Ca Homestead Declaration Form For Florida

Description

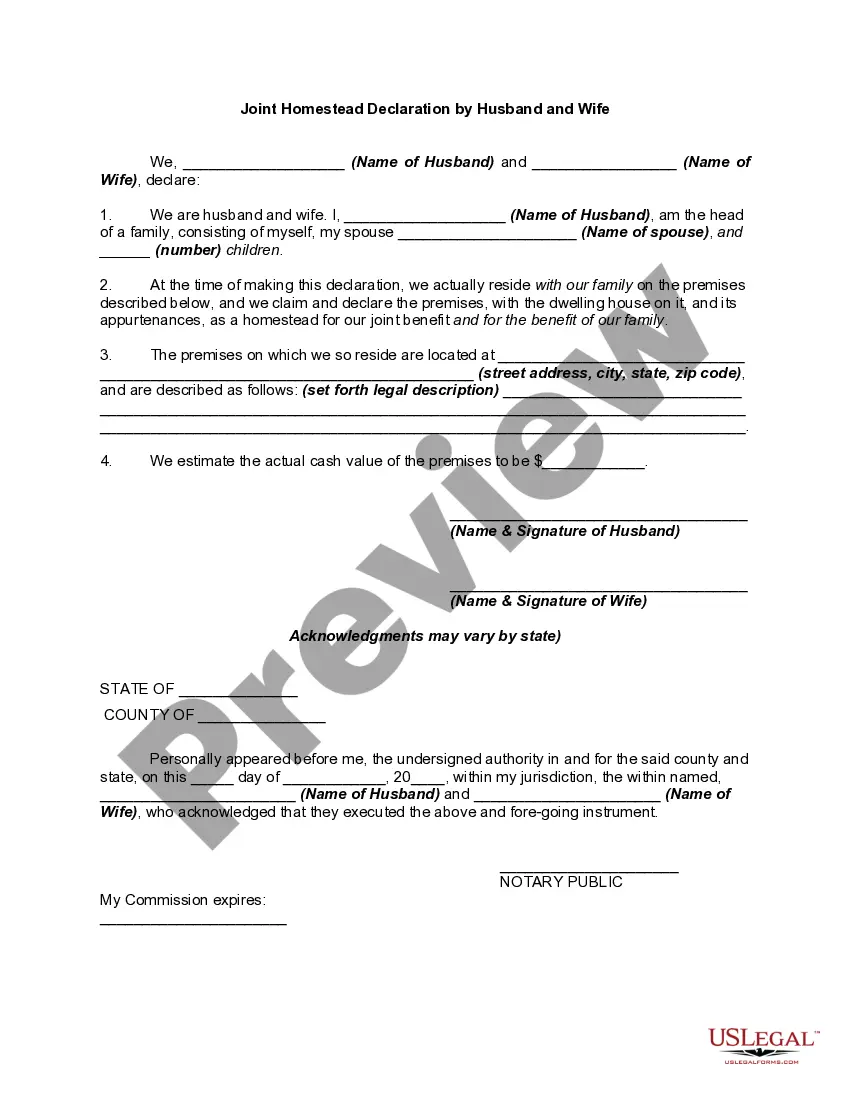

How to fill out California Homestead Declaration For Single Person?

It’s obvious that you can’t become a law professional immediately, nor can you figure out how to quickly prepare Ca Homestead Declaration Form For Florida without the need of a specialized background. Creating legal forms is a time-consuming venture requiring a certain training and skills. So why not leave the preparation of the Ca Homestead Declaration Form For Florida to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Ca Homestead Declaration Form For Florida is what you’re looking for.

- Begin your search again if you need a different form.

- Register for a free account and select a subscription plan to buy the form.

- Pick Buy now. Once the payment is through, you can download the Ca Homestead Declaration Form For Florida, fill it out, print it, and send or mail it to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser. Click here for county property appraiser contact and website information.

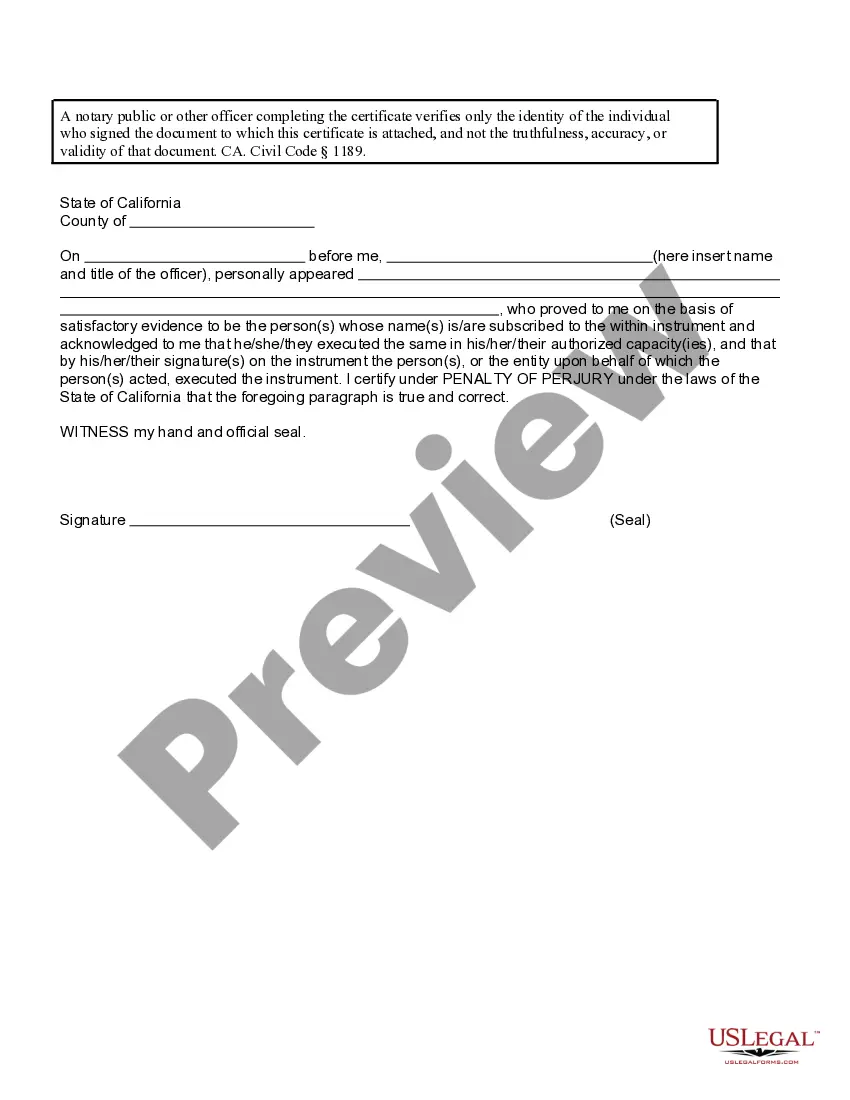

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. ... Vehicle Registration. Will need to provide tag # and issue date. ... Permanent Resident Alien Card. Will need to provide ID# and issue date.

As of January 1, 2021, the California homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the prior year. However, it can be as high as $600,000 if the median sale price in your county was more than that amount.

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes school board taxes and applies to properties with assessed values greater than $50,000.