California Joint Tenant Ca Form 100 Instructions

Description

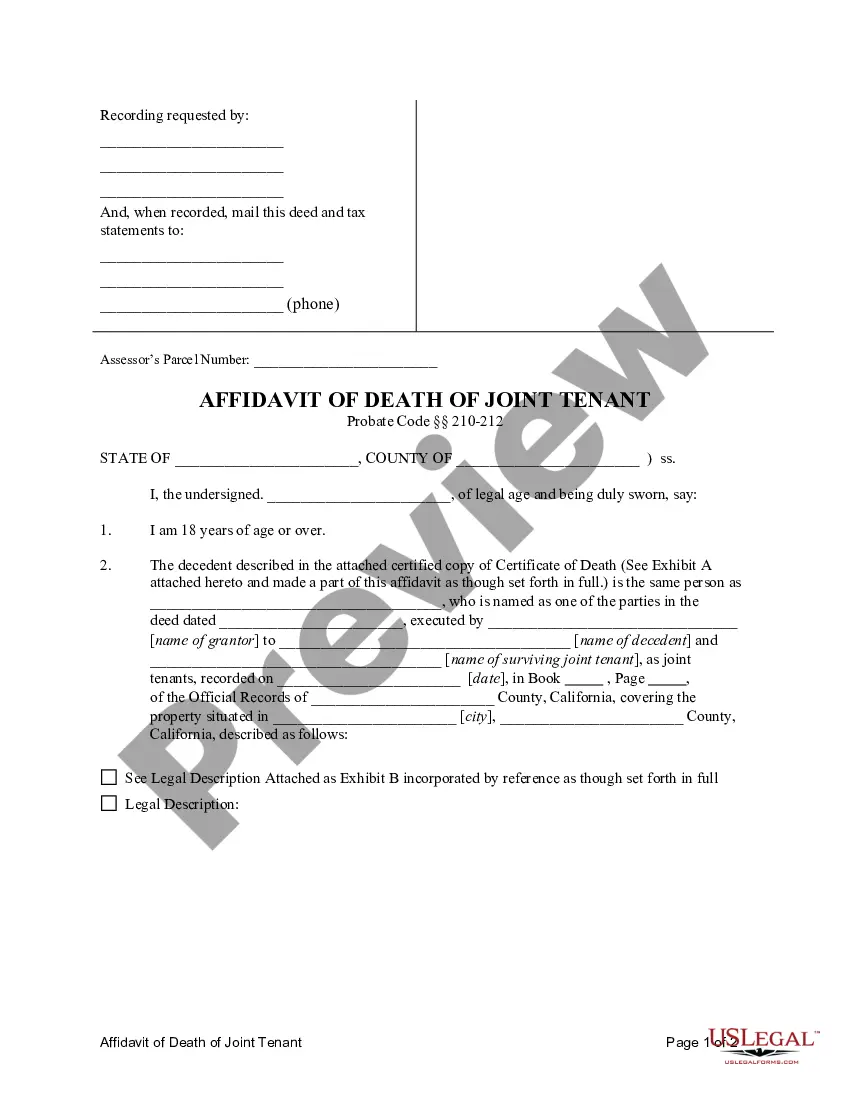

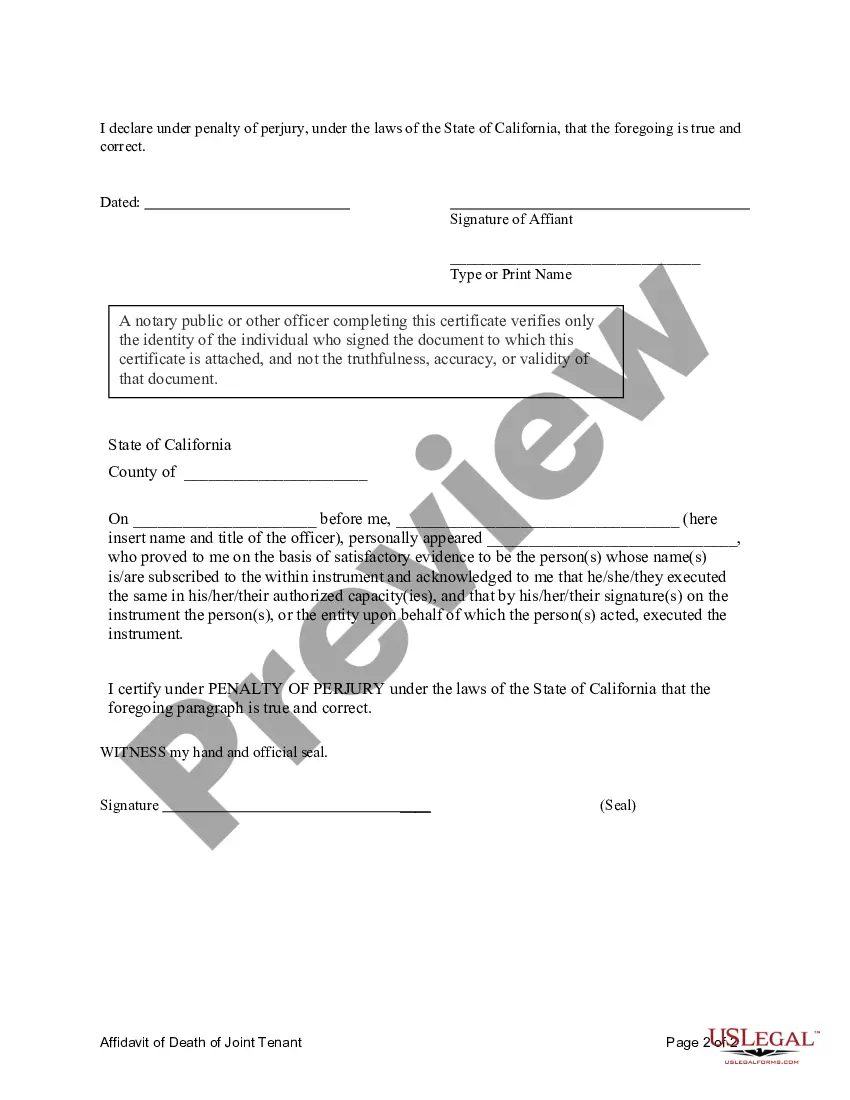

How to fill out California Affidavit Of Death Of Joint Tenant?

Accessing legal templates that meet the federal and local regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the appropriate California Joint Tenant Ca Form 100 Instructions sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life scenario. They are easy to browse with all files arranged by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a California Joint Tenant Ca Form 100 Instructions from our website.

Obtaining a California Joint Tenant Ca Form 100 Instructions is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the steps below:

- Take a look at the template utilizing the Preview feature or through the text description to ensure it fits your needs.

- Look for another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your California Joint Tenant Ca Form 100 Instructions and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

Form 100 California Corporation Franchise or Income Tax Return is the regular return for CA corporations. Form 100W California Corporation Franchise or Income Tax Return--Water's-Edge Filers can be filed by combined groups that meet the requirements.

The Franchise Tax Board (FTB) offers e-filing for corporations filing Form 100X.

Form 100S is used if a corporation has elected to be a small business corporation (S corporation). All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. The tax rate for financial S corporations is 3.5%.

Business FormWithout paymentWith payment100 100S 100W 100X 109 565 568Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501