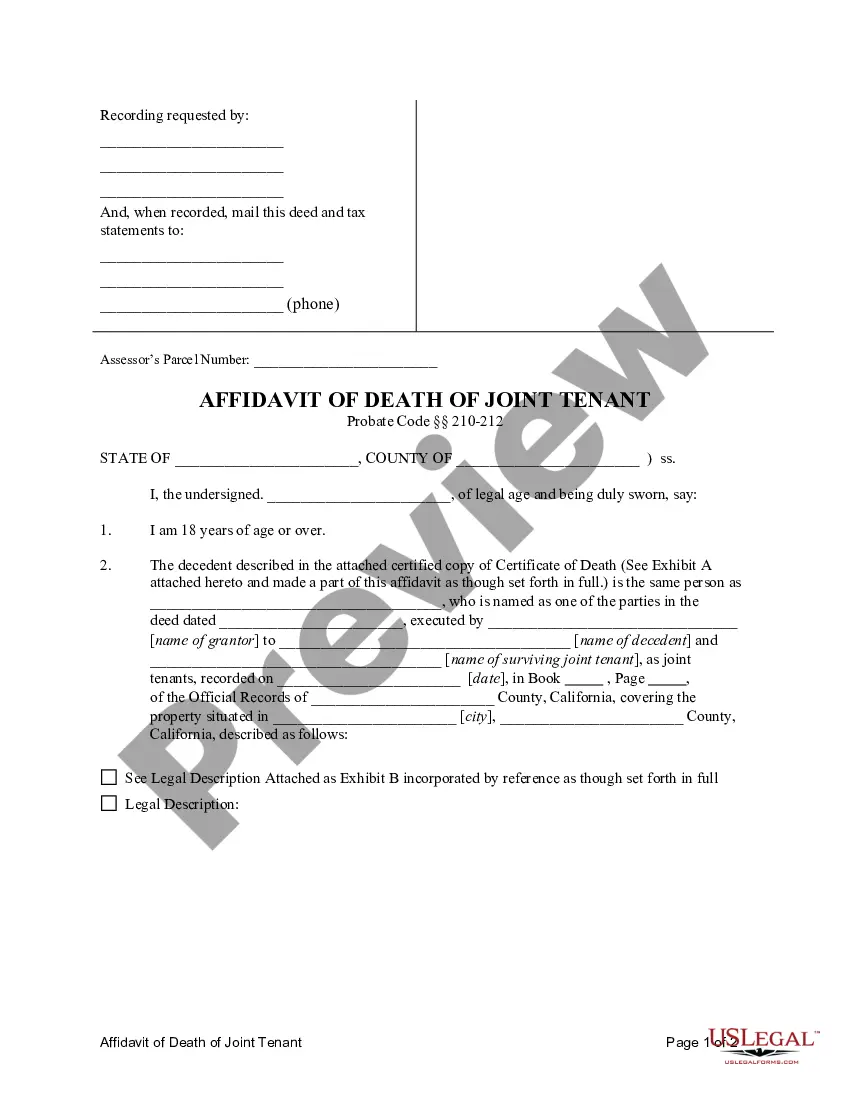

Ca Death Form For Pf

Description

How to fill out California Affidavit Of Death Of Joint Tenant?

The Ca Death Form For Pf displayed on this page is a reusable legal template crafted by professional attorneys following federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific forms for every business and personal event. It’s the fastest, simplest, and most reliable method to acquire the documentation you require, as the service ensures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have authentic legal templates for all of life's circumstances at your fingertips.

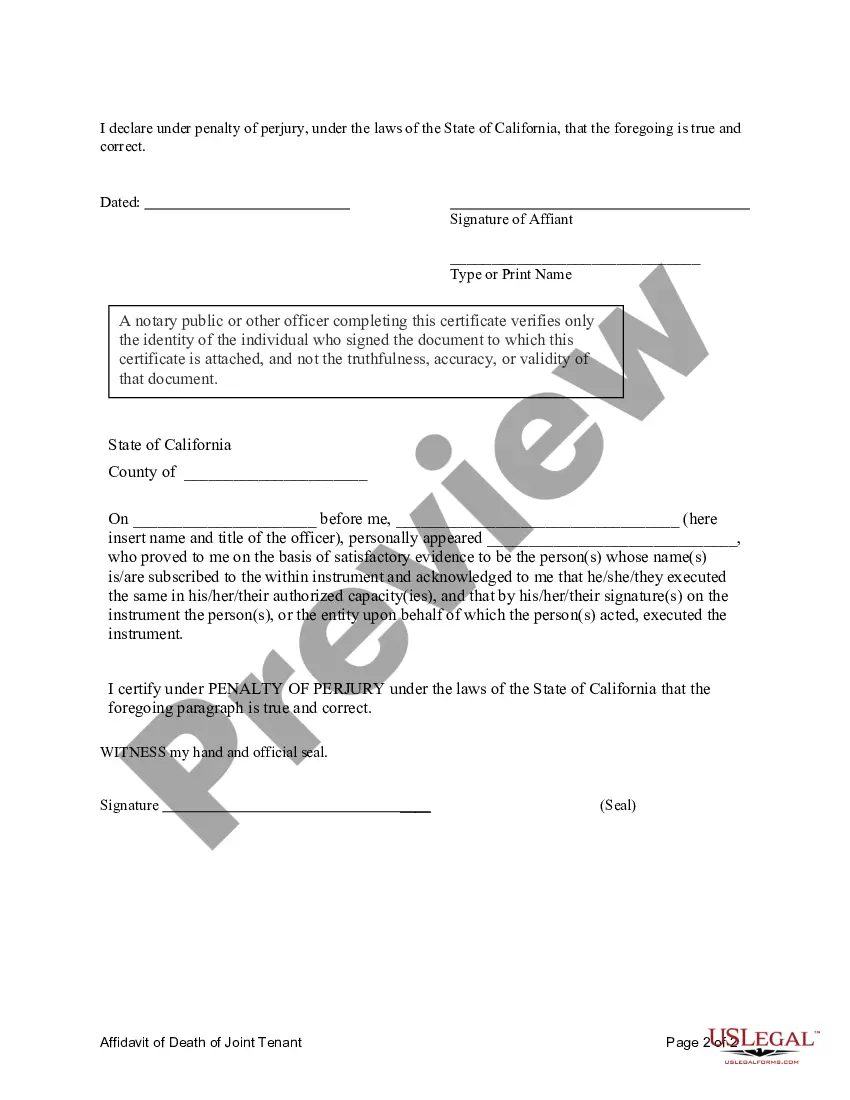

- Search for the document you require and examine it.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for quick payment. If you possess an existing account, Log In and verify your subscription to continue.

- Select the format you desire for your Ca Death Form For Pf (PDF, Word, RTF) and download the template onto your device.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your document with a legally-binding electronic signature.

- Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

Once a properly completed claim application is received, the EDD usually determines eligibility within 14 days. The EDD will send you the Notice of Computation (DE 429DF) to inform you of your potential weekly benefit amount based on the wages you earned in your base period.

Claim for Paid Family Leave (PFL) Benefits (DE 2501F) - English: You must submit an original form provided by the EDD. This form cannot be downloaded or reproduced. This form cannot be downloaded or reproduced. To submit the DE 2501F electronically, visit How to File a Paid Family Leave Claim in SDI Online.

How to File a Paid Family Leave Claim in SDI Online Step 1: Gather Required Information. ... Step 2: Create your myEDD Account. ... Step 3: Register for SDI Online. ... Step 4: File Your PFL Claim Online. ... Step 5: Attach Additional Documentation Required. ... Step 6: Completion of Your PFL Claim Filing.

If eligible, you can receive benefit payments for up to eight weeks. Payments are about 60 to 70 percent of your weekly wages earned 5 to 18 months before your claim start date. You will choose your benefit payment option when you file your claim.

Payment begins the first day of leave. You pay into the State Disability Insurance (SDI) program. It is not government assistance. California's Paid Family Leave (PFL) pays eligible employees up to eight weeks of benefits to be there for the moments that matter most.