Agreement Manager Property With No Money Down

Description

How to fill out California Property Manager Agreement?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Completing legal papers demands careful attention, starting with choosing the proper form template. For example, when you choose a wrong version of a Agreement Manager Property With No Money Down, it will be rejected once you submit it. It is therefore important to get a dependable source of legal files like US Legal Forms.

If you have to obtain a Agreement Manager Property With No Money Down template, follow these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it matches your case, state, and county.

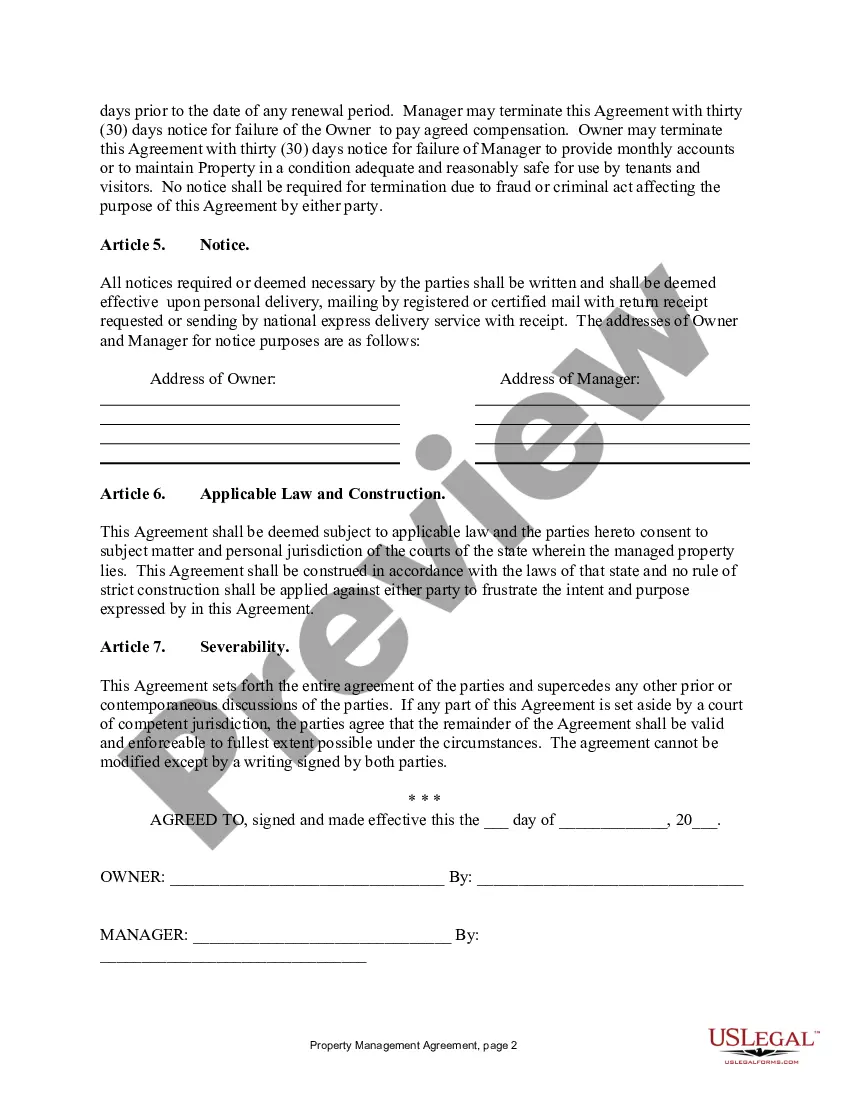

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Agreement Manager Property With No Money Down sample you need.

- Download the template when it meets your requirements.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Agreement Manager Property With No Money Down.

- When it is saved, you can fill out the form by using editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time looking for the appropriate template across the web. Make use of the library’s simple navigation to find the proper template for any situation.

Form popularity

FAQ

Here are some examples of no-money-down real estate deals: Borrow the money. ... Assume the existing mortgage. ... Lease with option to buy. ... Seller financing. ... Negotiate the down payment. ... Swap personal property. ... Exchange your skills. ... Take on a partner.

Yes, it is possible to purchase an investment property without paying a 20% down payment. By exploring alternative financing options such as seller financing or utilizing lines of credit or home equity through cash-out refinancing or HELOCs, you can reduce or eliminate the need for a large upfront payment.

If you are thinking about how to invest in real estate with little money, then Real Estate mutual funds are the answer. These are quite similar to conventional mutual funds with a majority of investment in real estate stocks, REITs, as well as direct purchase of residential, commercial, and industrial units.

Armed with the information on why the house isn't currently for sale, prepare an offer letter tailored to the owner's situation. Be flexible and work with the owners on a possible move-in date, or offer to let them rent from you while they find a new house. And get pre-approved for the mortgage before making the offer.

Check out these tactics, along with their pros and cons. Dip into your 401(k) If you've been socking away money in your 401(k), it is possible to borrow from that for a home loan?and get that cash in hand fast. ... Crack your IRA. ... Hit up your boss. ... Explore state and city programs. ... Get a gift from family or friends.