Limited Partnership With General Partner

Description

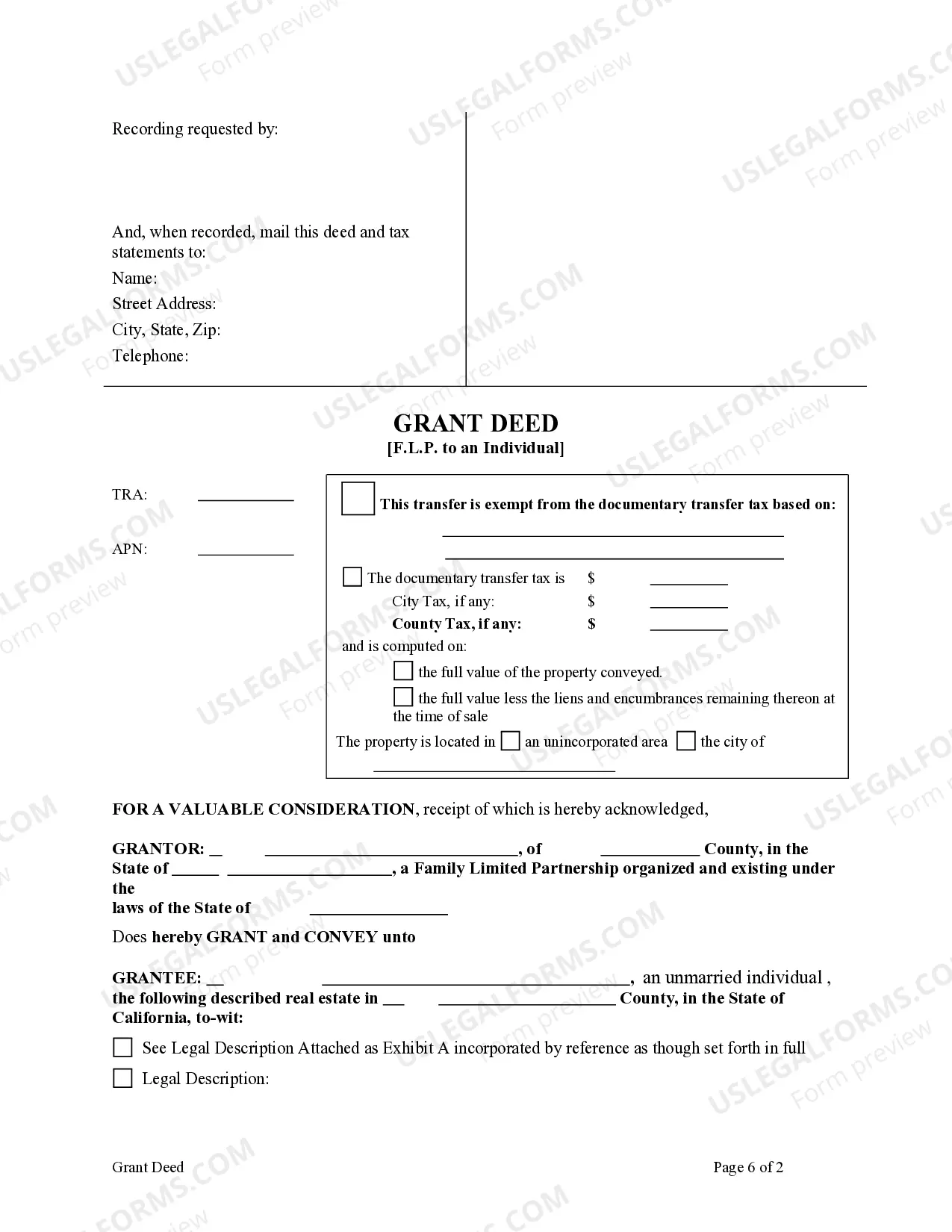

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- Log in to your account on US Legal Forms if you’ve used the service before. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by reviewing the Preview mode and descriptions of the forms available. Confirm that the selected form meets your local jurisdiction requirements.

- If the needed form does not match your needs, utilize the Search tab to explore other templates until you find the right one.

- Once you’ve identified the correct document, click on the Buy Now button and select your preferred subscription plan. Creating an account is necessary to access the library.

- Proceed to payment by entering your credit card information or choosing PayPal for a subscription purchase.

- After payment, download your document and save it to your device. You can access it anytime in the My Forms section of your profile.

By utilizing US Legal Forms, you gain access to a rich repository of legal resources and expert assistance, ensuring your documents are completed accurately and are legally sound.

Start streamlining your legal documentation today with US Legal Forms and experience the convenience of having the right resources at your fingertips!

Form popularity

FAQ

In a family limited partnership, the general partner holds significant responsibilities and control over the partnership's operations. Typically, this individual is a family member who manages the affairs of the limited partnership with general partner oversight. They have the authority to make important decisions, handle day-to-day operations, and guide the partnership's direction. If you are considering forming a family limited partnership, US Legal Forms can provide the necessary documents and resources to facilitate this process.

In general, a general partnership does not include limited partners; this arrangement typically exists in a limited partnership with general partner. Limited partners have restricted roles and liabilities compared to general partners. However, individuals looking for both structures can establish a limited partnership alongside a general partnership, allowing a mix of responsibilities.

A limited partnership with general partner can include a limited company as the general partner. This setup allows a corporation to take on the management role while offering liability protection to its owners. It is a strategic choice for many businesses, combining the benefits of both partnership and corporate structures.

In a limited partnership with general partner, a general partner typically cannot be a limited partner. The roles are distinct; general partners take on more responsibility and liability than limited partners. However, individuals may choose to form separate entities where they can play multiple roles, but it is important to maintain clear boundaries.

Yes, a general partner is essential in a limited partnership with general partner. This individual manages the business and holds unlimited liability. Therefore, the general partner makes important decisions and oversees day-to-day operations, ensuring the partnership runs smoothly.

The role of a general partner in a limited partnership with a general partner is multifaceted and essential for the partnership’s operation. They are responsible for managing the business affairs, making significant decisions, and maintaining relationships with stakeholders. Moreover, their active involvement contributes to the partnership's strategic direction and financial performance. For anyone considering forming such a partnership, uSlegalforms provides effective tools and resources to help establish a clear structure and roles.

In a limited partnership with a general partner, the liability of a general partner (GP) is unlimited. This means that if the partnership faces debts or legal actions, the general partner's personal assets could be at risk. On the other hand, a limited partner (LP) has liability restricted to their investment in the partnership. Understanding these liabilities is crucial before entering a limited partnership, so consider seeking assistance through platforms like uSlegalforms for clarity and protection.

In a limited liability partnership (LLP), the general partner plays a similar role to that in a limited partnership. This partner actively manages the business and ensures compliance with regulations, while also enjoying some liability protection. The structure allows for flexibility in management while safeguarding partners' personal assets. If you're looking to establish an LLP, uSlegalforms can streamline the necessary paperwork and provide guidance throughout the process.

Yes, you can be both a general partner and a limited partner in a limited partnership with a general partner. However, this dual role can lead to complex legal and financial implications. Being a general partner means you have unlimited liability, while being a limited partner restricts your liability to your investment amount. It’s crucial to understand these distinctions and consult legal assistance to navigate this effectively.

The role of the general partner in a limited partnership with a general partner involves overseeing day-to-day operations and making critical business decisions. They have the authority to enter contracts, hire employees, and manage finances. Importantly, general partners are also responsible for liability, meaning they can be held personally accountable for the partnership’s debts. Hence, their management skills and business acumen are vital for the partnership to thrive.