California Living Trust Sample For Idaho

Description

How to fill out California Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

Creating legal documentation from the ground up can frequently feel overwhelming.

Some situations may require extensive investigation and substantial financial investment.

If you're looking for a simpler and more cost-effective method of producing California Living Trust Sample For Idaho or any other paperwork without unnecessary hurdles, US Legal Forms is readily available.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously prepared by our legal professionals.

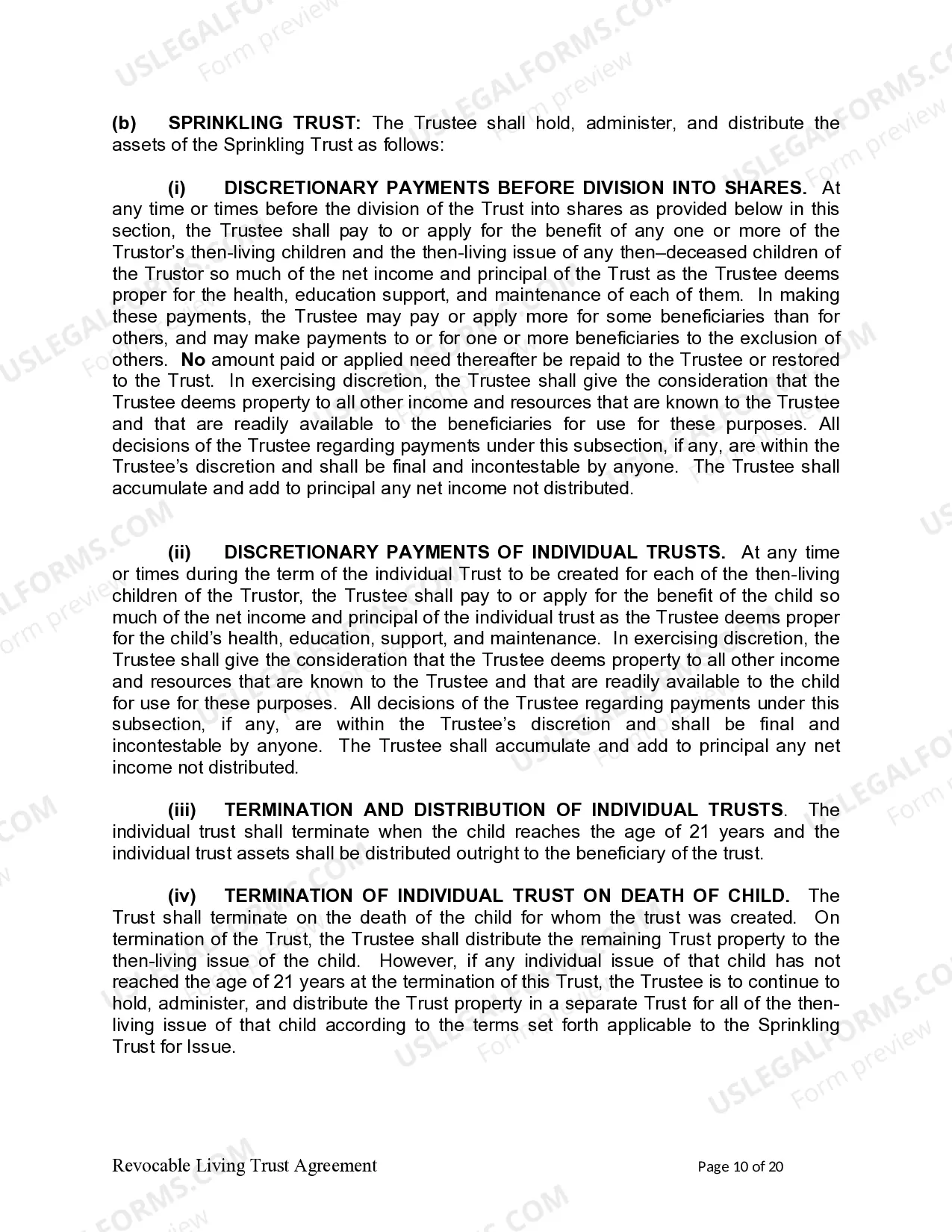

Review the form preview and descriptions to confirm you are on the correct form. Ensure the form you choose aligns with your state and county's rules and regulations. Select the appropriate subscription plan to acquire the California Living Trust Sample For Idaho. Download the document, then complete, validate, and print it. US Legal Forms maintains an impeccable reputation and over 25 years of experience. Join us now and make document completion a straightforward and efficient process!

- Utilize our website whenever you need dependable services to easily locate and download the California Living Trust Sample For Idaho.

- If you’re familiar with our offerings and have previously registered, simply Log In to your account, choose the template, and download it or re-download it anytime in the My documents section.

- Unsure if you have an account? No problem. Establishing one is quick and straightforward for navigating the library.

- Before diving into downloading California Living Trust Sample For Idaho, follow these guidelines.

Form popularity

FAQ

Yes, your California living trust can be valid in another state, including Idaho, as long as it complies with that state's laws. Using a California living trust sample for Idaho can assist in ensuring that your trust meets the local requirements. It's important to confirm that the relationship between your trust and the new state's regulations is sound. Consulting with a legal professional can help you navigate any potential complexities.

To set up a living trust in Idaho, start by gathering relevant information, such as your assets and beneficiaries. Next, you can utilize a California living trust sample for Idaho as a guideline to create your trust document. It’s crucial to define the terms of the trust clearly and consult with a legal advisor if necessary. Finally, you'll need to fund the trust by transferring ownership of your assets into it.

To obtain a copy of a living trust in California, you typically need to check with the estate's trustee or the attorney who drafted the trust. If you reside in Idaho and seek a California living trust sample for Idaho, utilizing resources like US Legal Forms can simplify the process. You can easily access templates and guidance tailored to your needs, ensuring you have the necessary documentation. This approach protects your interests and helps you understand the living trust process efficiently.

A California trust can be valid in Idaho, but it must comply with Idaho's specific laws regarding trust administration. This may involve reviewing the trust document and making any necessary revisions to align with Idaho's regulations. By looking at a California living trust sample for Idaho, you can navigate this process confidently and ensure that your trust remains effective in your new location.

Typically, a trust created in California can remain valid in another state; however, it can be subject to that state's laws and regulations. It's essential to review the laws in the state to which you move, as some elements of the trust may need adjustments. Using a California living trust sample for Idaho can provide insight into the necessary modifications to maintain the trust's validity when relocating to Idaho.

Yes, the state in which your trust exists can affect its administration and legal standing. Different states have varying laws regarding trusts, including tax implications and regulations that govern their use. By considering a California living trust sample for Idaho, you can better understand how the laws may differ and how to create a trust that meets your needs in Idaho.

To register a trust in Idaho, you must first draft the trust document, which serves as the foundation for your trust. Next, you should gather all required supporting documentation, and then file your trust with the appropriate county recorder's office where the trust property is located. Utilizing a California living trust sample for Idaho can help guide you through the specific requirements and ensure that your trust complies with state regulations.