California Limited Partnership Complete Withholding

Description

How to fill out California Complaint For Dissolution Of Limited Partnership?

Managing legal documents can be overwhelming, even for experienced professionals.

If you are looking for a California Limited Partnership Complete Withholding and lack the time to search for the correct and current version, the tasks can be challenging.

US Legal Forms meets any needs you may have, from individual to business documents, all in one place.

Utilize advanced tools to complete and manage your California Limited Partnership Complete Withholding.

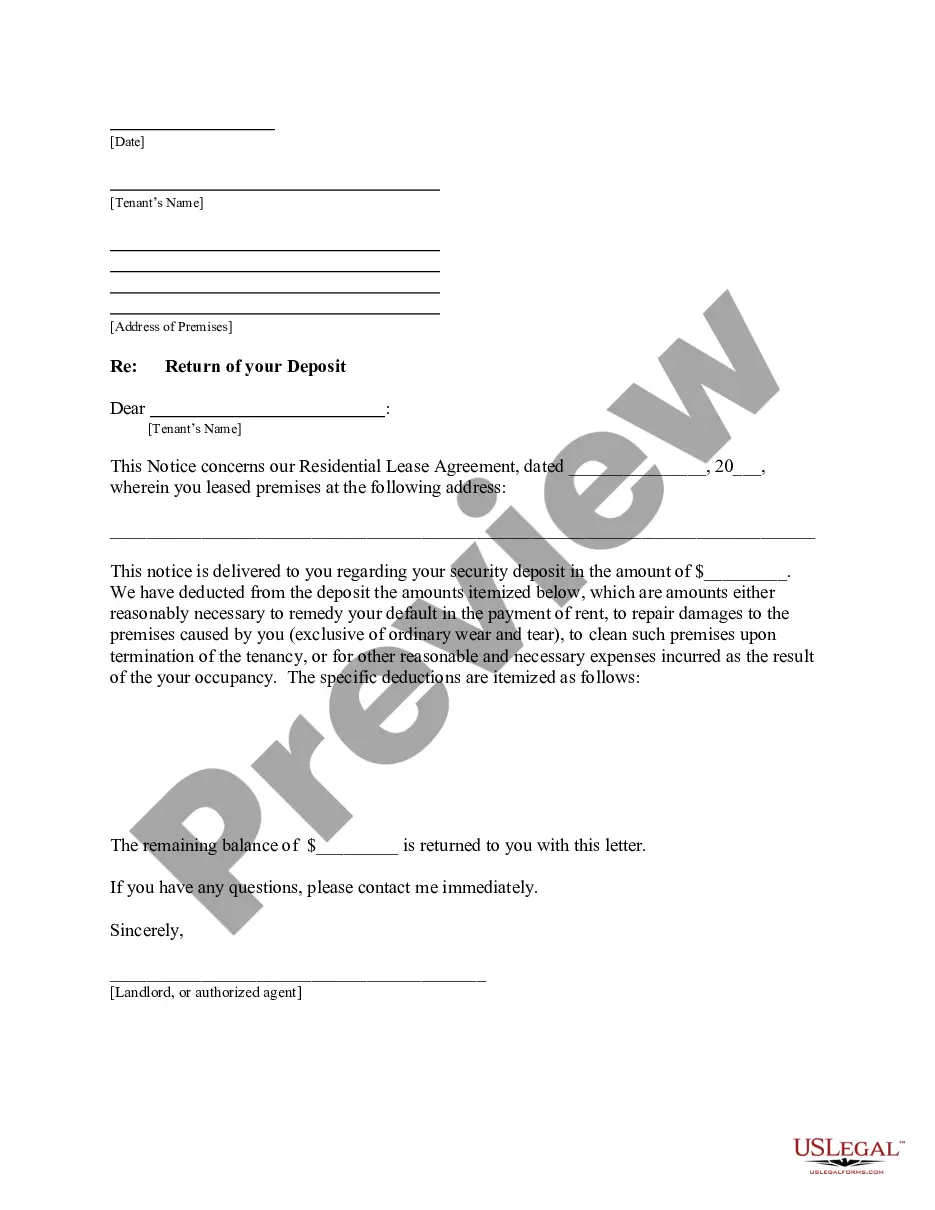

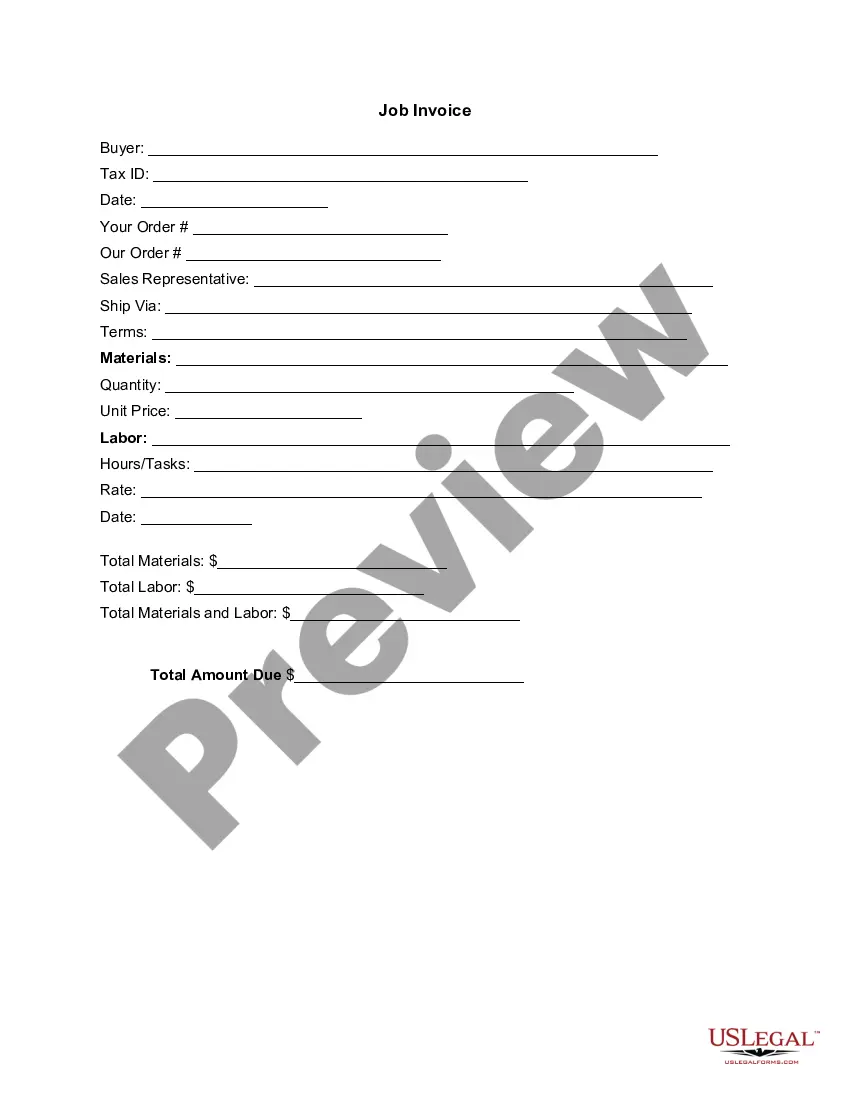

Here are the steps to follow after obtaining the form you need: Verify that this is the correct form by previewing it and reviewing its description. Ensure that the template is accepted in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Find the format you need, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms online catalog, supported by 25 years of experience and trustworthiness. Streamline your daily document management into a seamless and user-friendly process today.

- Access a library of articles, guides, and resources pertinent to your circumstances and requirements.

- Save time and energy searching for the documents you require, and use US Legal Forms’ advanced search and Review feature to locate California Limited Partnership Complete Withholding and obtain it.

- If you have a monthly membership, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents tab to view the documents you have previously saved and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A comprehensive online form directory can be transformative for anyone seeking to navigate these matters effectively.

- US Legal Forms is a leader in the field of online legal documents, with over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access localized legal and business documents.

Form popularity

FAQ

Limited partnerships, like general partnerships, are pass-through or flow-through entities. This means that all partners are responsible for taxes on their share of the partnership income, rather than the partnership itself.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Hear this out loud PauseGeneral partners of an LP have unlimited personal liability for the LP's debts and obligation. To form an LP in California, go to bizfileOnline.sos.ca.gov, log in, select Register a Business under the Business Entities Tile, Certificate of Limited Partnership - CA LP and follow the prompts to complete and submit.

Hear this out loud PauseFiling requirements LLPs do not pay income tax but they are subject to the annual tax of $800. Your return is due the 15th day of the 3rd month after the close of your taxable year. For more information visit Due dates for businesses .

Hear this out loud PauseFor California, these partnerships are treated like all other partnerships and must file partnership returns. They are subject to all California partnership penalties. What is the Limited Partnership Annual Tax? The limited partnership annual tax is $800.