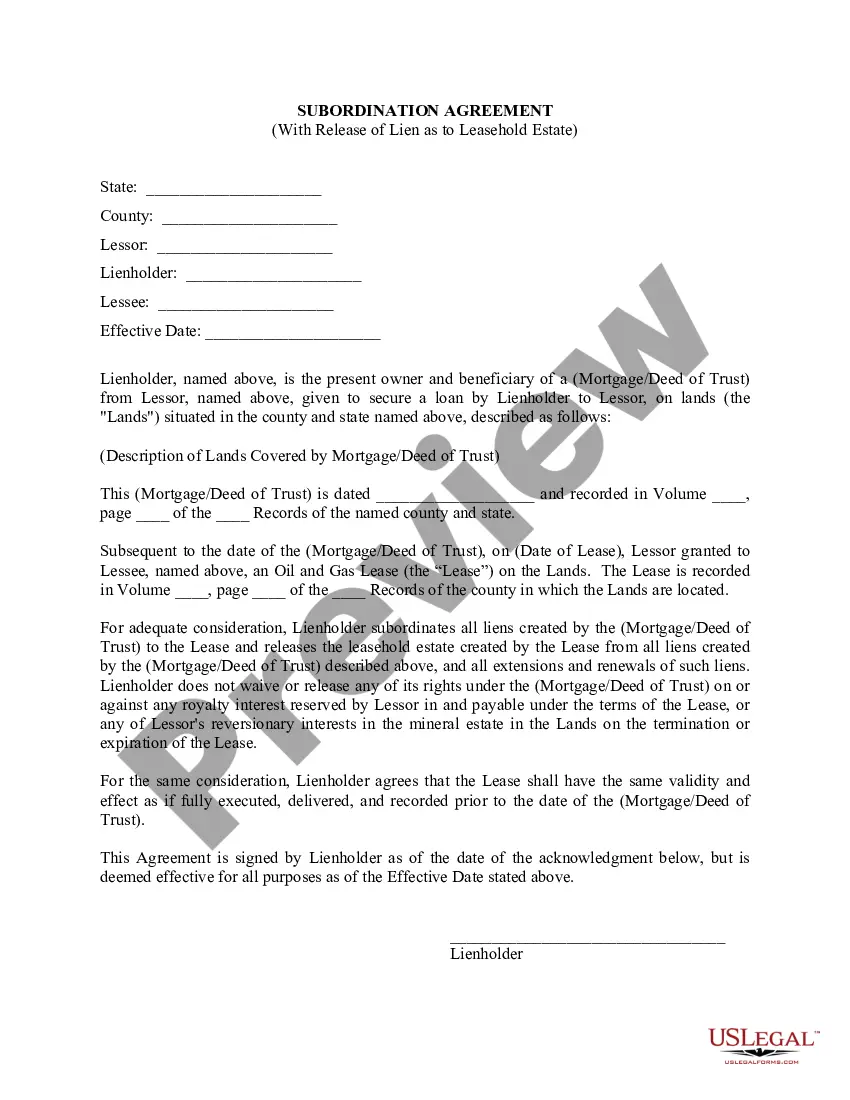

Lease Subordination Agreement With Irs

Description

How to fill out California Lease Subordination Agreement?

Precisely crafted official documentation is one of the essential assurances for preventing complications and legal disputes, but obtaining it without the assistance of a lawyer may require time.

Whether you need to swiftly locate a contemporary Lease Subordination Agreement With Irs or any other forms related to employment, family, or business circumstances, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If you have an active subscription, you just need to Log In to your account and click the Download button next to the selected file. Moreover, you can access the Lease Subordination Agreement With Irs at any time later, as all documents ever obtained on the platform remain accessible within the My documents tab of your profile. Save time and finances on preparing official documentation. Try US Legal Forms today!

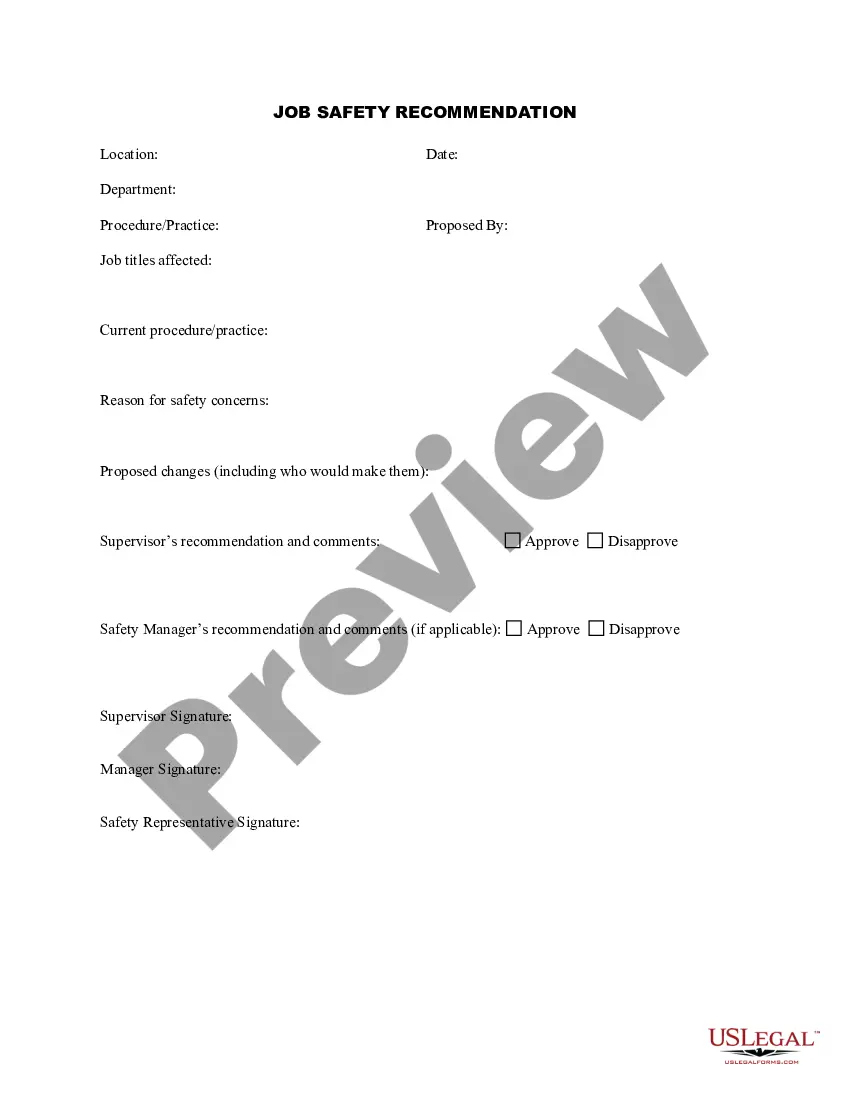

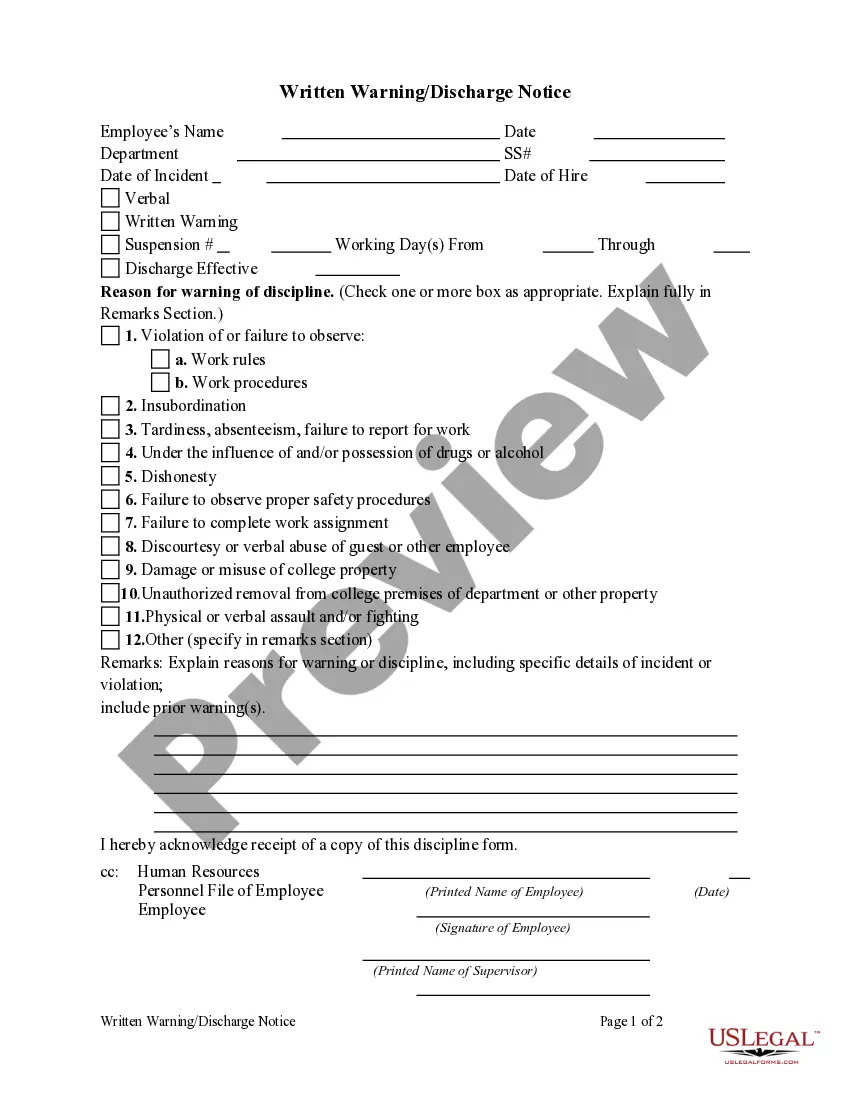

- Ensure that the form is appropriate for your situation and locality by reviewing the description and preview.

- If necessary, search for another sample using the Search bar located in the page header.

- When you identify the relevant template, click on Buy Now.

- Select a pricing plan, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Lease Subordination Agreement With Irs.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

In essence, federal tax lien subordination means the IRS is giving up its priority on your property so you can get a loan, mortgage, or other financing. With tax lien subordination, the IRS tax lien remains on your property, but it will be a lower priority than the financial interest of new lenders.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

Apply for a certificate of subordination of federal tax lien by following the instructions in Publication 784. You will need to complete Form 14134. It is also a smart idea to watch this self-help IRS video. It is important to apply at least 45 days before a loan settlement meeting.

The normal processing time for a Subordination may be as long as 30 to 60 days. However, when there is danger of losing the loan, the IRS may expedite the certificate at the taxpayer's or representative's request.