California Homestead County Ca Form Riverside

Description

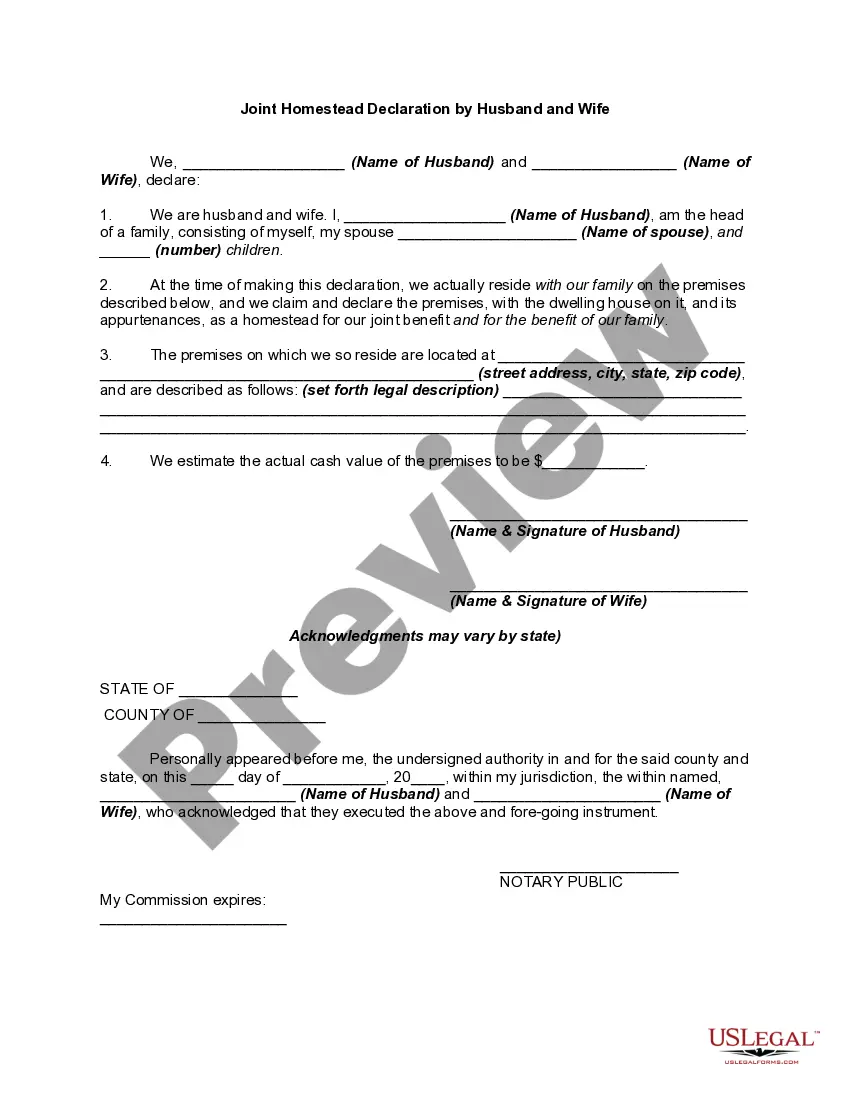

How to fill out California Homestead Declaration For Single Person?

Creating legal documents from the ground up can frequently feel overwhelming.

Specific situations may require extensive research and significant financial investment.

If you're seeking a more straightforward and economical method for drafting the California Homestead County Ca Form Riverside or any other documents without unnecessary obstacles, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-approved forms meticulously prepared for you by our legal experts.

Verify that the template you choose adheres to the regulations of your state and county. Select the most appropriate subscription option to acquire the California Homestead County Ca Form Riverside. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and simplify your form processing!

- Utilize our platform whenever you require dependable and trustworthy services that allow you to easily find and download the California Homestead County Ca Form Riverside.

- If you are already familiar with our site and have set up an account previously, simply Log In to your account, locate the template, and download it or re-download it anytime from the My documents section.

- Not a member yet? No worries. It requires minimal time to register and browse the selection.

- However, before diving into downloading the California Homestead County Ca Form Riverside, keep these tips in mind.

- Examine the document preview and descriptions to confirm you are on the correct form.

Form popularity

FAQ

Using the revised exemption for 2021, a debtor may have $600,000 of equity in their Los Angeles or Orange County home and still file a Chapter 7 bankruptcy with their home being protected. The homestead exemption in Riverside County is $400,500.

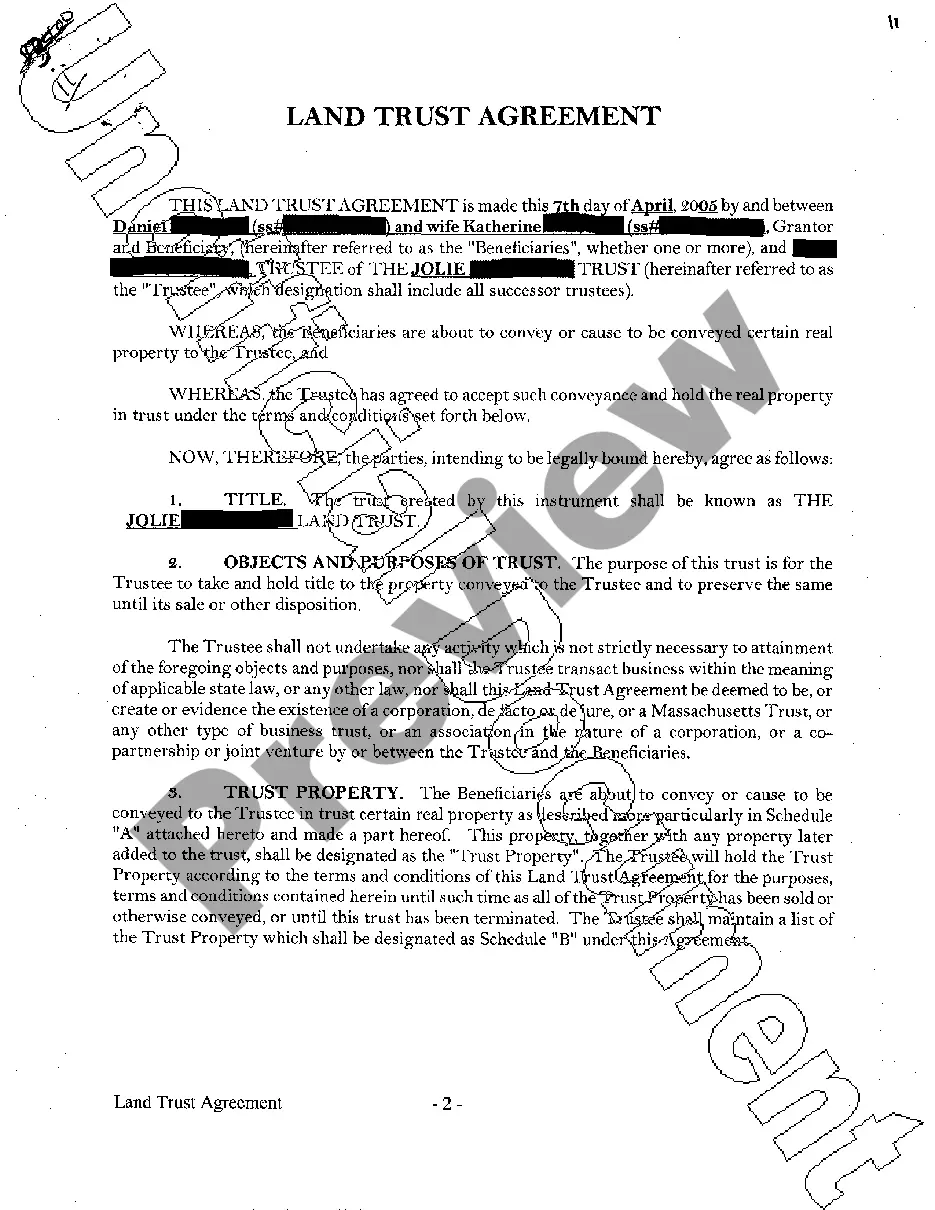

Homestead protection laws exist to protect your home against most creditors, up to the value of homestead exemption. California homestead law is complex and technical in nature. A Declaration of Homestead, when not properly prepared, may be invalid.

The County of Riverside Assessor-County Clerk-Recorder states that ?The homestead declaration, or 'Declaration of Homestead', is a statutory protection where-by a portion of a homeowner's equity in his or her residence may be protected from judgments, liens and creditors.? It also ?names the declared homestead owner, ...

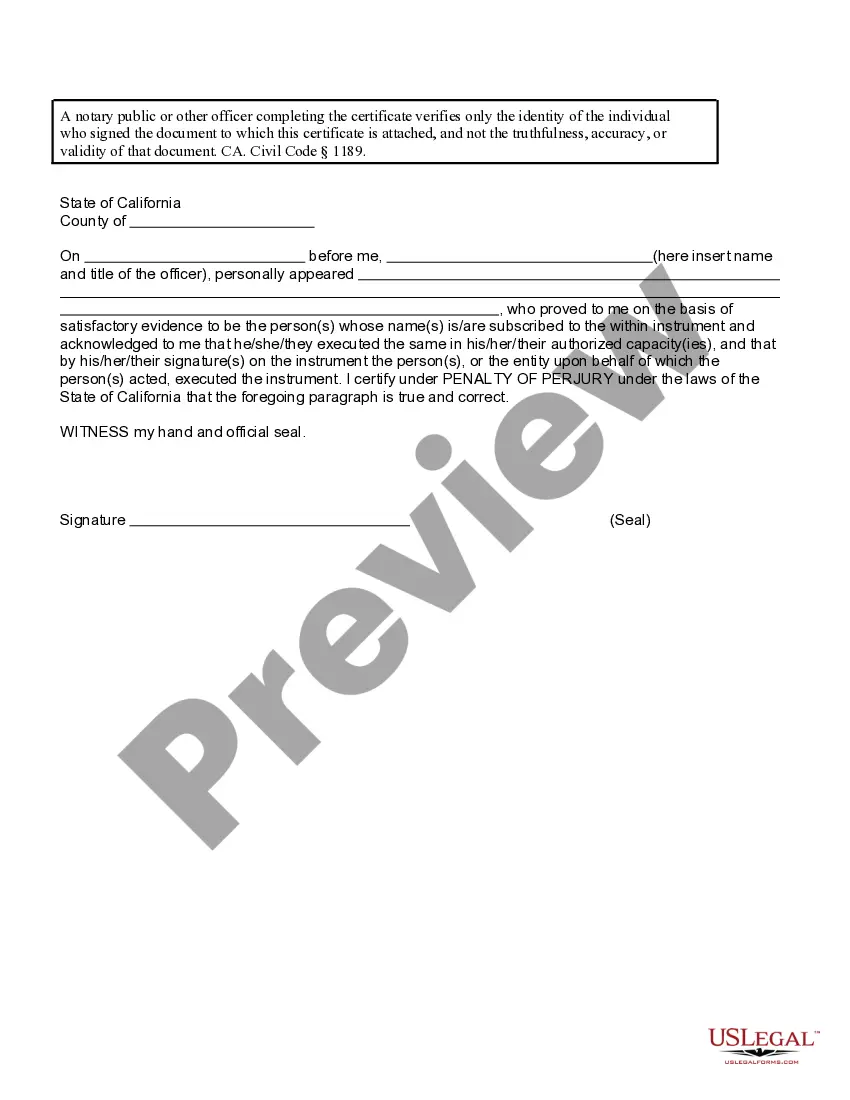

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

Property owners who occupy their homes as their principal place of residence on January 1 may be eligible for an exemption. The Homeowners' Exemption provides for a maximum reduction of $7,000 off the assessed value of your residence. This results in an annual Property Tax savings of approximately $70.