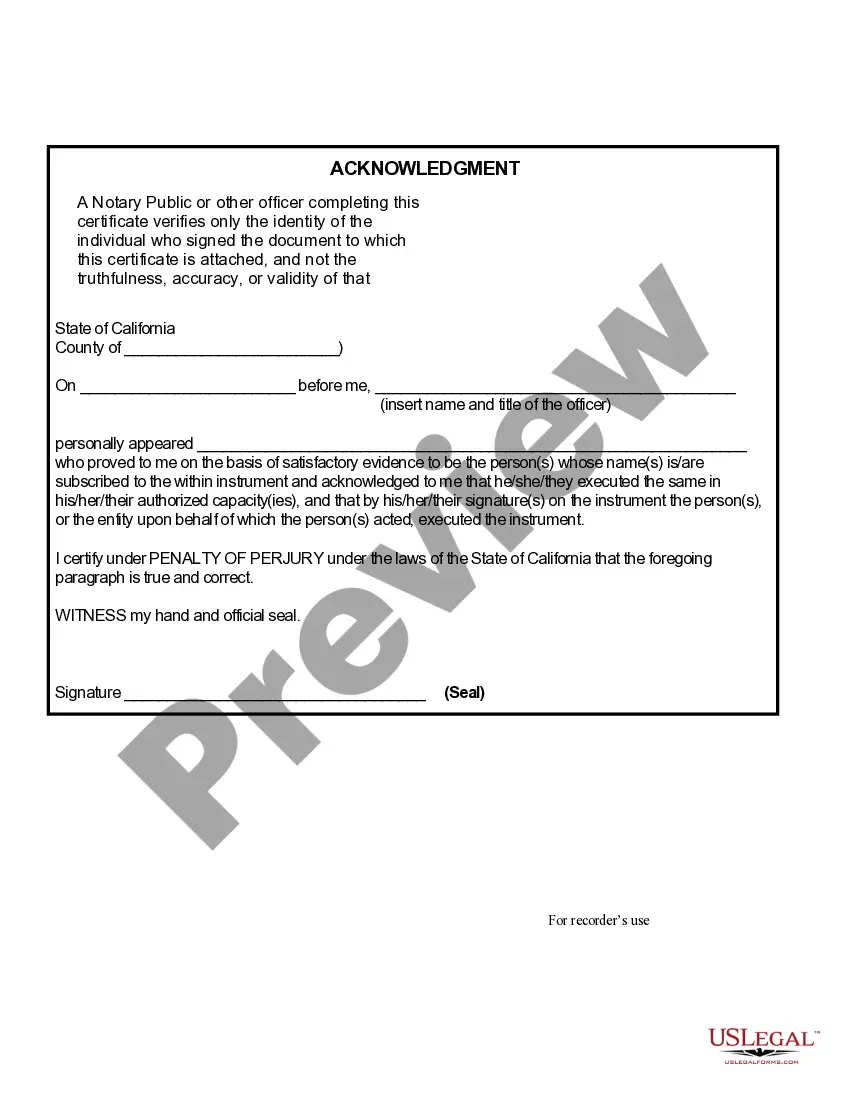

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $208,850?

Whether for professional reasons or for personal matters, everyone must confront legal circumstances at some point in their lives.

Completing legal documents demands meticulous care, beginning with selecting the appropriate form template.

With a comprehensive library of US Legal Forms available, you won't waste time searching for the correct template online. Take advantage of the library's straightforward navigation to find the right document for any occasion.

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the description of the form to confirm it aligns with your situation, jurisdiction, and locality.

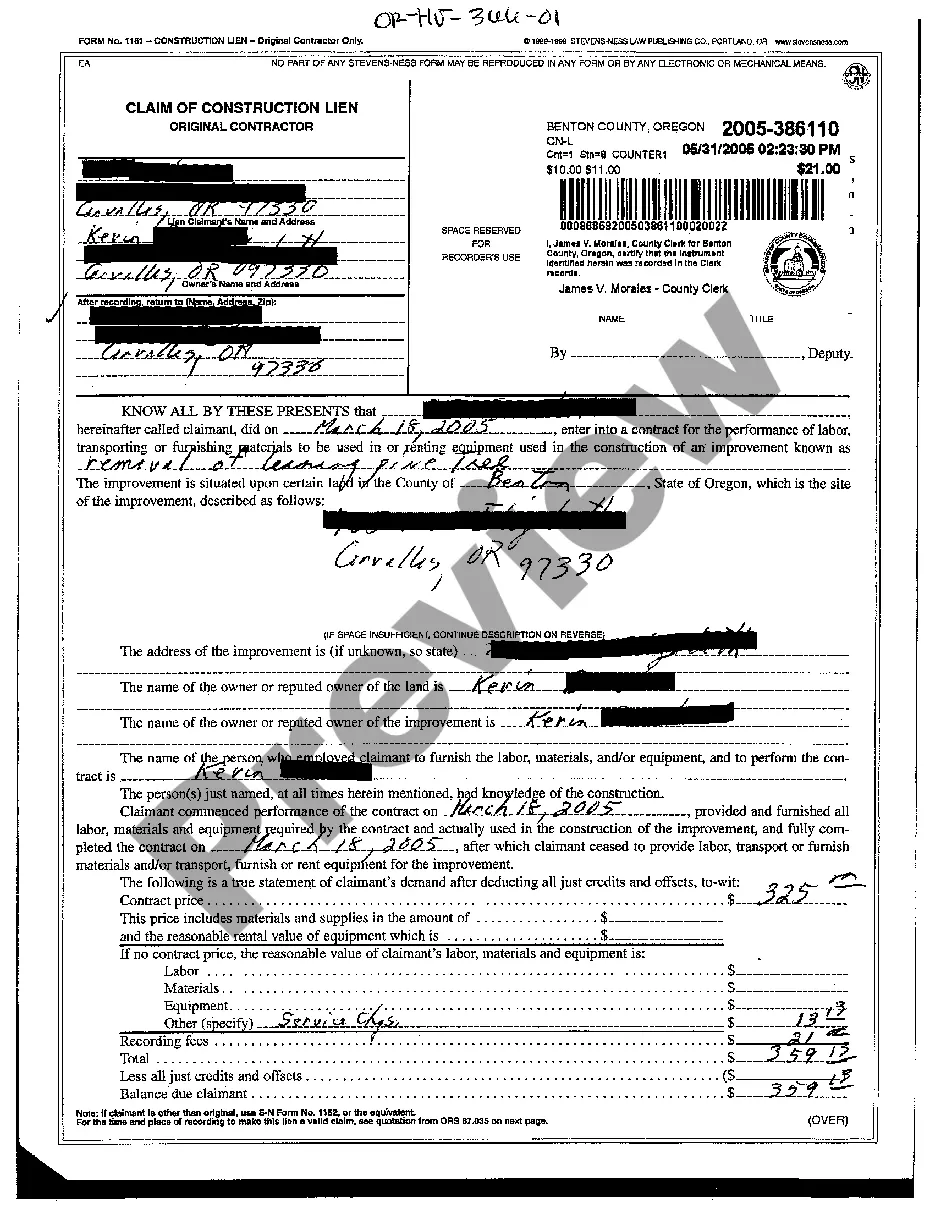

- Click on the preview of the form to examine it.

- If it is not the correct form, return to the search tool to locate the Small Estate In Texas template you seek.

- Acquire the document if it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved forms in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the suitable pricing plan.

- Fill out the registration form for your profile.

- Select your method of payment: you can use a credit card or PayPal account.

- Choose the desired file format and download the Small Estate In Texas.

- Once downloaded, you can complete the form using editing software or print it out and finish it by hand.

Form popularity

FAQ

Yes, an estate can be settled without probate in Texas under certain conditions. If the total value of the estate is below the small estate threshold of $75,000, you may be able to use an affidavit to transfer assets. This approach provides a more streamlined method for handling a small estate in Texas. Additionally, using uslegalforms can help simplify the necessary paperwork and ensure everything is completed correctly, allowing you to focus on what matters most.

In Texas, the small estate threshold is set at $75,000. This means that if the total value of the deceased's assets, excluding certain items like homestead and exempt property, is less than this amount, you may qualify for a simpler process. This process allows you to settle a small estate in Texas without going through formal probate. It can save time and reduce costs, making it an excellent option for many families.

A small estate in Texas is typically an estate valued at $75,000 or less, excluding homesteads and exempt assets. This classification allows for simpler and faster distribution of the decedent's property without extensive court involvement. Ensure to evaluate your individual circumstances and assets to determine if your estate qualifies as a small estate in Texas.

Filling out the small estate affidavit involves providing detailed information about the deceased and their assets. You must include the names of the heirs, the estimated value of the estate, and information about any debts. The US Legal Forms platform offers templates and step-by-step guidance, making it easier for you to complete the small estate affidavit accurately.

You can avoid probate with a small estate in Texas by utilizing a small estate affidavit. This legal document allows heirs to claim property without going through formal probate proceedings. By completing and filing this affidavit with the court, heirs can gain access to the assets of the small estate in Texas quickly and efficiently.

To qualify as a small estate in Texas, the total value of the estate must be less than $75,000, excluding certain types of property, such as homesteads and exempt property. Additionally, there can be no pending claims against the estate. It's important to gather documentation and evaluate all assets properly to ensure compliance with these requirements.

The time frame for obtaining a small estate affidavit in Texas can vary, but generally, the process can be completed within a few weeks if all documents are in order. After filing, expect a short waiting period for approval from the court. It is advisable to ensure complete and accurate information to avoid any delays in settling a small estate in Texas. Using streamlined services, like those provided by uslegalforms, can help expedite your filing.

You do not necessarily need a lawyer to file a small estate affidavit in Texas, but having legal guidance can simplify the process. Many individuals successfully complete this step on their own, provided they understand the requirements and have all the necessary documents ready. However, consulting with a professional can help you navigate any complex scenarios surrounding a small estate in Texas.

In Texas, a small estate is defined as one that has a total value of $75,000 or less, excluding certain property types like homesteads and exempt belongings. This definition allows for a more straightforward probate process. Moreover, using a small estate affidavit can help expedite asset distribution without the lengthy probate court procedures. Understanding these qualifications can help you determine if you can utilize options for a small estate in Texas.

Yes, banks in Texas typically accept a small estate affidavit as valid legal documentation. This affidavit serves as proof of the authority to access the deceased's funds. However, it's essential to check with the specific bank, as policies may vary. Providing a properly completed affidavit can streamline the process of settling a small estate in Texas.