Tenancy Common Dwelling For Rental Property

Description

How to fill out California Tenancy In Common Agreement - Single Dwelling - Married Couple?

- If you're a returning user, simply log in to your account and check your subscription status. Make sure it's active before you proceed to download your necessary form template.

- If you're new to our service, start by browsing the extensive online library. Review the preview and description of your desired form to verify it meets your requirements and complies with local laws.

- If you don't find the correct template, utilize the Search tab to explore other options until you locate the right one.

- Once you identify a suitable document, click on the Buy Now button and select your preferred subscription plan to proceed.

- Enter your payment information, either through a credit card or PayPal, to finalize your purchase.

- Finally, download your form and save it to your device. You can always access it later in the My Forms section of your profile.

US Legal Forms offers a robust collection of over 85,000 legal forms, which surpasses competitors in both quantity and quality. Additionally, users can consult premium experts for help, ensuring that all documents are accurate and compliant.

Take the hassle out of legal paperwork. Start using US Legal Forms today to make your rental property transactions smoother and more efficient!

Form popularity

FAQ

One downside of tenants by the entirety is that it limits individual control over the property. If one spouse chooses to sell or mortgage their share, the other spouse must agree. Additionally, if the couple divorces, the ownership can become complicated, leading to potential legal disputes. This arrangement may not suit everyone, particularly for those considering a tenancy common dwelling for rental property.

Tenant property in common areas refers to shared spaces within a rental property, such as hallways, lobbies, and recreational facilities. These areas are accessible to all tenants and require collective maintenance efforts. Ownership and responsibilities in these common areas are typically defined in the lease agreement. Being clear about common area responsibilities is essential when discussing tenancy common dwelling for rental property.

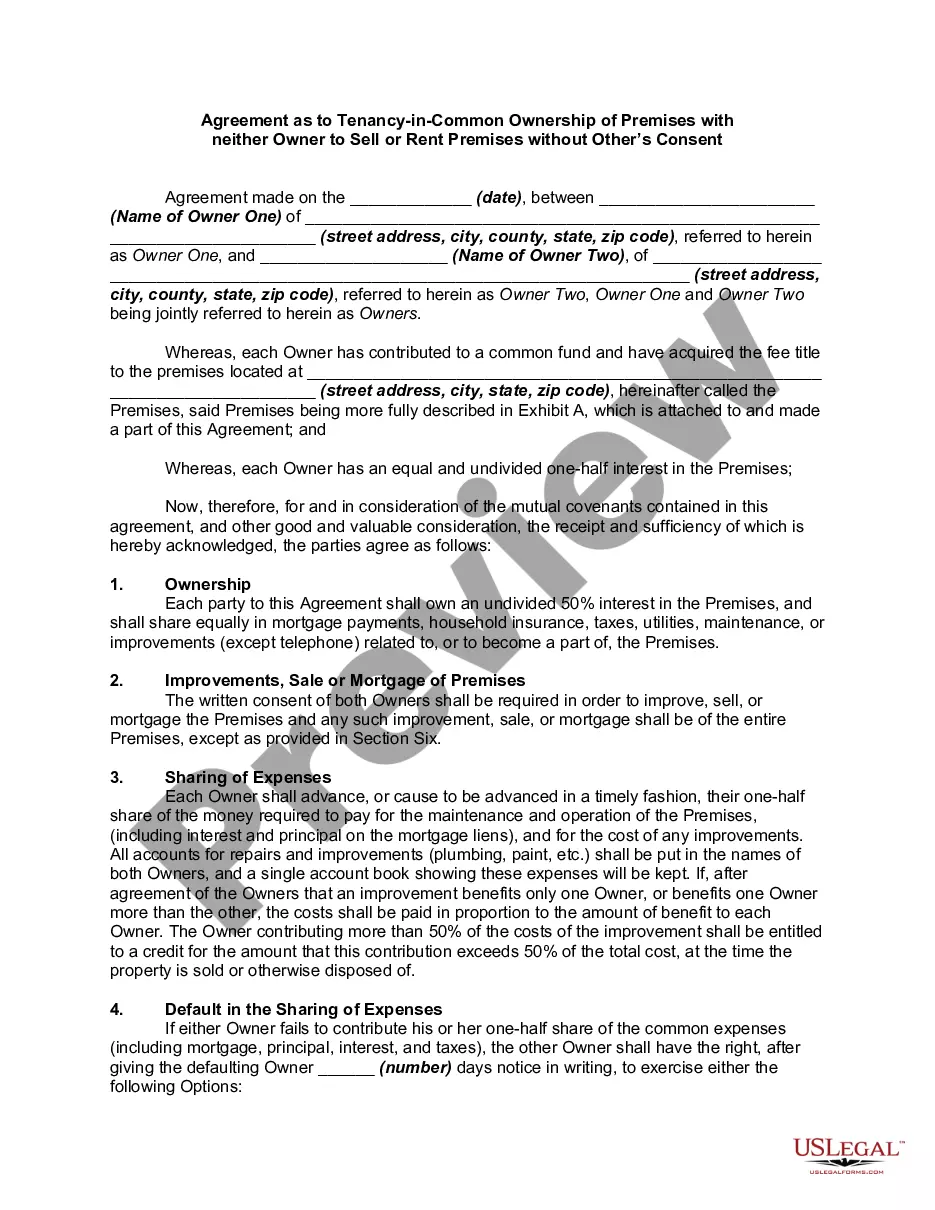

Tenants in common and tenants by the entirety are different forms of property ownership. Tenants in common allow multiple owners to hold shares in a property, which can be unequal, and each owner's share can be sold or transferred. In contrast, tenants by the entirety is a form of joint ownership available only to married couples, where both spouses hold equal shares, and neither can sell or transfer their share without consent from the other. Understanding these differences can help you choose the right structure for your tenancy common dwelling for rental property.

Since both terms describe the same relationship, the difference lies in the wording rather than concepts. However, knowing this distinction helps clarify that individuals can own unequal shares in a property under tenancy in common. For prospective investors, recognizing this can influence how you structure your ownership of a tenancy common dwelling for rental property. Our platform, US Legal Forms, can provide resources to navigate these nuances effectively.

Yes, 'tenants in common' and 'tenancy in common' refer to the same legal arrangement for property ownership. In this setup, two or more individuals hold title to a property together, allowing for shared use. Each owner has a distinct share, which they can sell or bequeath independently. Understanding this arrangement is essential for anyone exploring a tenancy common dwelling for rental property.

While tenancy in common does not legally require a written contract, having one is highly recommended for clarity and protection. A written agreement helps define ownership shares and responsibilities related to a tenancy common dwelling for rental property. It can prevent disputes and misunderstandings among co-owners. Using platforms like USLegalForms can simplify the process of creating this essential document.

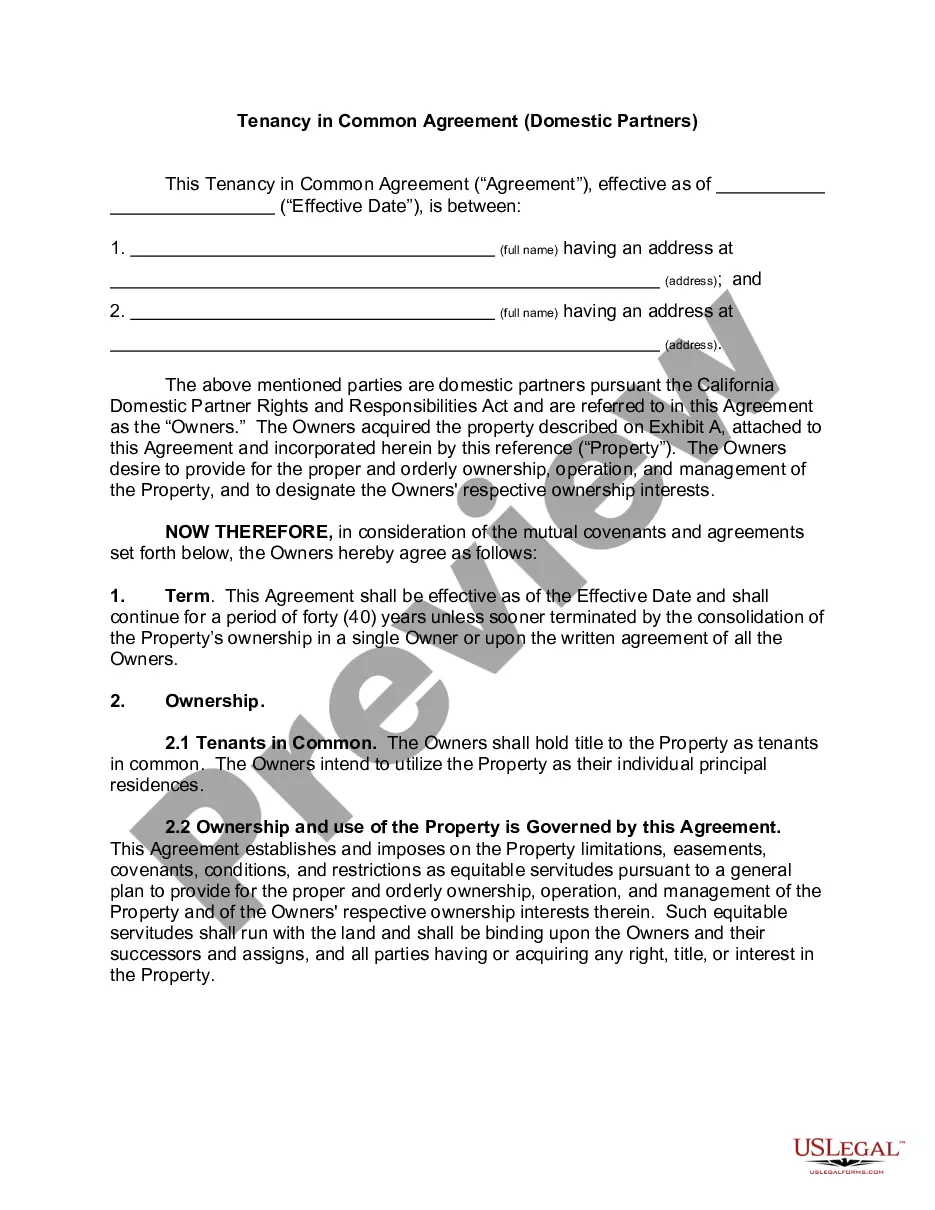

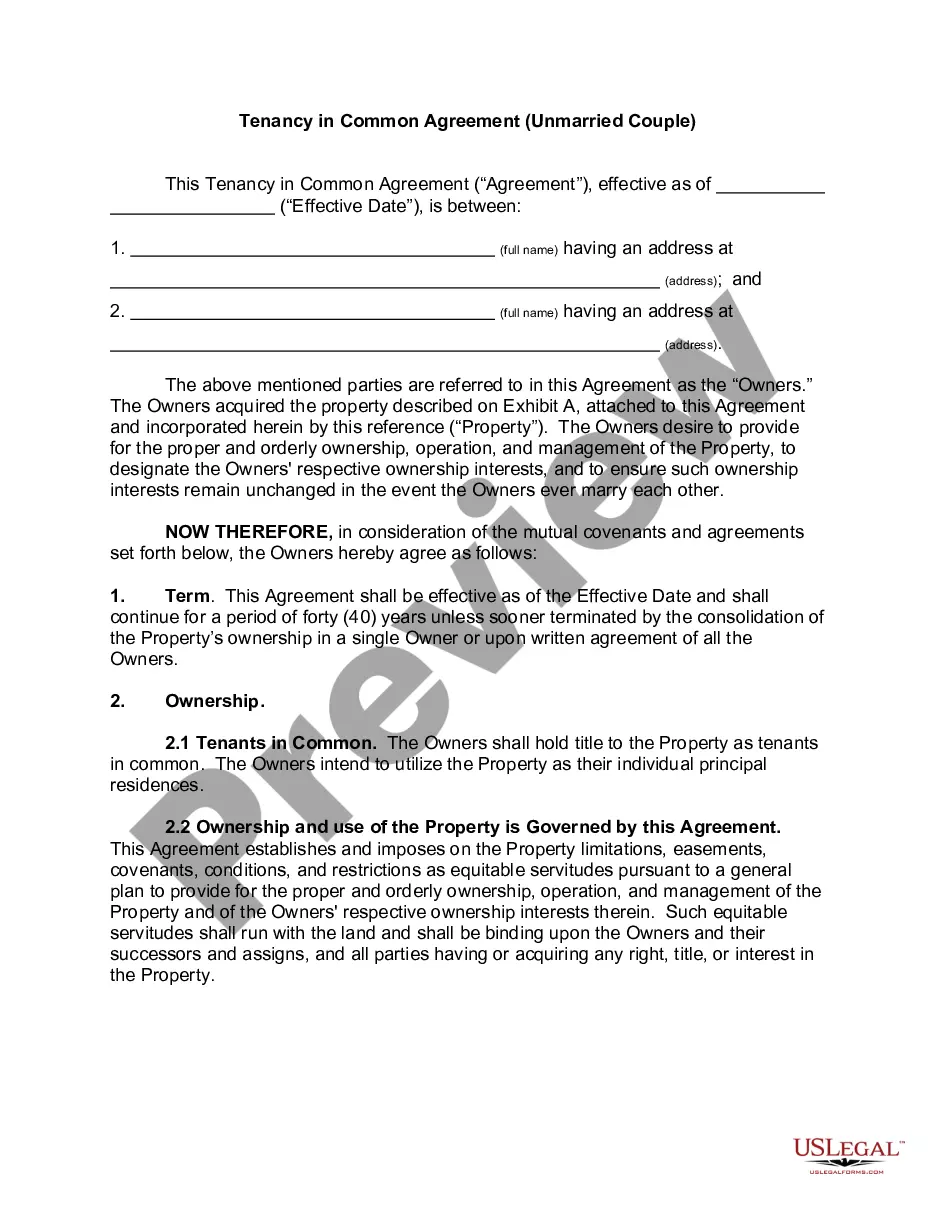

Creating a tenants in common agreement is an essential step for co-owners of a property. Start by outlining the ownership percentages and the responsibilities of each owner regarding a tenancy common dwelling for rental property. It is advisable to include terms on how profits and expenses will be shared. For a thorough agreement, consider using a reliable resource like USLegalForms to generate a legally sound document.

Tenants in common can take advantage of various tax deductions related to property ownership. When you own a tenancy common dwelling for rental property, you can deduct your share of mortgage interest, property taxes, and maintenance costs. This arrangement allows you to reduce your taxable income. To ensure you benefit fully from these deductions, consider consulting a tax professional.

The IRS views tenancy in common as an ownership structure where each owner reports income, deductions, and losses from the property on their tax returns according to their share. For individuals considering a TIC for rental property, understanding tax obligations is important. Consulting with a tax professional or using resources from platforms like USLegalForms can provide clarity on these rules.

One notable disadvantage of a tenancy in common is the potential for disputes among co-owners related to property usage or financial obligations. Additionally, each owner's share can be passed down to heirs, which may complicate ownership. Understanding these downsides is crucial as you consider your options for rental property ownership.