Amending Trust California Withholding Tax

Description

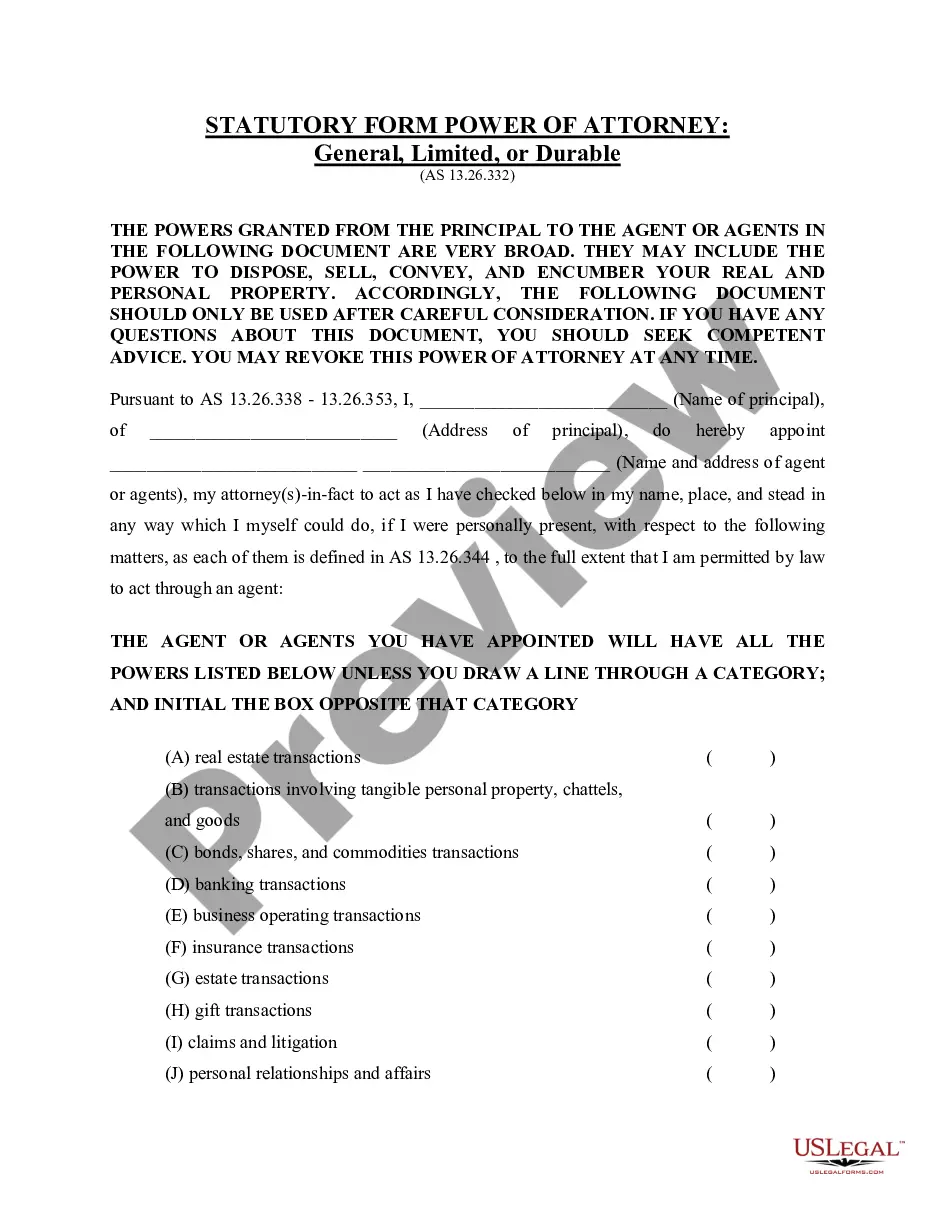

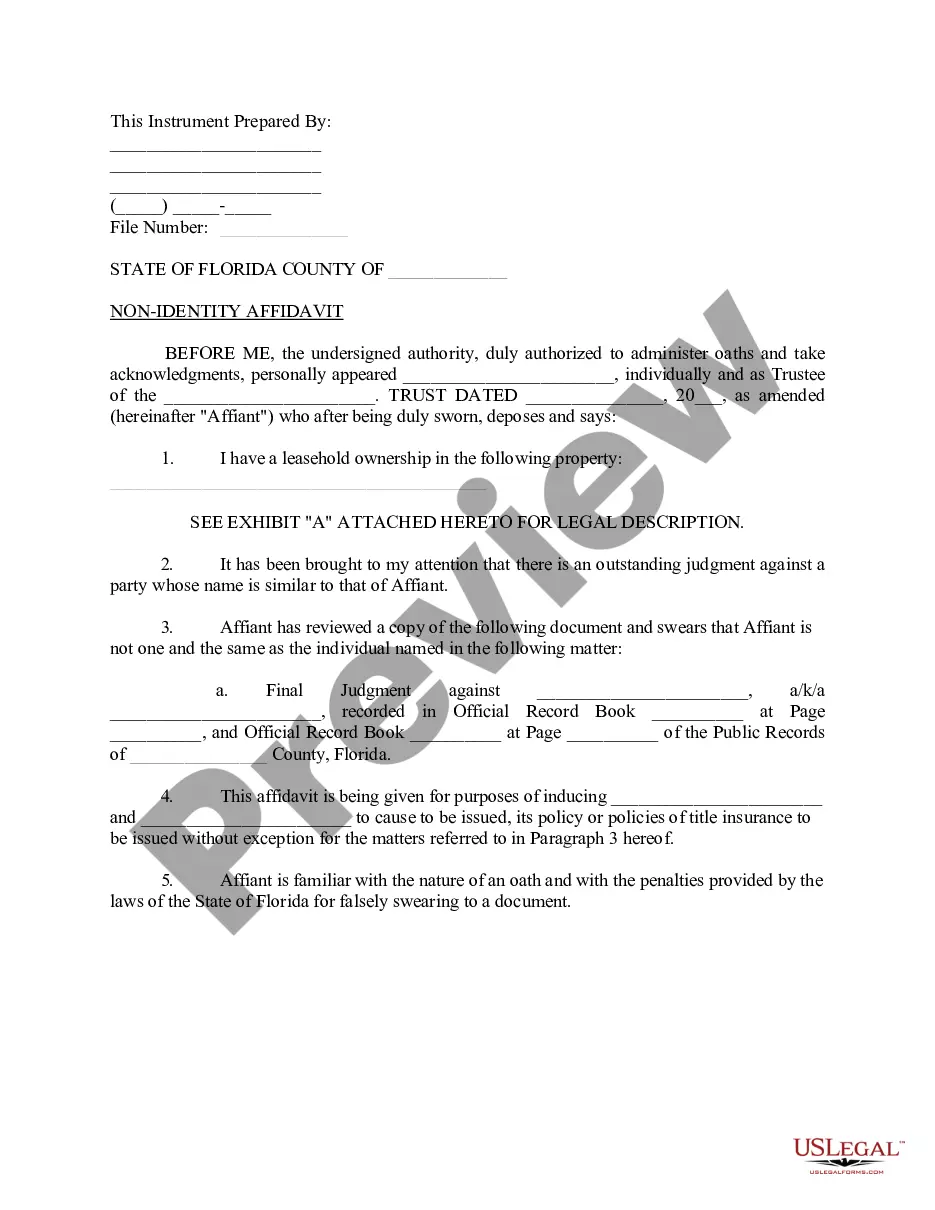

How to fill out California Amendment To Living Trust?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more economical method of drafting Amending Trust California Withholding Tax or any other paperwork without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

Examine the form preview and descriptions to confirm that you have located the correct document. Verify if the template you select meets the standards of your state and county. Select the appropriate subscription plan to acquire the Amending Trust California Withholding Tax. Download the document, then complete, sign, and print it. US Legal Forms enjoys an impeccable reputation and over 25 years of expertise. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can promptly acquire state- and county-specific forms meticulously prepared by our legal professionals.

- Utilize our site whenever you require dependable and trustworthy services to swiftly locate and obtain the Amending Trust California Withholding Tax.

- If you’re familiar with our platform and have already established an account, simply Log In, select the form, and download it, or retrieve it later in the My documents section.

- Not yet a member? No problem. It only takes a few minutes to register and browse the library.

- However, before proceeding to download Amending Trust California Withholding Tax, consider these suggestions.

Form popularity

FAQ

Tax Due Amendment Return: Complete a new Form CA 540 or 540NR and attach a completed Schedule X to the Form.

Tax withheld on California source income is reported to the Franchise Tax Board (FTB) using Form 592. Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts.

Purpose. Use Form 593: Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's loss or zero gain for withholding purposes and to calculate an alternative withholding calculation amount.

Withholding ? Withholding cannot be distributed to the beneficiaries. It must be refunded to the trust or estate.

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.