Ca Homestead County California Form Orange

Description

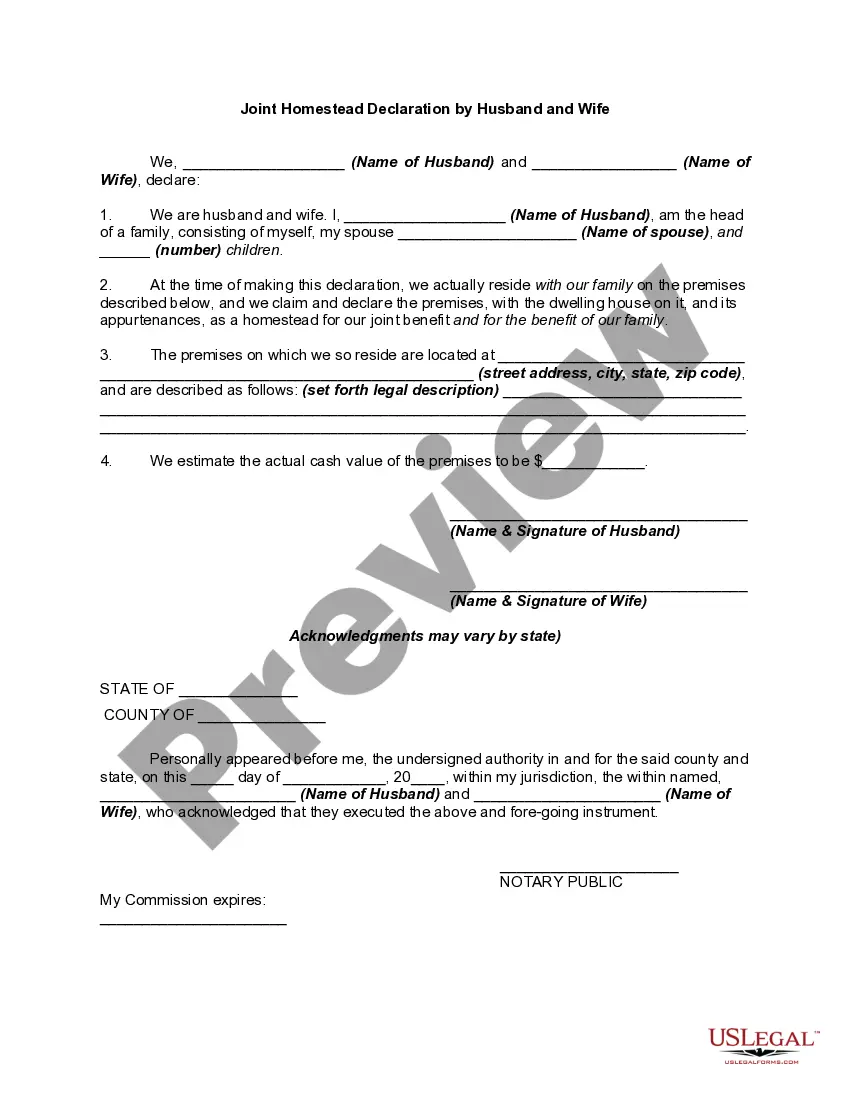

How to fill out California Homestead Declaration For Single Person?

Managing legal paperwork and tasks can be an arduous addition to your routine. Ca Homestead County California Form Orange and similar documents generally necessitate that you search for them and grasp how to fill them out efficiently.

Thus, whether you are addressing financial, legal, or personal issues, maintaining a detailed and user-friendly online catalogue of forms readily available will greatly assist you.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific forms and various resources to help you complete your documents with ease.

Browse the collection of relevant documents at your fingertips with a simple click.

- US Legal Forms provides state- and county-specific forms accessible anytime for download.

- Protect your document handling processes with a premium service that enables you to prepare any form within minutes without extra or concealed charges.

- Simply Log In to your account, find Ca Homestead County California Form Orange, and obtain it instantly from the My documents section.

- You can also access previously stored forms.

- Is this your first experience with US Legal Forms? Sign up and establish an account in just a few minutes to gain access to the forms catalogue and Ca Homestead County California Form Orange.

Form popularity

FAQ

Add How do I get a Homeowner's Exemption? New property owners will usually receive an exemption application within 90 days of recording a deed. If you acquired the property more than 90 days ago and have not received an application, please call 714-834-3821 for an application.

You may apply for a Homeowners' Exemption if you do not have this type of exemption on any other property. The Assessor will automatically send exemption applications to new homeowners. Call (714) 834-3821 for more information. Homeowners' Exemption applications are not available on-line.

Add How do I get a Homeowner's Exemption? New property owners will usually receive an exemption application within 90 days of recording a deed. If you acquired the property more than 90 days ago and have not received an application, please call 714-834-3821 for an application.

California offers an automatic homestead exemption to every homeowner who occupies their home, whether it is a single-family dwelling, mobile home, or even a boat. As of January 1, 2021, the California homestead exemption is a minimum of 300,000 dollars, but can be as high as 600,000 dollars.

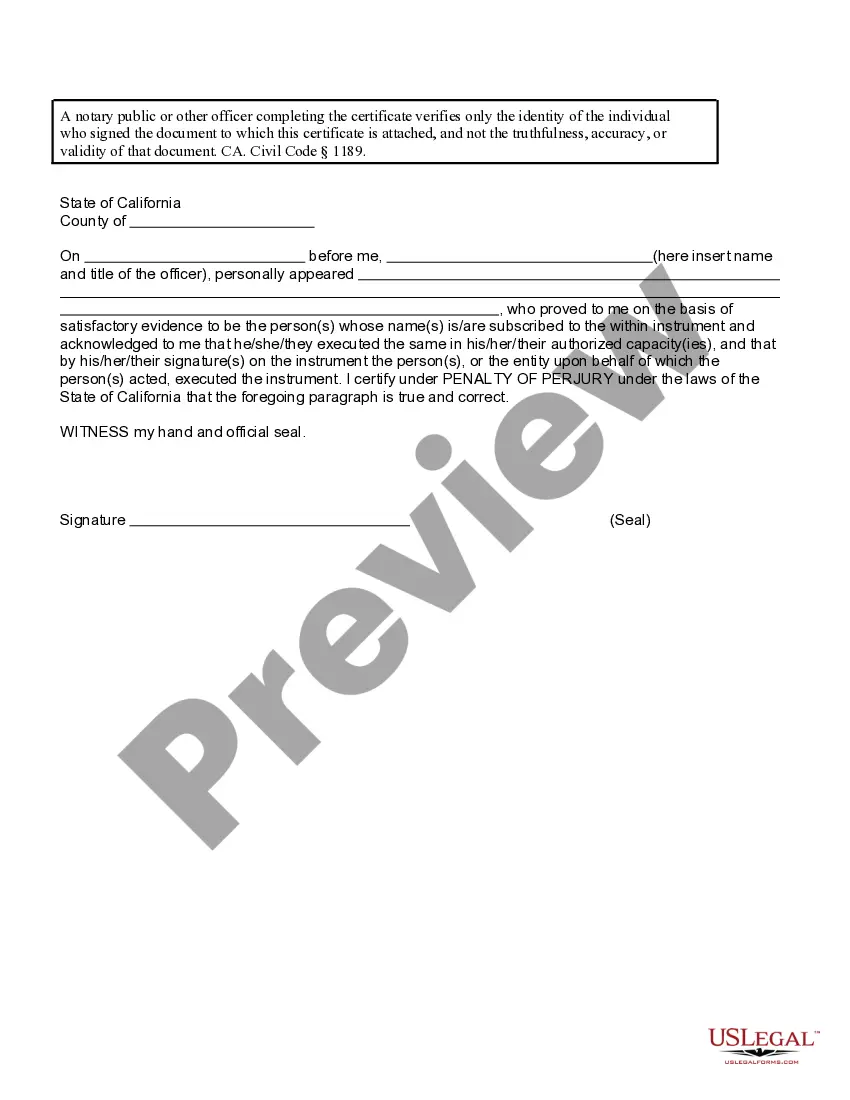

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.