Dissolution Limited Form Complete For California Llc

Description

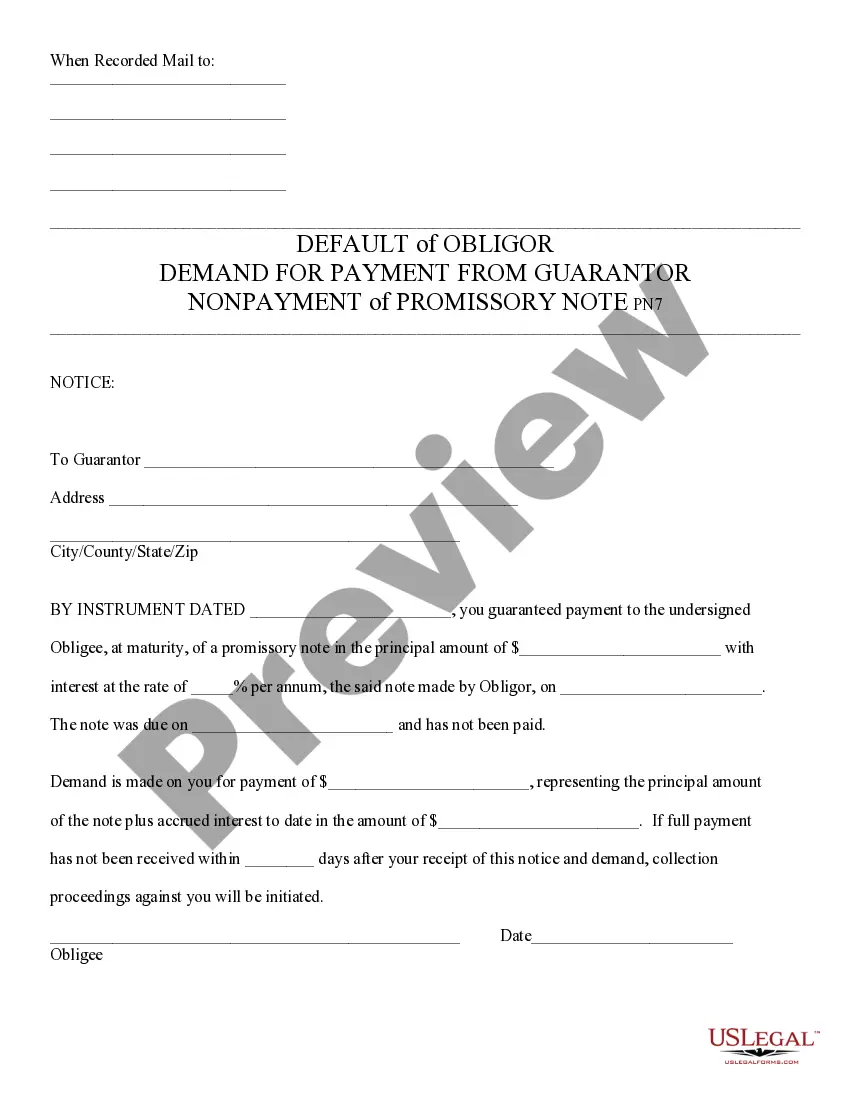

How to fill out California Complaint For Dissolution Of Limited Partnership?

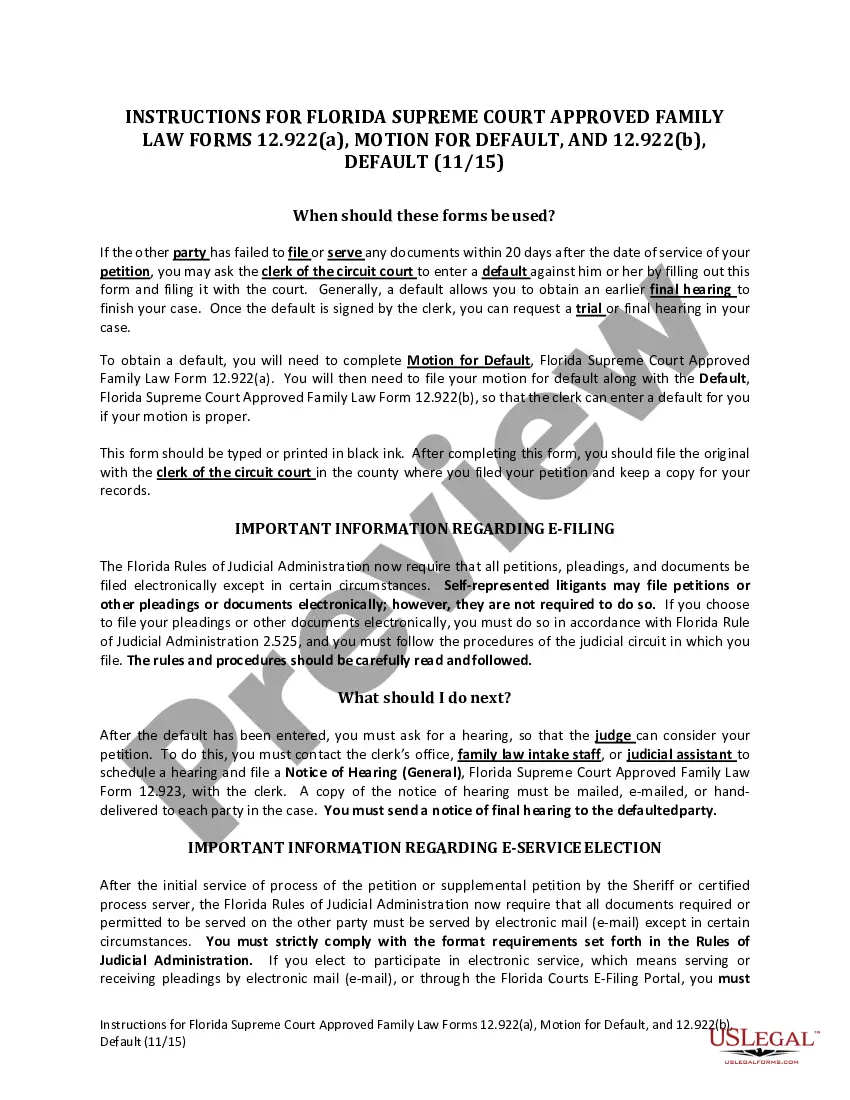

- If you are a returning user, log in to your US Legal Forms account and locate the necessary template by clicking the Download button. Verify your subscription remains active; renew if necessary.

- For first-time users, start by exploring the Preview mode and the form description. Confirm that you have selected the appropriate document for your specific requirements.

- If you need to find an alternative template, utilize the Search tab to ensure you're choosing the correct form that aligns with your jurisdiction.

- Proceed to purchase the document by clicking on the Buy Now button and selecting a suitable subscription plan. Remember, creating an account is essential for accessing the platform's vast resources.

- Complete your purchase by entering your payment information using either a credit card or your PayPal account.

- Finally, download your form and save it on your device. You can access it anytime in the My Forms section of your profile.

By using US Legal Forms, you're not just accessing a form; you're tapping into a robust resource designed to empower users and attorneys alike. With over 85,000 legal forms available, all editable and fillable, you're set for success.

Ready to complete your dissolution process? Visit US Legal Forms today and streamline your legal documentation with ease.

Form popularity

FAQ

Dissolving a Limited Liability Partnership (LLP) starts with a discussion among partners regarding your intent to dissolve. Next, evaluate your LLP agreement for any specific requirements to initiate the dissolution. After informing partners and creditors, complete the dissolution limited form complete for California LLC, and file it with the state to complete the process. This ensures all legal requirements are met effectively.

Withdrawing from a limited partnership requires following the terms outlined in your partnership agreement. Notify your partners of your decision to withdraw and provide any required documentation. Afterward, file the appropriate forms, like the dissolution limited form complete for California LLC, if necessary. This keeps all parties informed and helps maintain an orderly transition.

To terminate a limited partnership, begin by consulting your limited partnership agreement for any required steps. Then, notify both general and limited partners, as well as creditors, to prevent future liabilities. After that, complete the relevant paperwork, which includes the dissolution limited form complete for California LLC, and file it with the appropriate state agency.

Dissolving a partnership involves several key steps. First, review your partnership agreement for any specific dissolution procedures. Next, notify all partners and creditors about your plan to dissolve, ensuring transparency. Finally, file the necessary dissolution forms with the state, such as the dissolution limited form complete for California LLC, to officially register the dissolution.

Yes, you can file for CA LLC dissolution online, which offers convenience and efficiency. The California Secretary of State provides an online filing option for the Dissolution Limited Form Complete for California LLC. This approach allows you to submit your forms quickly, reducing processing time. Consider utilizing USLegalForms to guide you through the process seamlessly and ensure that every detail is correctly addressed.

Before dissolving your LLC, you should settle all outstanding debts and obligations, ensuring the business is in good standing. Review your operating agreement for any specific requirements regarding the dissolution process. Additionally, notify members and stakeholders about the impending dissolution and consider seeking assistance from USLegalForms to manage the documentation effectively. This preparation helps prevent legal headaches down the road.

To write a notice of dissolution, include essential details such as the LLC's name, the decision to dissolve, and the effective date. Make sure to communicate this notice to all members and relevant parties, ensuring they are informed of the dissolution. Utilizing the dissolution limited form complete for California LLC can be incredibly beneficial, as it provides a clear template and required elements for your notice.

Writing a dissolution involves clearly stating your intention to dissolve the business, along with the effective date and any necessary details specific to your LLC. Ensure your document is signed and includes information about members' consent. For assistance, consider the dissolution limited form complete for California LLC, which offers a structured format to make writing easier.

Articles of Dissolution apply specifically to LLCs and partnerships, officially ending their existence, while Articles of Termination can refer to corporations or other business entities. Essentially, each form serves a similar purpose in terminating a business, but they are tailored to the specific type of entity. Understanding this difference is crucial, especially when you utilize a dissolution limited form complete for California LLC to ensure compliance.

Completing Articles of Dissolution involves gathering your LLC’s pertinent information, such as the date of dissolution and any final tax reports. Make sure to check all requirements set by the California Secretary of State to avoid delays. The dissolution limited form complete for California LLC provides a comprehensive template that simplifies the entire filling process.