Accounting Complaint California For Involuntary Dissolution

Description

How to fill out California Complaint For Accounting - General - State Basis?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In some respect, this holds true, as preparing Accounting Complaint California For Involuntary Dissolution demands significant knowledge in topic details, including state and municipal laws.

However, with US Legal Forms, the situation has become more manageable: pre-designed legal templates for any life and business event specific to state statutes are gathered in a single online directory and are now accessible to all.

Establish an account or sign in to continue to the payment page.

- US Legal Forms provides over 85,000 current documents categorized by state and use cases, making the search for Accounting Complaint California For Involuntary Dissolution or any other specific template quick and easy.

- Users who have already registered and hold an active subscription should Log In to their account and select Download to obtain the form.

- New users will first need to sign up for an account and subscribe before they can store any documentation.

- Here is a straightforward guide on how to acquire the Accounting Complaint California For Involuntary Dissolution.

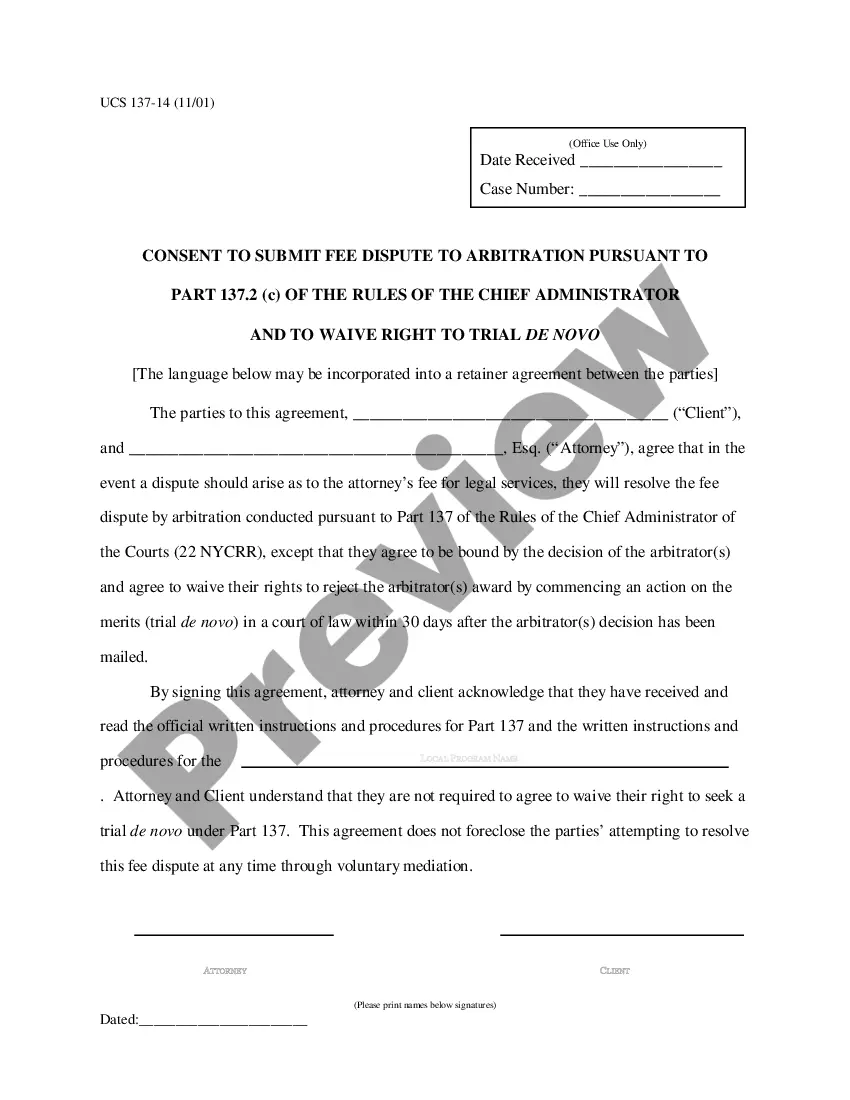

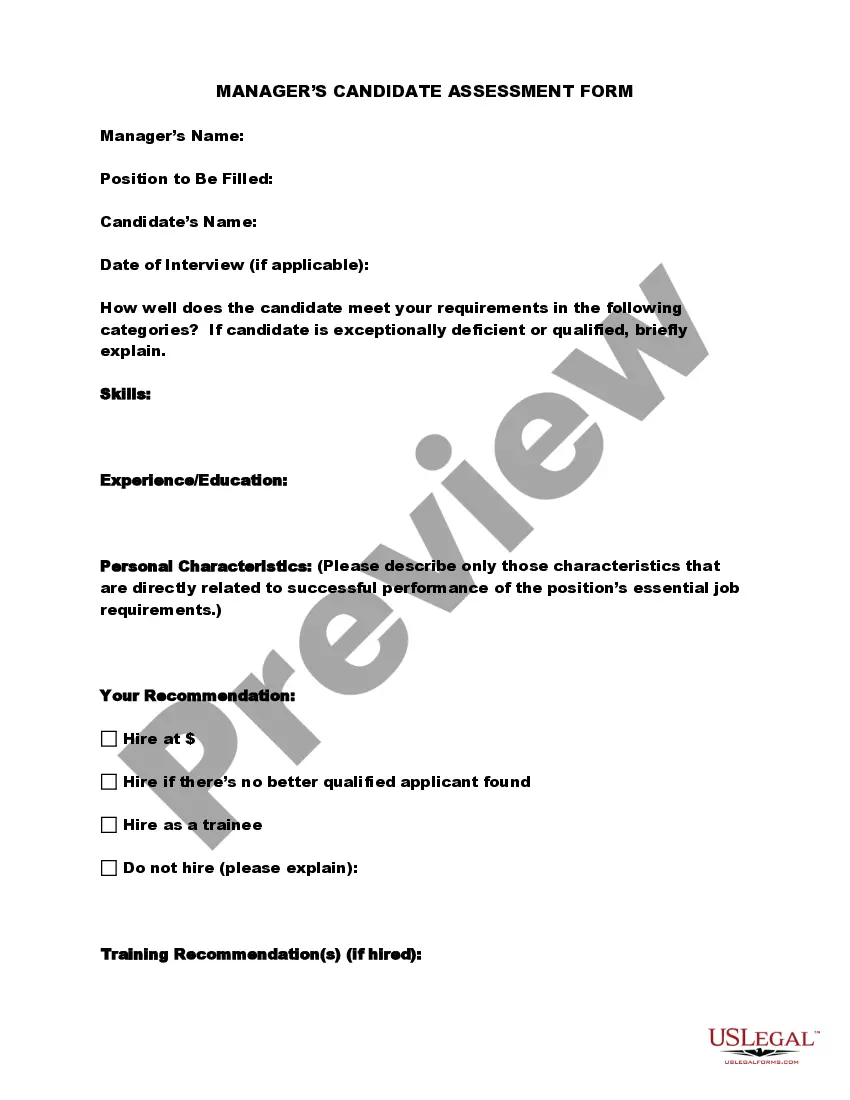

- Review the page content thoroughly to confirm it aligns with your requirements.

- Examine the form description or view it through the Preview feature.

- Locate an alternative example through the Search field above if the initial one doesn't fit your needs.

- Select Buy Now once you identify the appropriate Accounting Complaint California For Involuntary Dissolution.

- Choose a pricing plan that satisfies your requirements and budget.

Form popularity

FAQ

Yes, a dissolved corporation can still be sued in California. However, once a corporation is dissolved, legal actions can become complex. Individuals may consider filing an accounting complaint in California for involuntary dissolution as part of their legal strategy. Understanding the implications of a dissolved status can help stakeholders make informed decisions about legal matters.

Generally, the directors and officers are not personally liable for the corporation's debts unless they engaged in wrongful conduct. However, creditors might still pursue outstanding debts depending on the state laws and circumstances surrounding the dissolution. In cases involving an accounting complaint in California for involuntary dissolution, it is crucial to understand how liability may shift during this process. Seeking professional advice can clarify potential risks.

Yes, an administratively dissolved corporation can file a lawsuit, but this comes with limitations. The corporation must first apply for reinstatement to regain full legal standing. In some cases, addressing an accounting complaint in California for involuntary dissolution might be necessary before proceeding with any legal actions. It’s important to consult legal guidance to navigate this process effectively.

An involuntary dissolution occurs when a corporation is dissolved by a government authority due to noncompliance with state laws. For instance, if a corporation fails to file required paperwork or taxes, the state can initiate an involuntary dissolution. This scenario may lead to an accounting complaint in California for involuntary dissolution. Understanding this process can help business owners remain compliant and avoid legal issues.

Involuntary dissolution of a partnership occurs when a partnership is dissolved by operation of law or through a formal government action. This can happen due to failure to comply with legal requirements or to resolve conflicts between partners. The dissolution process can lead to various financial implications, which may prompt an accounting complaint California for involuntary dissolution. Seeking mediation or legal solutions can help partners manage this challenging transition.

An inactive LLC cannot legally conduct business in California. If an LLC has been dissolved, it loses its rights to operate, which also includes entering contracts or bringing legal actions. Attempting to conduct business without proper standing could create additional complications, potentially resulting in an accounting complaint California for involuntary dissolution. For clarity, it is best to consult legal advice if you’re unsure about your LLC’s status.

An LLC may face involuntary dissolution due to various factors, such as failing to file required documents, not paying taxes, or violating state laws. This dissolution process can significantly affect the LLC's ability to operate legally. Moreover, it can impede financial matters, prompting potential accounting complaints California for involuntary dissolution. To prevent this, keeping accurate records and adhering to compliance requirements is key.

In California, limited liability companies (LLCs) can be involuntarily dissolved for failing to file an annual report. This can result from non-compliance with state regulations, leading to significant operational consequences. It's crucial for LLCs to maintain good standing by adhering to filing requirements, as failure may necessitate resolutions related to an accounting complaint California for involuntary dissolution.

To file a complaint against an accountant in California, you need to gather all relevant documentation. This may include contracts, communication records, and any evidence of wrongdoing. Your complaint must then be submitted to the California Board of Accountancy. If the situation involves financial mishandling related to an accounting complaint California for involuntary dissolution, it’s essential to include that context in your complaint.

The three types of dissolution in California are voluntary, involuntary, and administrative. Voluntary dissolution occurs when the owners decide to close the business. Involuntary dissolution happens through state action due to non-compliance, such as failing to adhere to regulations. Administrative dissolution commonly arises from not filing necessary documents, which may lead to the need for accounting complaint California for involuntary dissolution.