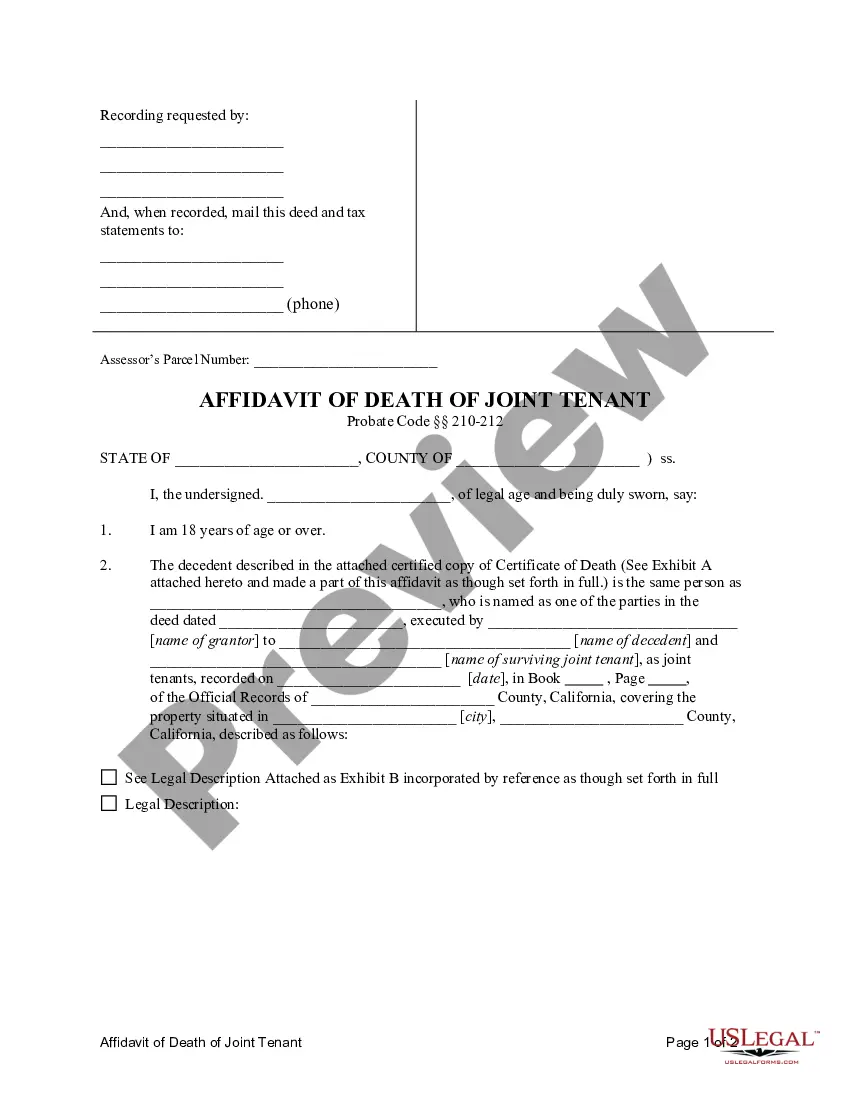

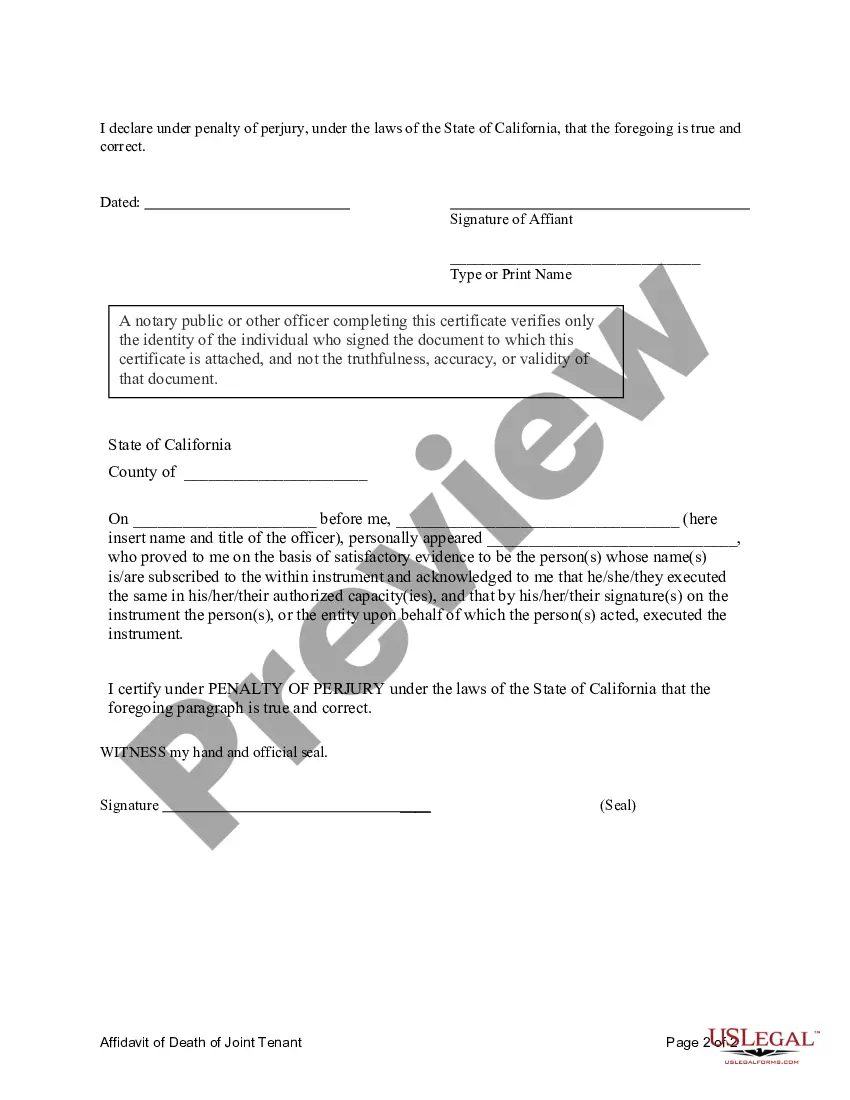

Ca Death Form With Signature

Description

How to fill out California Affidavit Of Death Of Joint Tenant?

The Ca Death Form With Signature presented on this page is a reusable legal document created by experienced attorneys in compliance with federal and local laws.

For over 25 years, US Legal Forms has furnished individuals, enterprises, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, easiest, and most trustworthy method to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Choose the format you desire for your Ca Death Form With Signature (PDF, DOCX, RTF) and download the document onto your device.

- Search for the document you require and review it.

- Browse through the sample you found and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the right one. Click Buy Now once you have identified the template you need.

- Subscribe and Log In.

- Select the pricing option that fits you and create an account. Utilize PayPal or a credit card to make an instant payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Make sure your documentation is clear and legible. ... Depending on whether you are using paper or electronic notes, ensure the patient's details (name, DOB, address) and location are documented. Document if anyone was with the patient when they died and who it was that first noted the patient was deceased.

A Funeral Director certified copy can be used to claim Canada Pension Death Benefit and should be requested if not offered at the time of the arrangements. In the event a lawyer is settling the estate, they can usually certify copies as needed so more than two copies are generally not required.

You can use a statement of death or a death certificate as proof of death. The statement of death is sufficient in most situations to notify the federal government of a death.

Contact us about the date of death as soon as possible Contact the CRA as soon as possible to avoid any repayment situations for benefits. Even if the deceased was not receiving benefit payments, you should report the date of death.

After someone with a filing requirement passes away, their surviving spouse or representative should file the deceased person's final tax return. On the final tax return, the surviving spouse or representative should note that the person has died.