California Affidavit Form Withholding

Description

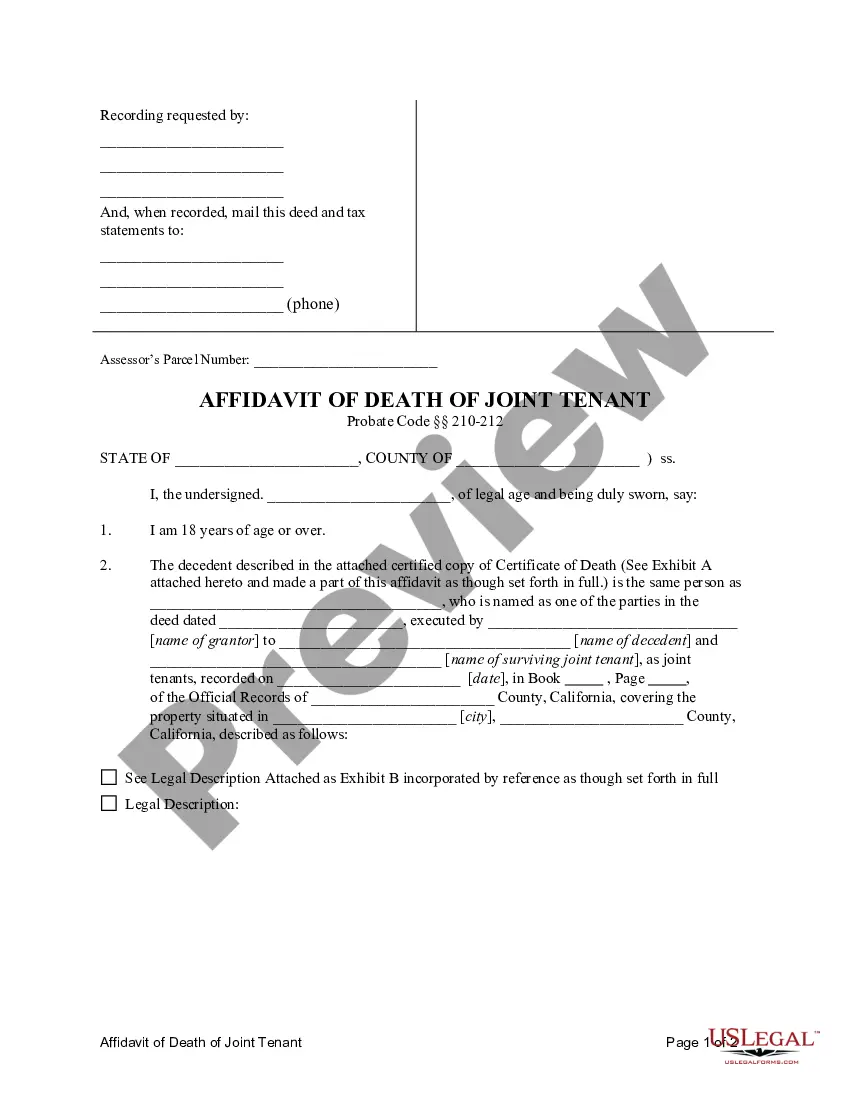

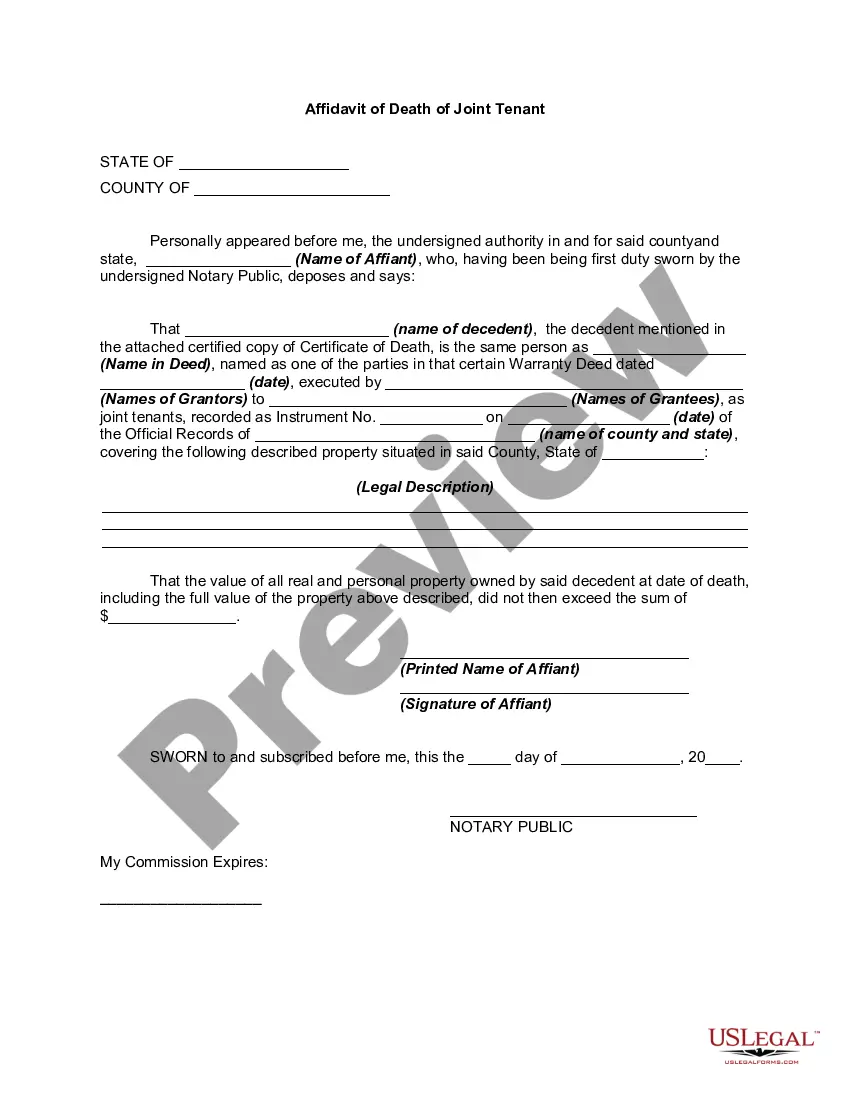

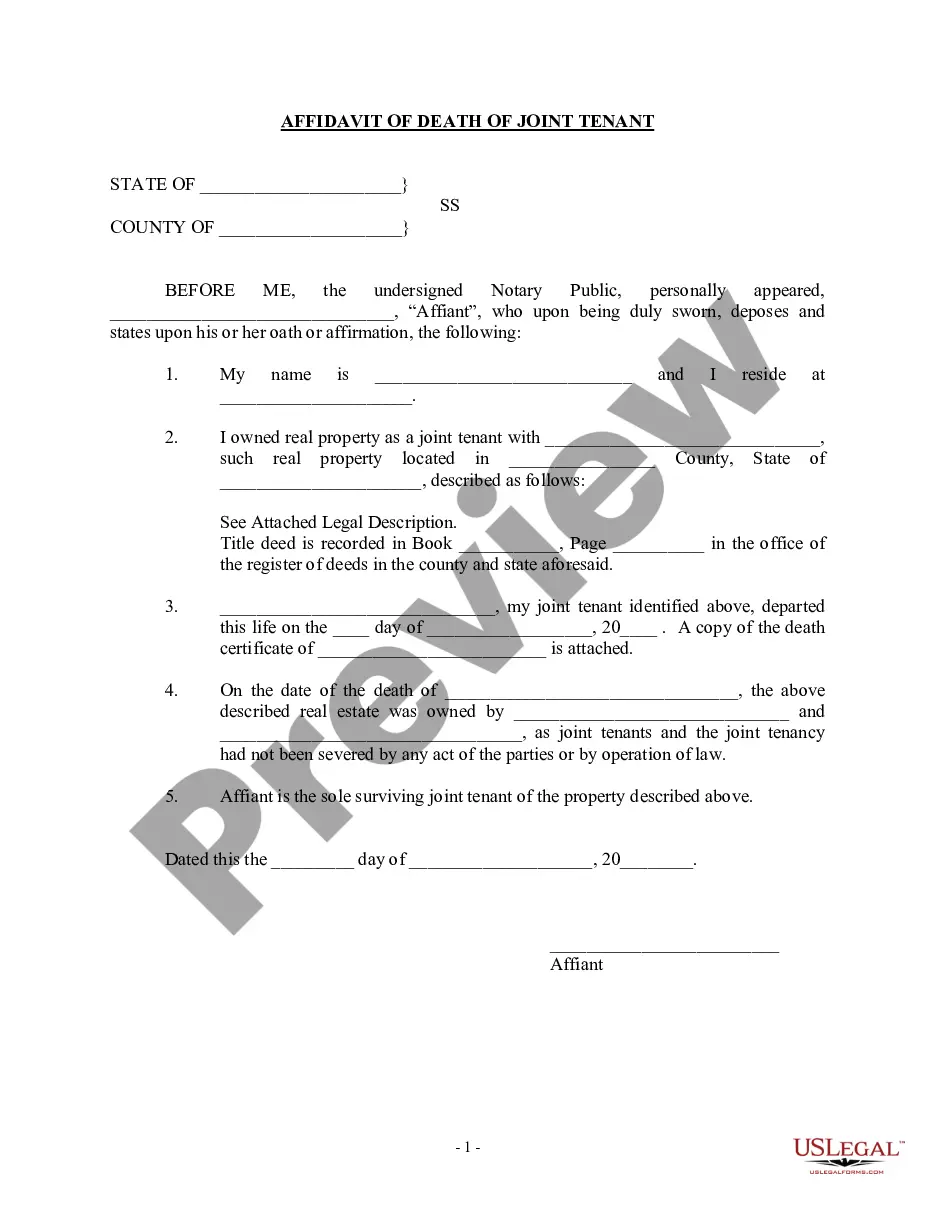

How to fill out California Affidavit Of Death Of Joint Tenant?

It’s well-known that you cannot become a legal expert instantly, nor can you swiftly learn how to prepare the California Affidavit Form Withholding without possessing a specific set of skills.

Assembling legal documents is a lengthy process that demands certain education and abilities. So why not entrust the preparation of the California Affidavit Form Withholding to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can locate anything from court papers to templates for internal corporate communication. We understand the significance of compliance with federal and state laws and regulations. Therefore, on our website, all templates are location-specific and current.

Select Buy now. Once the payment is processed, you can acquire the California Affidavit Form Withholding, complete it, print it, and send or mail it to the necessary individuals or entities.

You can access your documents again from the My documents tab at any time. If you’re a returning customer, you can simply Log In, and find and download the template from the same tab. Regardless of the intention behind your documents—whether for financial, legal, or personal use—our website has you covered. Try US Legal Forms today!

- Begin with our website and obtain the document you require in just a few minutes.

- Find the form you are looking for using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to ascertain whether the California Affidavit Form Withholding is what you need.

- Restart your search if you require a different form.

- Create a free account and choose a subscription plan to purchase the template.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

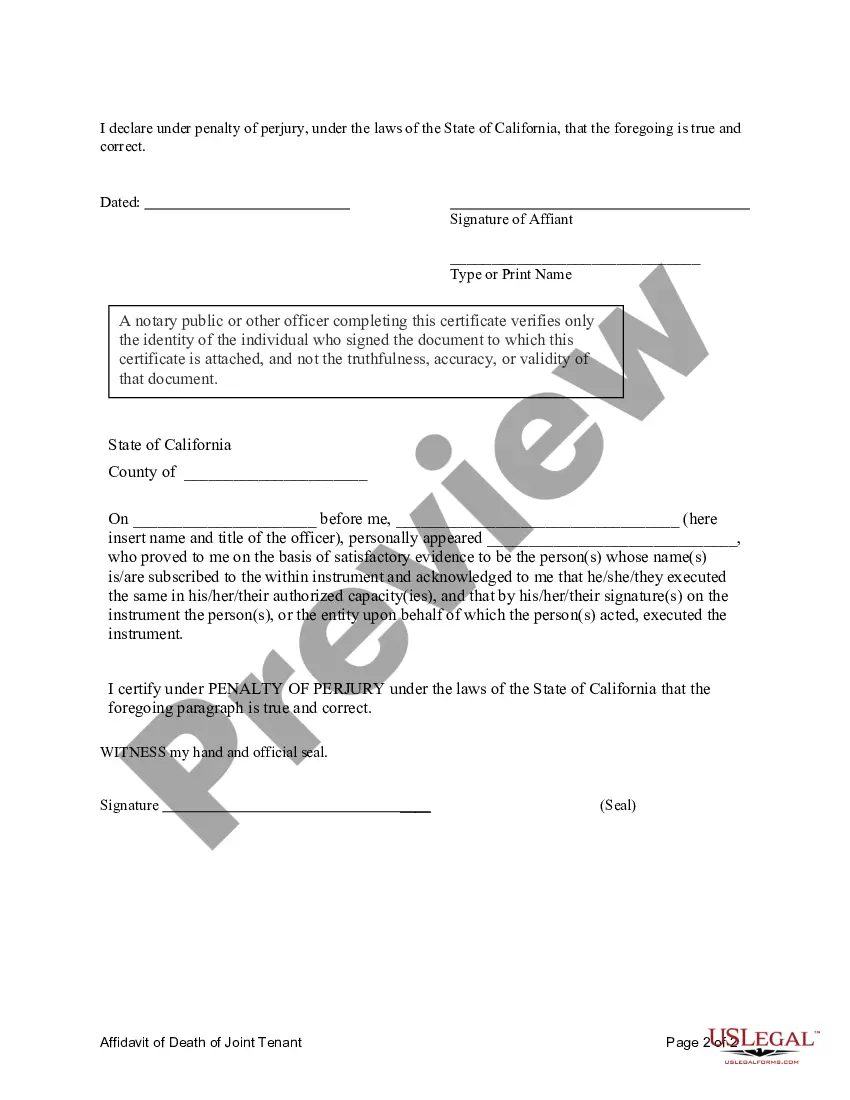

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.