California Deed Ca Form 568 Instructions

Description

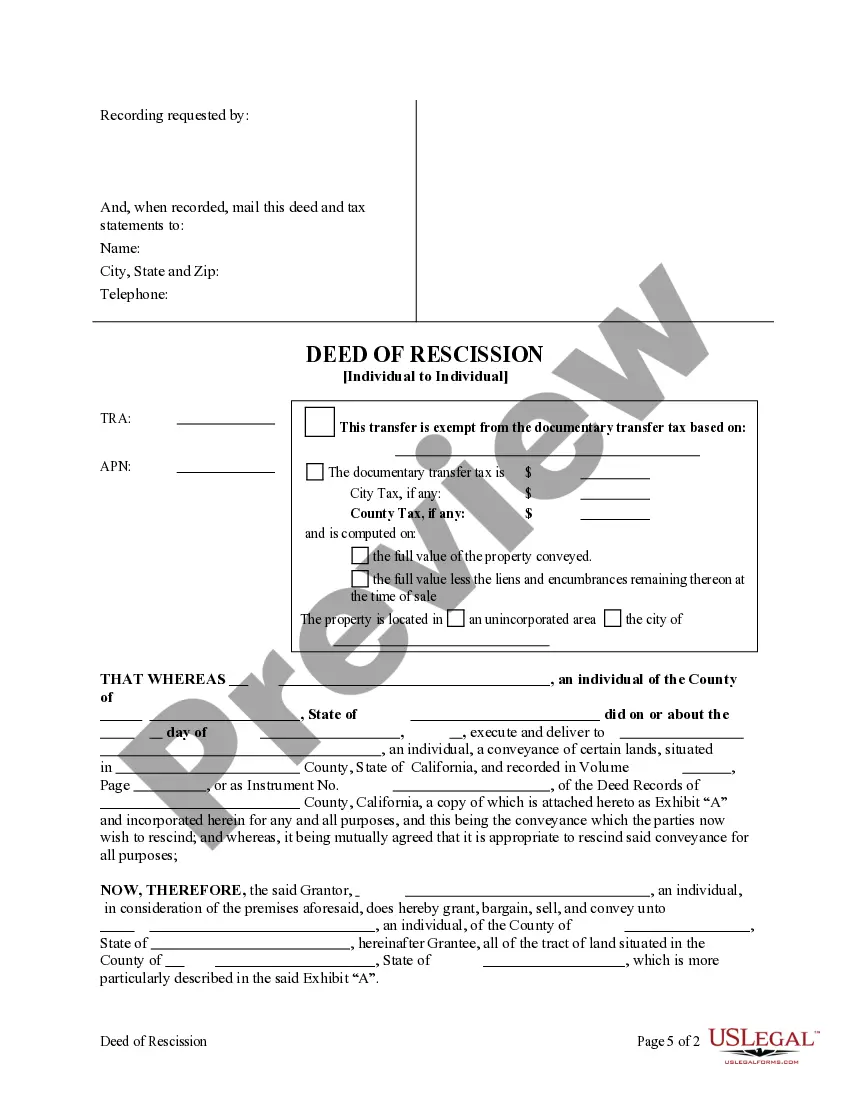

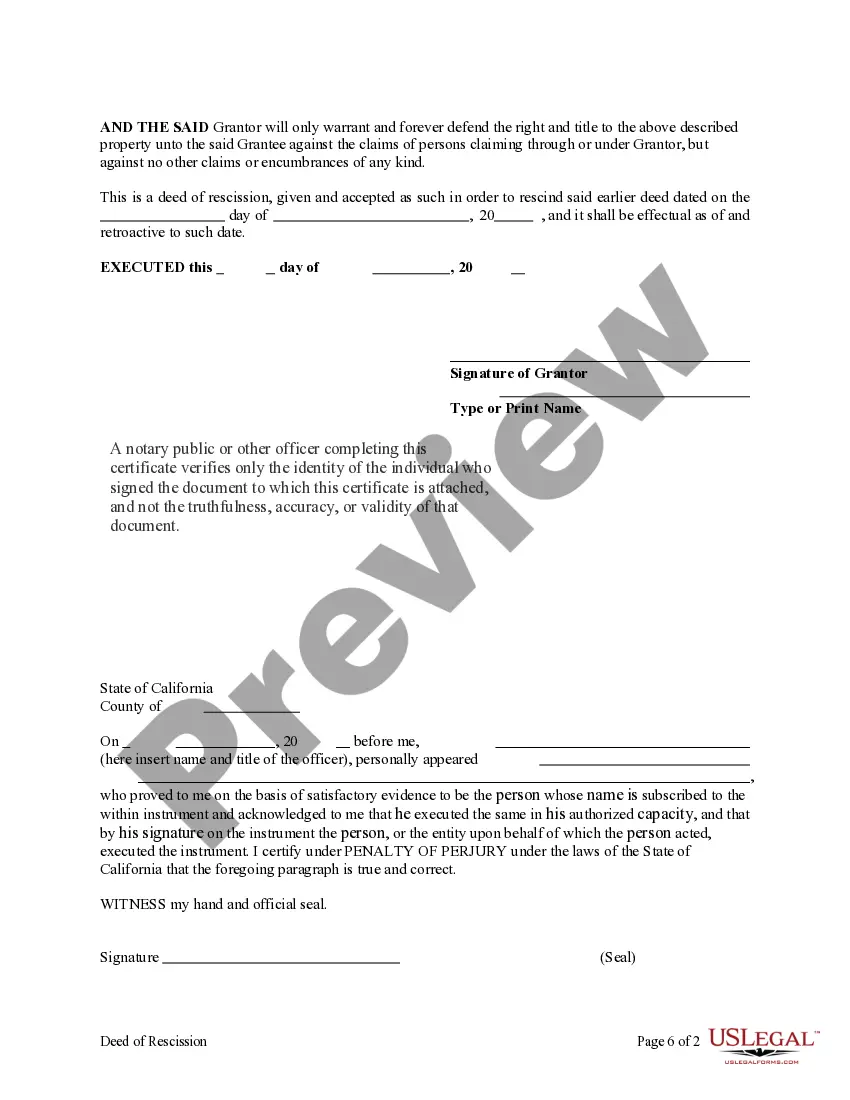

How to fill out California Deed Of Rescission - Individual To Individual?

Legal administration can be daunting, even for the most skilled professionals.

When seeking a California Deed Ca Form 568 Instructions and lacking the time to spend on locating the correct and updated version, the tasks can be challenging.

Access a resource library of articles, manuals, and guides relevant to your situation and needs.

Save time and effort searching for the documents you require, using US Legal Forms' advanced search and Preview tool to find the California Deed Ca Form 568 Instructions and obtain it.

Take advantage of the US Legal Forms online library, supported by 25 years of experience and dependability. Transform your daily document management into a seamless and user-friendly process today.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to see the documents you have downloaded previously and manage your folders as desired.

- If it is your first experience with US Legal Forms, create a free account and gain unrestricted access to all the benefits of the library.

- Once you have accessed the needed form, verify this is the correct one by previewing it and reviewing its description.

- Confirm that the sample is recognized in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription plan.

- Choose the format you desire, then Download, fill out, eSign, print, and dispatch your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms fulfills any requirements you may have, from personal to business paperwork, all in one location.

- Utilize cutting-edge tools to complete and manage your California Deed Ca Form 568 Instructions.

Form popularity

FAQ

This is the Maine form for keeping your address confidential when filing for a Protection from Abuse order. Use this form if you don't want the abuser to know your address.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

When the credit reporting time limit does expire for a debt, it should drop off your credit report automatically. If for some reason, an old debt remains on your credit report, you can use the credit report dispute process to have it removed.

Statute of Limitations by State Statute of Limitations by State (in years)Maine66Maryland33Massachusetts66Michigan6650 more rows ?

Statute of limitations on debt for all states StateWrittenOralCalifornia4 years2Colorado6 years6Connecticut6 years3Delaware3 years346 more rows ?

A debt collector may not commence a collection action more than 6 years after the date of the consumer's last activity on the debt. This limitations period applies notwithstanding any other applicable statute of limitations, unless a shorter limitations period is provided under the laws of this State.

The fee to file a Small Claim is $40 which includes the cost of postage and a mediation fee. Checks or money orders for the $40 filing fee should be made payable to ?Maine District Court?. An essential part of a Small Claims case is notifying the defendant about the case.

Small claims court is a simple, speedy and informal court process in which the plaintiff (the person suing) is seeking a money judgment of $6,000 or less. Parties involved in small claims cases often represent themselves but they may also hire an attorney. Small claims court is a session of the District Court.