California Homestead File Format

Description

How to fill out California Homestead Declaration For Single Person?

It’s obvious that you can’t become a law professional immediately, nor can you grasp how to quickly draft California Homestead File Format without the need of a specialized set of skills. Creating legal forms is a long venture requiring a particular education and skills. So why not leave the preparation of the California Homestead File Format to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the document you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether California Homestead File Format is what you’re searching for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the template.

- Choose Buy now. As soon as the payment is complete, you can download the California Homestead File Format, complete it, print it, and send or mail it to the designated people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

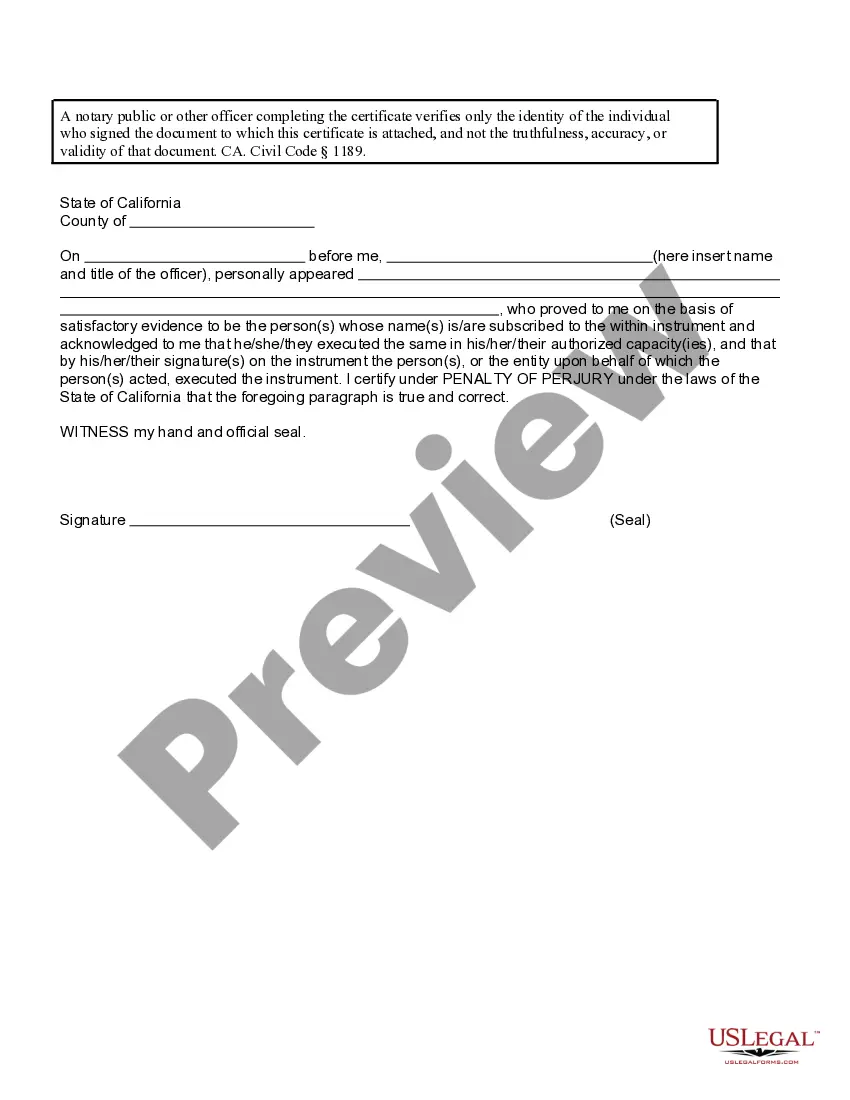

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

To put it simply, the minimum exemption is $300,000; the maximum is $600,000; but your particular exemption limit will be the median, not the average, home sale price from the prior year for your county. Additionally, these figures will be tied to inflation and adjusted annually beginning January 1, 2022.

These limits, adjusted annually for inflation, have increased the 2023 bankruptcy homestead exemption to $678,391 in San Diego County for those who qualify. A chapter 7 trustee can sell a debtor's non-exempt property to pay creditors.

As of January 1, 2021, the California homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the prior year. However, it can be as high as $600,000 if the median sale price in your county was more than that amount.

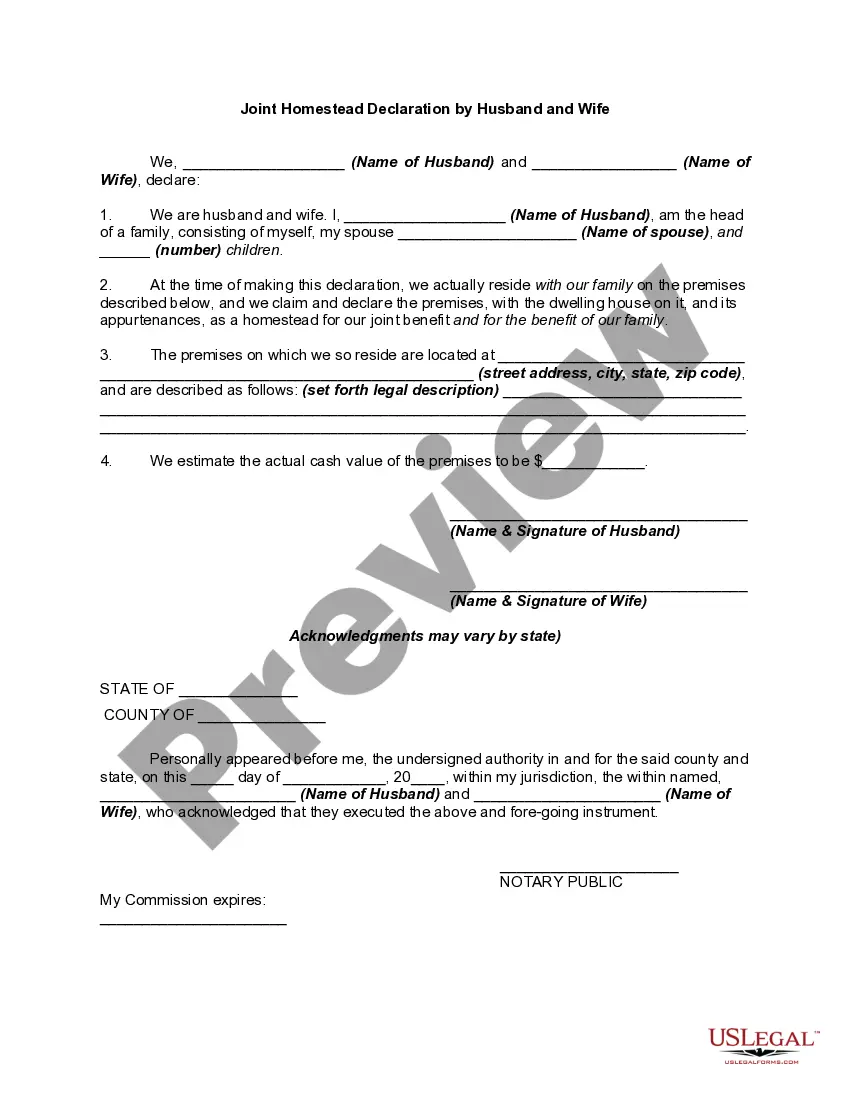

Now, in case you're wondering how you can ensure a homestead exemption applies to your home, you should know that there are two types: automatic and declared homestead exemptions. A homestead exemption is automatically applied to your residence but only upon the forced sale of the property.