Sample Addendum To Living Trust For Tax Purposes

Description

How to fill out California Amendment To Living Trust?

Working with legal paperwork and operations could be a time-consuming addition to your day. Sample Addendum To Living Trust For Tax Purposes and forms like it typically require you to look for them and understand the way to complete them effectively. Consequently, regardless if you are taking care of financial, legal, or individual matters, using a thorough and hassle-free online library of forms close at hand will go a long way.

US Legal Forms is the top online platform of legal templates, featuring over 85,000 state-specific forms and a number of resources that will help you complete your paperwork effortlessly. Explore the library of relevant papers available with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Safeguard your papers administration procedures using a high quality service that allows you to make any form in minutes without any extra or hidden charges. Just log in to your profile, find Sample Addendum To Living Trust For Tax Purposes and acquire it immediately in the My Forms tab. You may also access previously saved forms.

Is it your first time utilizing US Legal Forms? Register and set up an account in a few minutes and you will get access to the form library and Sample Addendum To Living Trust For Tax Purposes. Then, adhere to the steps below to complete your form:

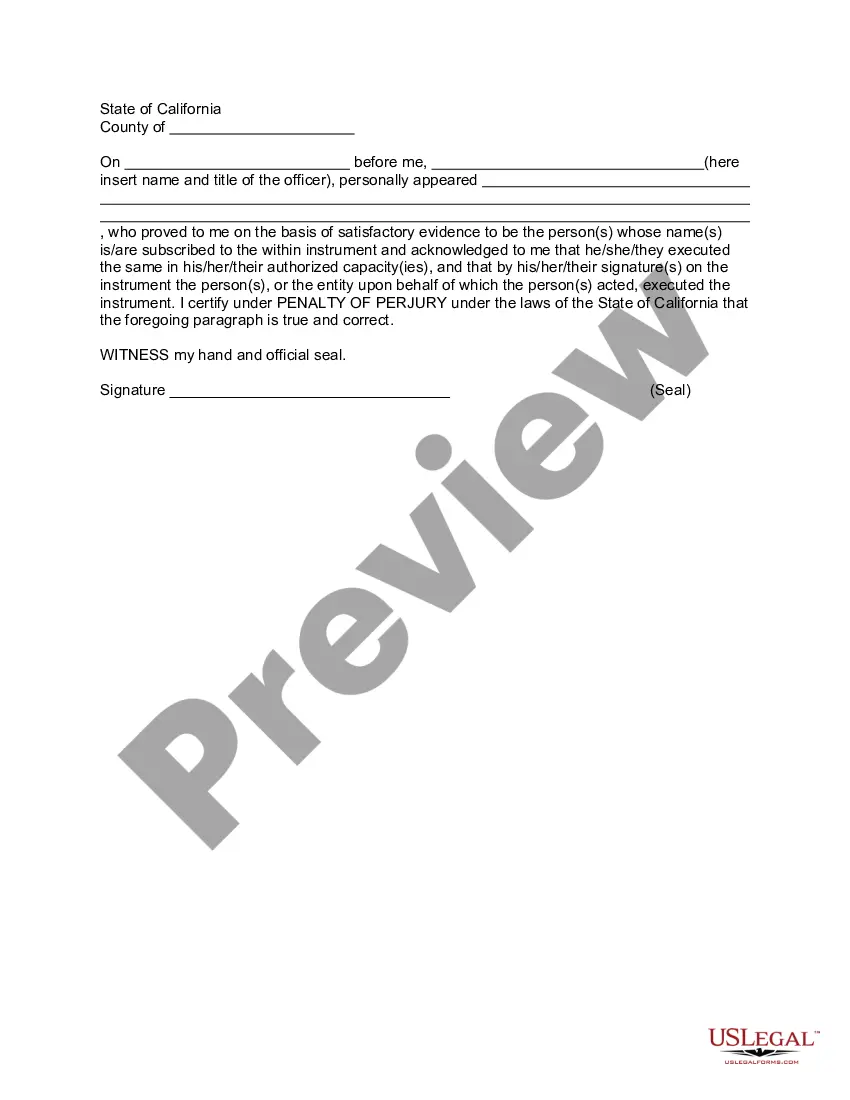

- Be sure you have the right form using the Preview option and reading the form information.

- Pick Buy Now when all set, and choose the subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise assisting users control their legal paperwork. Find the form you need right now and enhance any operation without having to break a sweat.

Form popularity

FAQ

For example, you might use a trust amendment form to: Update your trustee or successor trustee: If your chosen trustee is no longer willing or able to manage the trust, or you'd like to designate someone else, you can use an amendment form to name another person or organization to manage your trust.

For example, a trust provision may stipulate that upon the death of the grantor, if all her children are over the age of 30, the trust assets are to be distributed equally amongst them, while if some are under the age of 30, then the trust does not terminate until the youngest reaches that age.

?A Restatement? is also an amendment, but of the whole trust instrument, not just of the handpicked parts of the trust, like in the ?Amendment? described above. So a Restatement would say ?I hereby take my entire trust named TRUST dated DATE and replace it with this whole new trust named TRUST dated TODAY'S DATE.?

(California Probate Code §15401-15402). The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.

For example, a trust provision may stipulate that upon the death of the grantor, if all her children are over the age of 30, the trust assets are to be distributed equally amongst them, while if some are under the age of 30, then the trust does not terminate until the youngest reaches that age.