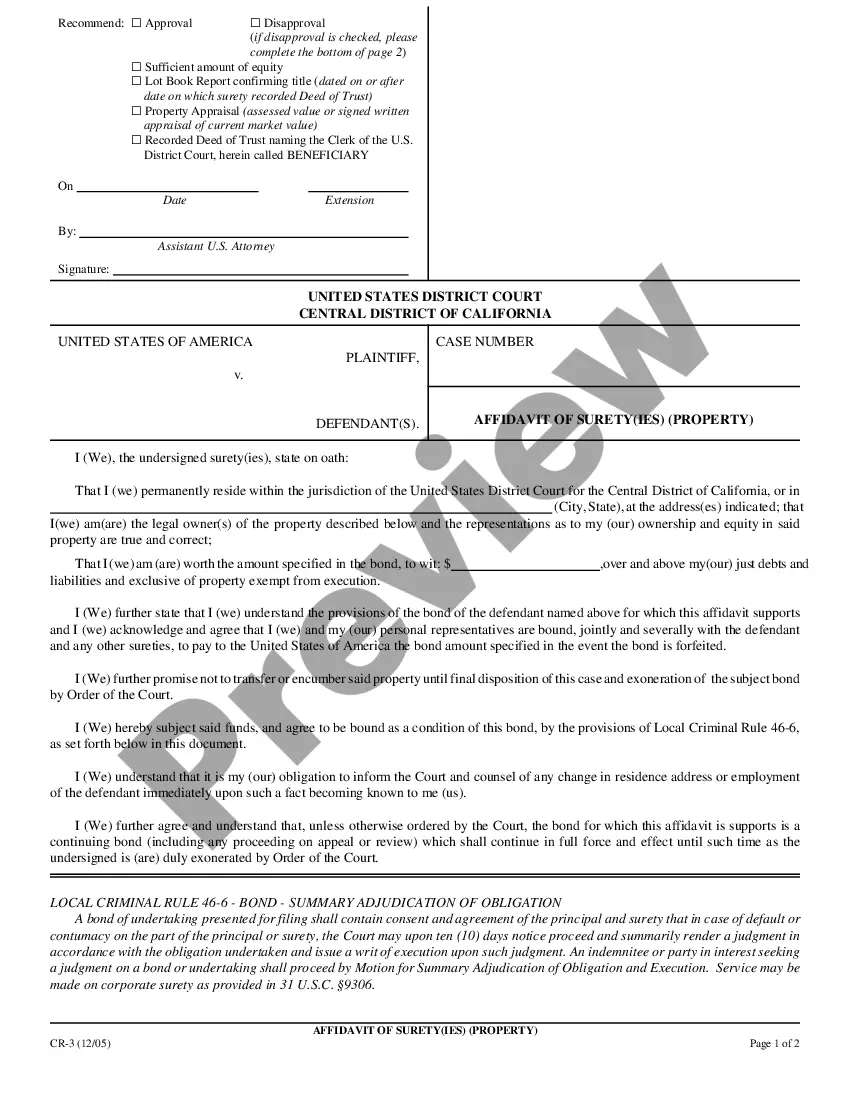

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit of Sureties , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s). USLF control no. CA-CR-004-FED

Surety Without Bond

Description

How to fill out California Affidavit Of Surety - No Justification?

Whether for business purposes or for personal matters, everyone has to deal with legal situations at some point in their life. Completing legal paperwork needs careful attention, beginning from choosing the proper form sample. For example, if you choose a wrong edition of the Surety Without Bond, it will be rejected once you submit it. It is therefore crucial to get a trustworthy source of legal documents like US Legal Forms.

If you have to obtain a Surety Without Bond sample, stick to these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Examine the form’s description to ensure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the Surety Without Bond sample you need.

- Download the template if it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Choose the file format you want and download the Surety Without Bond.

- After it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the internet. Utilize the library’s easy navigation to find the right form for any situation.

Form popularity

FAQ

To obtain a surety bond, the principal pays a premium to the surety, typically an insurance company. The surety bond requires the principal to sign an indemnity agreement that pledges company and personal assets to reimburse the surety if a claim occurs. What is a Surety Bond and When Do You Need One? - ValuePenguin valuepenguin.com ? small-business ? what-i... valuepenguin.com ? small-business ? what-i...

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract. What is the Difference Between a Cash and Surety Bond? worldinsurance.com ? blog ? what-is-the-dif... worldinsurance.com ? blog ? what-is-the-dif...

A surety bond is defined as a three-party agreement that legally binds together a principal who needs the bond, an obligee who requires the bond and a surety company that sells the bond. The bond guarantees the principal will act in ance with certain laws. Surety Bond Definition Explained | SuretyBonds.com suretybonds.com ? surety-bond-definition suretybonds.com ? surety-bond-definition

These bond types are also referred to as ?commercial bonds" or ?business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds. 3 Most Common Types of Surety Bonds You Need to Know nnasuretybonds.com ? 3-most-common-typ... nnasuretybonds.com ? 3-most-common-typ...

What Are Surety Bonds. A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).