Compromise And Release California Withholding Tax

Description

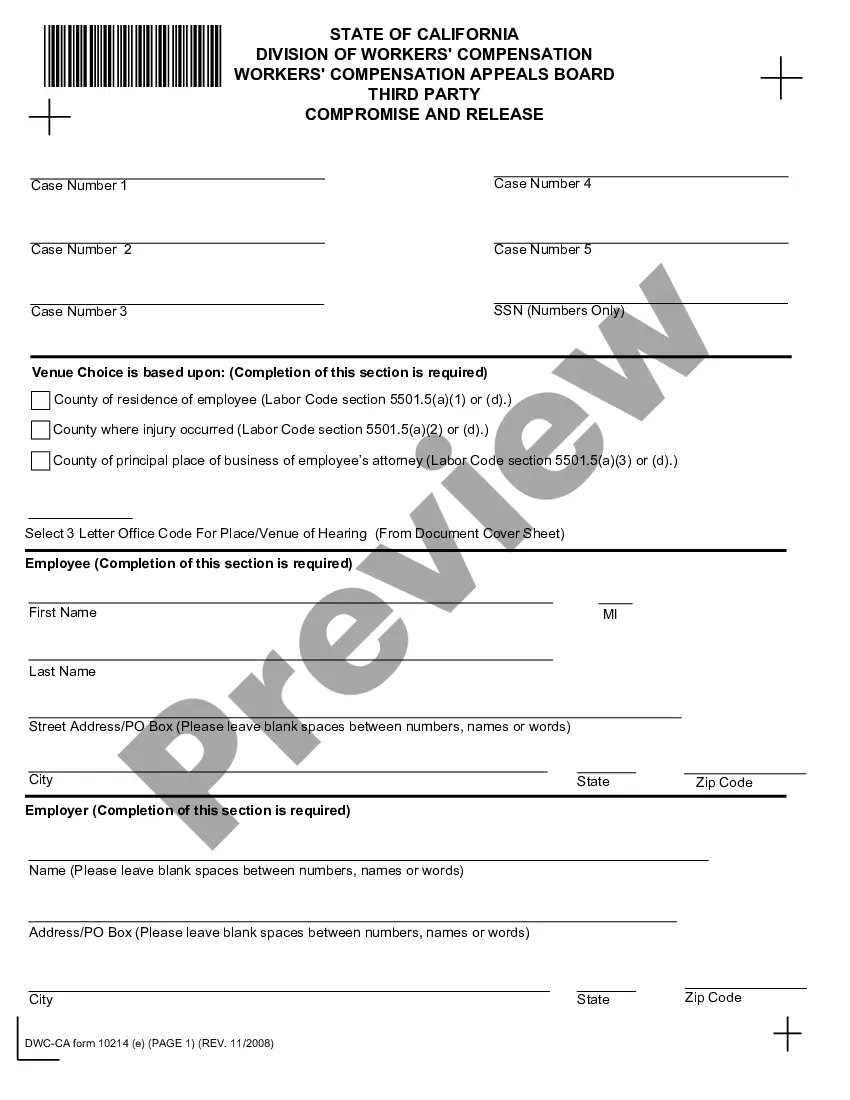

How to fill out California Compromise And Release For Workers' Compensation?

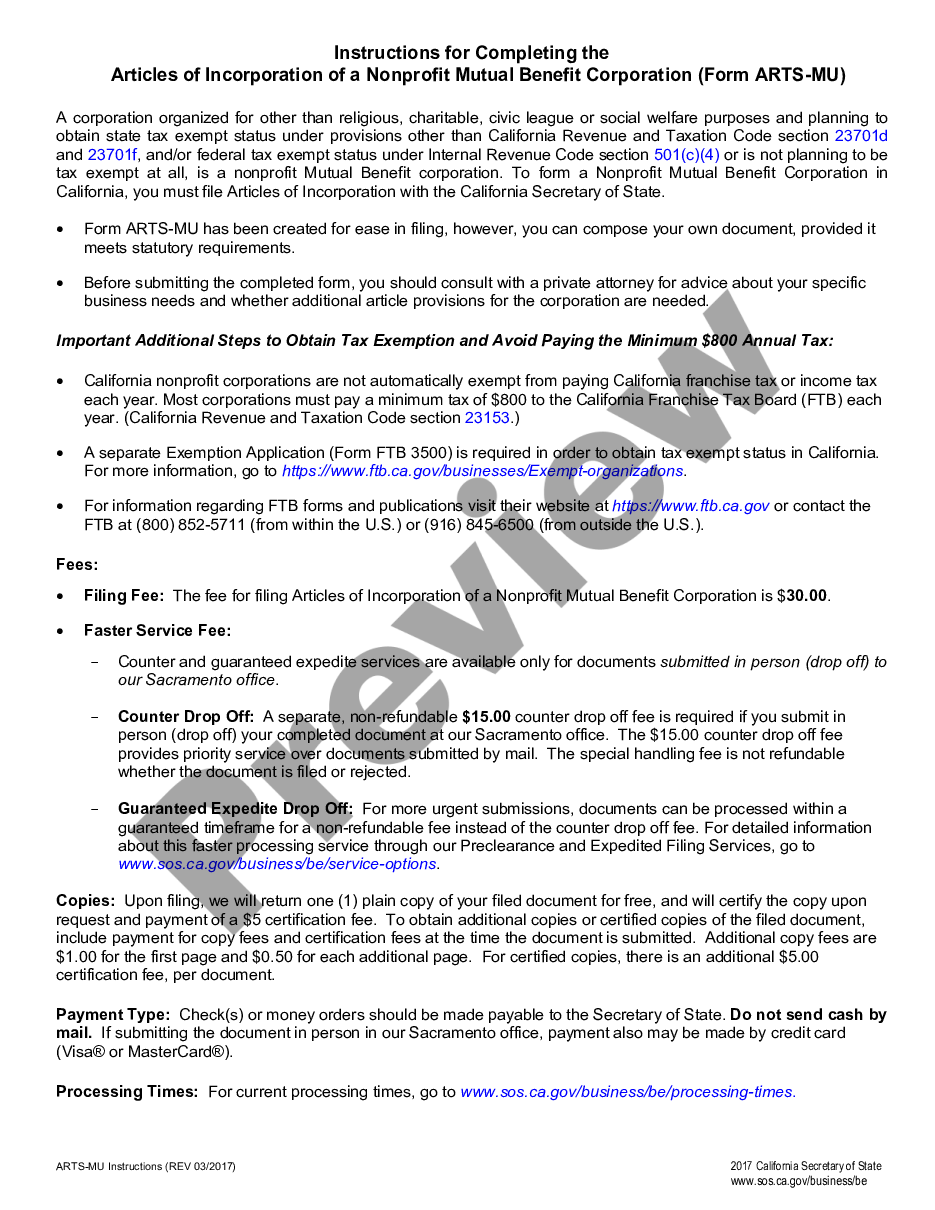

Legal papers management can be frustrating, even for experienced specialists. When you are searching for a Compromise And Release California Withholding Tax and do not have the time to devote looking for the appropriate and updated version, the processes might be nerve-racking. A robust online form library could be a gamechanger for anyone who wants to take care of these situations efficiently. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you may have, from personal to business documents, in one location.

- Employ innovative tools to accomplish and manage your Compromise And Release California Withholding Tax

- Gain access to a resource base of articles, instructions and handbooks and materials connected to your situation and requirements

Save effort and time looking for the documents you need, and use US Legal Forms’ advanced search and Review tool to get Compromise And Release California Withholding Tax and download it. For those who have a membership, log in for your US Legal Forms account, search for the form, and download it. Review your My Forms tab to find out the documents you previously downloaded as well as to manage your folders as you can see fit.

Should it be the first time with US Legal Forms, create a free account and get limitless usage of all advantages of the library. Here are the steps to take after downloading the form you want:

- Validate this is the correct form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Find the format you want, and Download, complete, sign, print out and send out your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and trustworthiness. Enhance your everyday papers administration in a easy and intuitive process today.

Form popularity

FAQ

The taxpayer can apply for a California State Tax Offer in Compromise only if they filed tax returns or are not required to file tax returns. The taxpayer also must fully complete the Offer in Compromise application, and provide all supporting documentation.

You plan to pay your Offer in Compromise with a lump sum payment. To calculate your Offer in Compromise with a lump sum payment, multiply your remaining monthly income of $400 by 12, which will make your remaining future income $4,800. Then, add this to your available equity in assets, which is $5,000, to get $9,800.

A Workers' Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers' compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare.

The addendum to the compromise and release agreement, stating that the applicant released the defendant from all liability for injuries during the applicant's entire period of employment, was superseded by the provision in the pre-printed compromise and release form limiting the settlement to the body parts ...

An offer in compromise (OIC) is a proposal to pay CDTFA an amount that is less than the full tax or fee liability due. If you make an offer and we accept it, you will no longer be liable for the full amount due and we will release any related tax liens as provided by the terms and conditions relative to your offer.