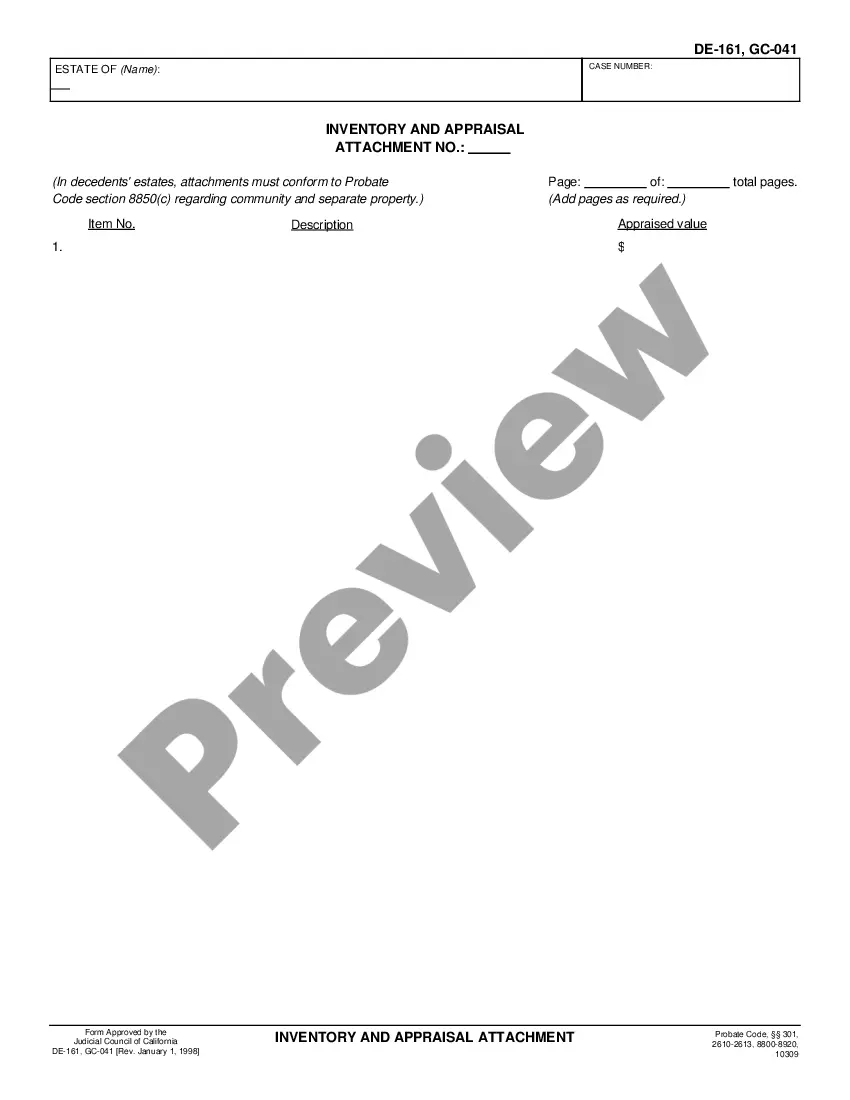

California Probate Inventory And Appraisal Form

Description

Form popularity

FAQ

The purpose of an appraisal is to accurately determine the value of assets within an estate during probate. This value establishes the foundation for the California probate inventory and appraisal form, which is essential for fair distribution among heirs. Appraisals can also influence tax liabilities, ensuring compliance with state laws. Ultimately, a well-conducted appraisal supports a smooth probate process and protects the interests of all parties involved.

You can access probate records in California through the Superior Court in the county where the probate case is filed. These records include vital documents such as the California probate inventory and appraisal form. Many counties offer online databases for easy access, simplifying your search. If you need further assistance, consider reaching out to legal professionals for help with the process.

Appraised in the inventory refers to the process of evaluating the worth of each asset listed in a probate inventory. This appraisal is critical for the California probate inventory and appraisal form, as it establishes the fair market value of your possessions. Accurate appraisals help inform beneficiaries and can affect tax obligations. Additionally, having a thorough appraisal can prevent future disputes among heirs.

An inventory assessment provides a detailed list of all assets belonging to an estate during the probate process. This assessment is vital for creating the California probate inventory and appraisal form, which helps in determining the value of the estate. It ensures that all property is accounted for and adequately valued. By compiling this inventory, you can simplify the probate proceedings and avoid potential disputes.

Certain assets are exempt from probate in California, which can simplify the process. Items like life insurance policies, retirement accounts, and properties held in joint tenancy do not require probate. Understanding these exemptions can ease any financial burden for beneficiaries. The California probate inventory and appraisal form can help clarify which assets are subject to probate and which are not.

To initiate probate in California, several key documents are required. These typically include the death certificate, will (if applicable), and the California probate inventory and appraisal form. Additionally, any relevant financial statements or property titles will help establish the estate's value. Utilizing platforms like uslegalforms can provide the necessary templates and instructions for these documents.

Starting the probate process in California involves filing the appropriate petition with the court. You will also need to submit the California probate inventory and appraisal form, which details the deceased's assets. Gathering vital documents and ensuring all forms are completed accurately can streamline the process. Resources like uslegalforms can guide you through this important initial step.

An inventory appraisal refers to assessing and valuing the assets of a deceased person's estate. This is essential for determining the total value of the estate during the probate process. The California probate inventory and appraisal form documents this assessment, helping administrators and beneficiaries understand the estate's worth. It is vital for allocating assets fairly among heirs.

Yes, you can navigate probate in California without a lawyer. However, it's important to understand the legal processes involved. Completing the California probate inventory and appraisal form correctly is crucial for a successful outcome. Many people find that using resources, such as uslegalforms, simplifies the process, ensuring all necessary documents are in order.

Probate accounting in California requires a detailed report of all income and expenses related to the estate. You need to track asset valuations, including the information provided on the California probate inventory and appraisal form. This clarity will help beneficiaries understand the estate's financial status and ensure compliance with court requirements.