Difference Between Assignment And Lease

Description

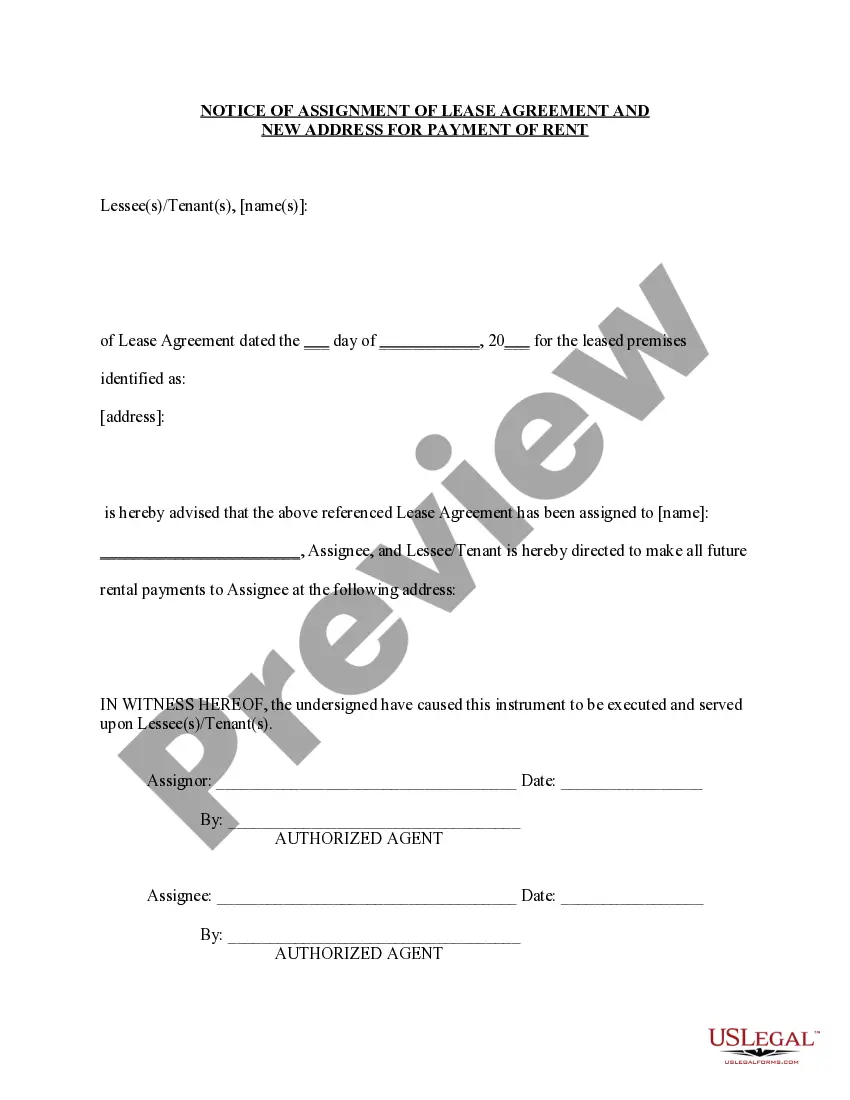

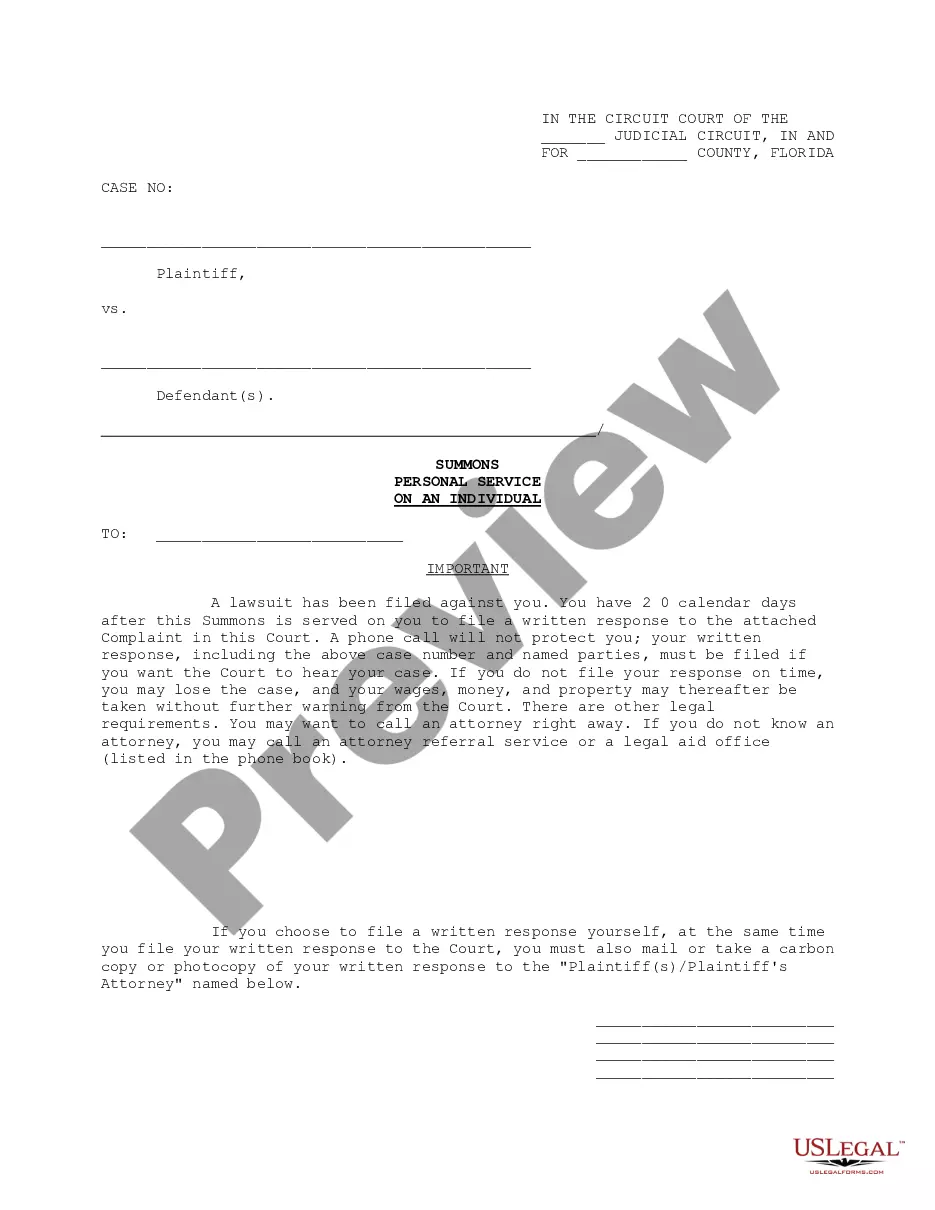

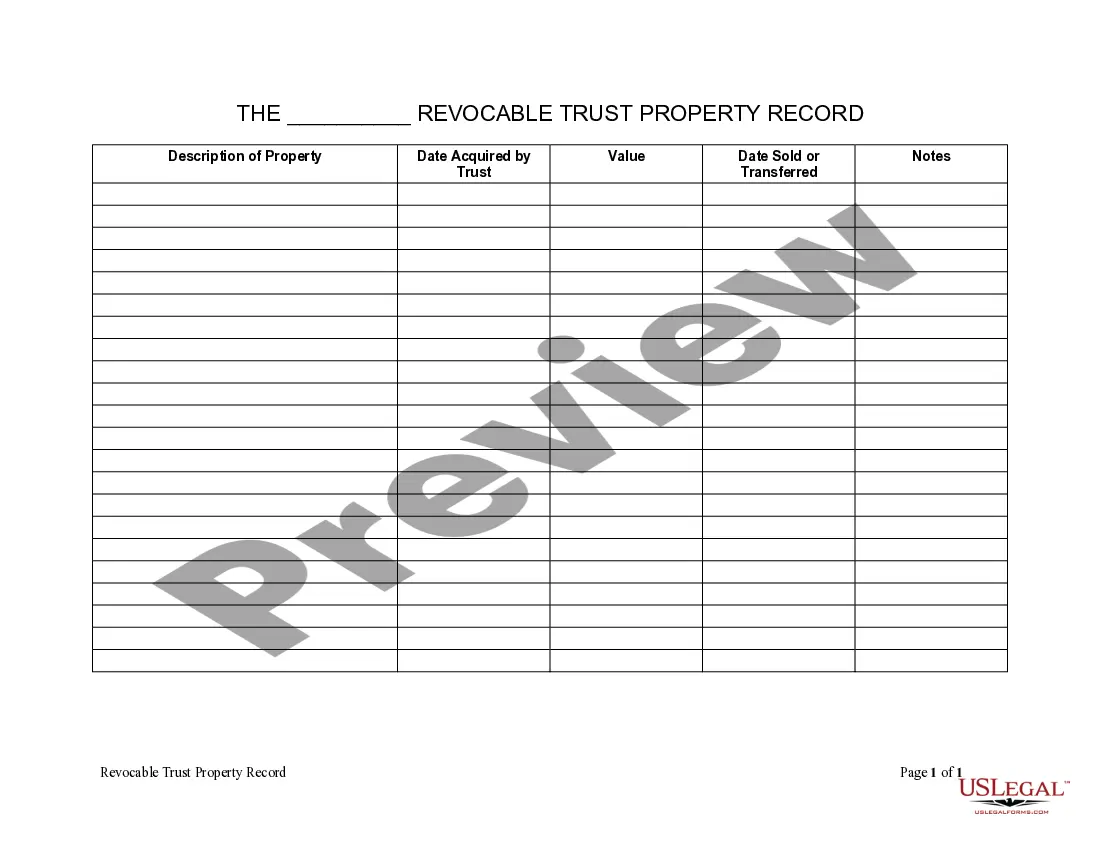

How to fill out California Assignment Of Lease From Lessor With Notice Of Assignment?

Finding an essential location to obtain the latest and pertinent legal samples is part of the challenge of managing bureaucracy.

Selecting the correct legal documents requires precision and meticulousness, which is why it's crucial to source samples of Difference Between Assignment And Lease from trustworthy sources, like US Legal Forms.

Once you have the form on your device, you can modify it using the editor or print it and fill it out manually. Eliminate the stress associated with your legal paperwork. Browse the comprehensive US Legal Forms library to locate legal samples, verify their appropriateness for your situation, and download them right away.

- Use the library navigation or search bar to locate your sample.

- Examine the form’s description to determine if it meets the needs of your state and region.

- View the form preview, if available, to confirm that the template is indeed the one you are looking for.

- Continue searching and find the appropriate document if the Difference Between Assignment And Lease does not suit your needs.

- If you are confident in the form’s applicability, download it.

- Once you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you haven’t created an account yet, click Buy now to acquire the form.

- Choose the pricing plan that aligns with your needs.

- Proceed with registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Difference Between Assignment And Lease.

Form popularity

FAQ

All Montana LLCs need to pay $20 per year for the Montana Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.

Create an LLC in Montana Select a Name for the LLC. ... Designate a Montana Registered Agent. ... File Articles of Organization. ... Write a Montana LLC Operating Agreement. ... Get an Employer Identification Number from the IRS. ... File BOI Report to FinCEN. ... Open a Bank Account in Montana.

Under Montana law, LLCs can be formed to provide professional services. However, only one specific type of service may be provided and all the owners of the LLC must be licensed or registered to perform the professional service for which the LLC was organized.

Single-member LLCs are recognized in every state and are the most common type of LLC. Here, the word "member" is a stand-in for "owner." Single-member LLCs have an individual owner. The Internal Revenue Service (IRS) treats them as sole proprietorships for tax purposes.

Go to eStop.mt.gov to apply, renew, pay and manage your eStop Business Licenses online. It's simple, convenient and secure.

If a single-member LLC chooses not to become a corporation, it is classified as a ?disregarded entity" and is taxed as a sole proprietorship. LLCs can also be taxed as a corporation. Single-member is the most popular filing type and is the most affordable LLC formation.

In a series, there is a parent LLC (or a master LLC) that holds separate LLCs (also called series or subsidiaries) that are each treated as a separate entity with their own bank accounts, operating agreement, asset protection, members and name.

A Montana LLC is created by filing by Articles of Organization with the Montana Secretary of State. The articles must include: the type of LLC--regular LLC, professional LLC, Series LLC, or Professional Series LLC.