Notice 30 Day Forecast Omaha

Description

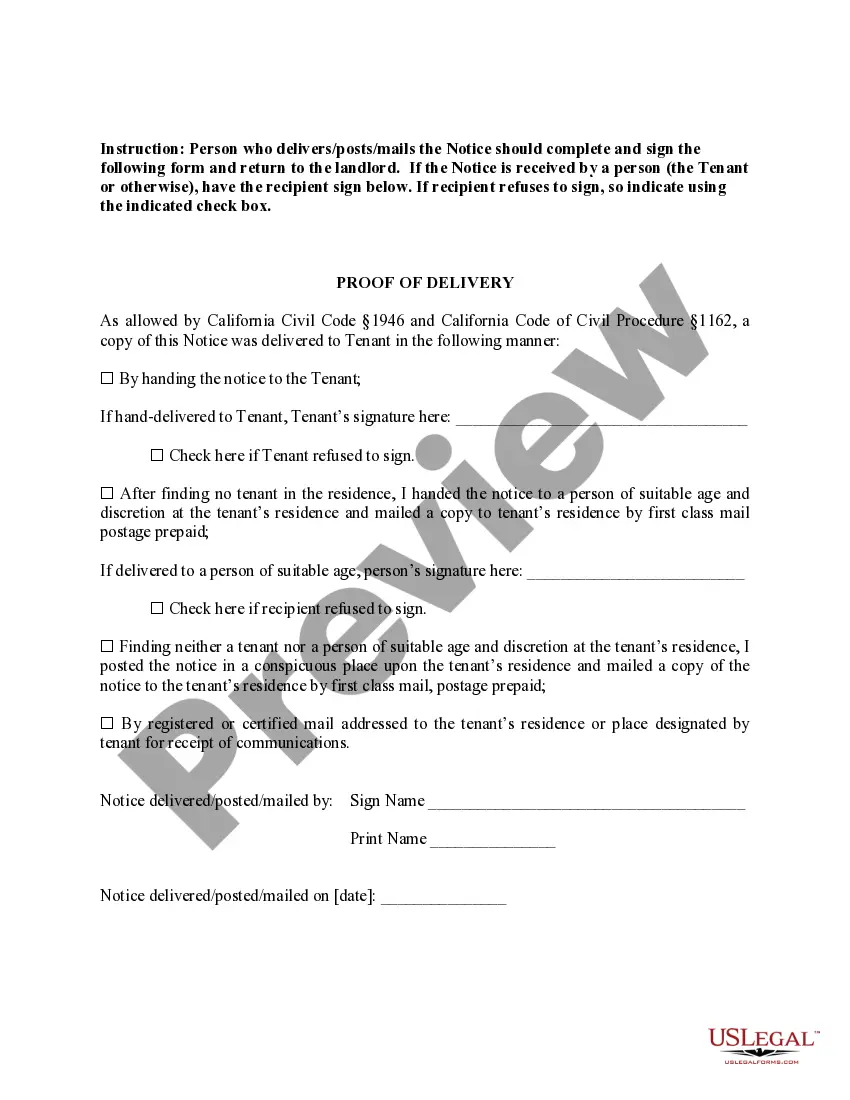

How to fill out California 30 Day Notice Of Termination - Residential Month-to-Month Tenancy - Nonrenewal Of Lease?

Managing legal documentation and processes can be a lengthy addition to your daily routine.

Forms like Notice 30 Day Forecast Omaha often require you to search for them and determine the most efficient way to complete them.

Thus, if you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online registry of forms when necessary will significantly help you.

US Legal Forms is the premier online resource for legal documents, featuring over 85,000 state-specific templates and various tools to assist you in completing your documents with ease.

Is this your first experience using US Legal Forms? Create and set up a free account in a few minutes to gain access to the document collection and Notice 30 Day Forecast Omaha. Then, adhere to the steps below to fill out your document: Ensure that you have identified the correct form by utilizing the Preview feature and reviewing the form details. Select Buy Now when prepared, and choose the subscription plan that meets your requirements. Click Download, then complete, sign, and print the form.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers you access to state- and county-specific templates that you can download at any time.

- Safeguard your document management efforts with a high-quality service that allows you to prepare any form in minutes without additional or hidden fees.

- Simply Log In to your account, locate Notice 30 Day Forecast Omaha and retrieve it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

M60, Income Tax Return Payment voucher.

There is very good news for taxpayers in Minnesota, USA, given that a stimulus checks September 2023 program is being rolled out in this state. Governor Tim Walz has organised a new scheme that will give many families stimulus checks in the form of a surprise tax rebate.

Many taxpayers in Minnesota, USA, are set to receive a tax refund over the coming days, thanks to a new tax rebate August 2023 law. Overall, over two million checks worth up to 1,300 dollars each will be sent out across August and September, thanks to a new initiative from Governor Tim Walz.

Here are the rebate check totals: $260 for individuals with adjusted gross income of $75,000 or less. $520 for married couples who filed a joint return with an adjusted gross income of $150,000 or less. An additional $260 added for each dependent, with a maximum of three dependents totaling $780.

Eligibility for the rebates was based on income. Those making $75,000 or less were sent a one-time payment of $260. Couples making $150,000 or less got $520, and parents in those income brackets got another $260 per child, for up to three kids ? with the maximum possible credit totaling $1,300.

All Minnesota taxpayers with a 2021 adjusted gross income of $75,000 or less are eligible for a payment of $260. Married couples that jointly filed taxes in 2021 with an adjusted gross income of $150,000 or less are eligible for a payment of $520.

One-Time Refund for Tax Year 2021. The Minnesota Department of Revenue has finished processing one-time tax rebate payments for eligible Minnesota taxpayers. We issued nearly 2.1 million rebates ? totaling nearly $1 billion ? under a law passed in May.