Ca Homestead Declaration Form For 2023

Description

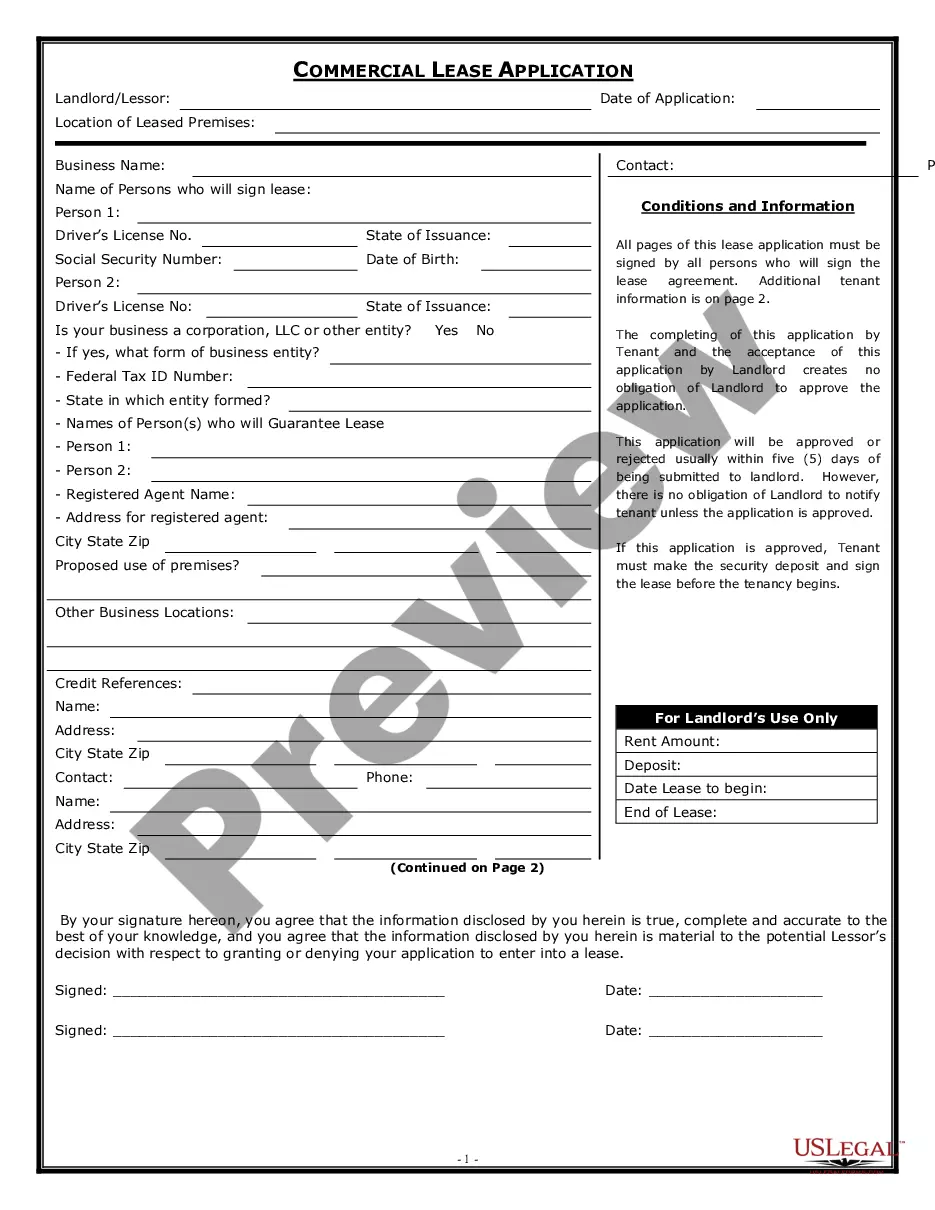

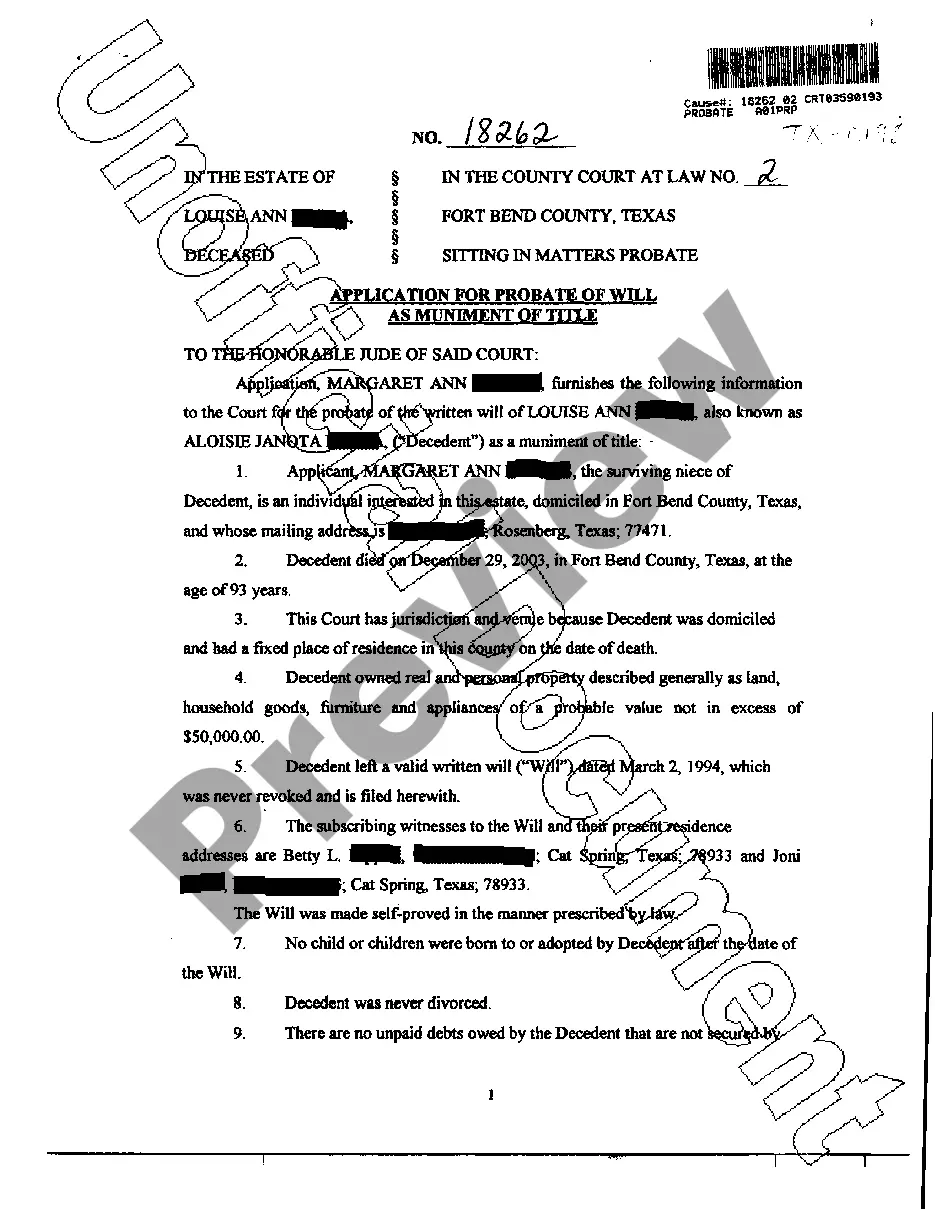

How to fill out California Homestead Declaration For Single Person?

Finding a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents calls for accuracy and attention to detail, which explains why it is very important to take samples of Ca Homestead Declaration Form For 2023 only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You can access and check all the details regarding the document’s use and relevance for the situation and in your state or region.

Take the listed steps to complete your Ca Homestead Declaration Form For 2023:

- Utilize the library navigation or search field to find your template.

- View the form’s description to ascertain if it fits the requirements of your state and area.

- View the form preview, if there is one, to ensure the form is definitely the one you are searching for.

- Go back to the search and look for the correct document if the Ca Homestead Declaration Form For 2023 does not suit your needs.

- If you are positive about the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that suits your preferences.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (bank card or PayPal).

- Choose the document format for downloading Ca Homestead Declaration Form For 2023.

- When you have the form on your gadget, you can modify it using the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal paperwork. Discover the extensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

The newly expanded homestead exemption increased the exemption limit in California to $300,000 to $600,000 varying based on the county. These limits, adjusted annually for inflation, have increased the 2023 bankruptcy homestead exemption to $678,391 in San Diego County for those who qualify.

Hear this out loud PauseThe home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

Hear this out loud PauseThese limits, adjusted annually for inflation, have increased the 2023 bankruptcy homestead exemption to $678,391 in San Diego County for those who qualify. A chapter 7 trustee can sell a debtor's non-exempt property to pay creditors.

Hear this out loud PauseAs of January 1, 2021, the California homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the prior year. However, it can be as high as $600,000 if the median sale price in your county was more than that amount.