Ca Partnership Deed Format

Description

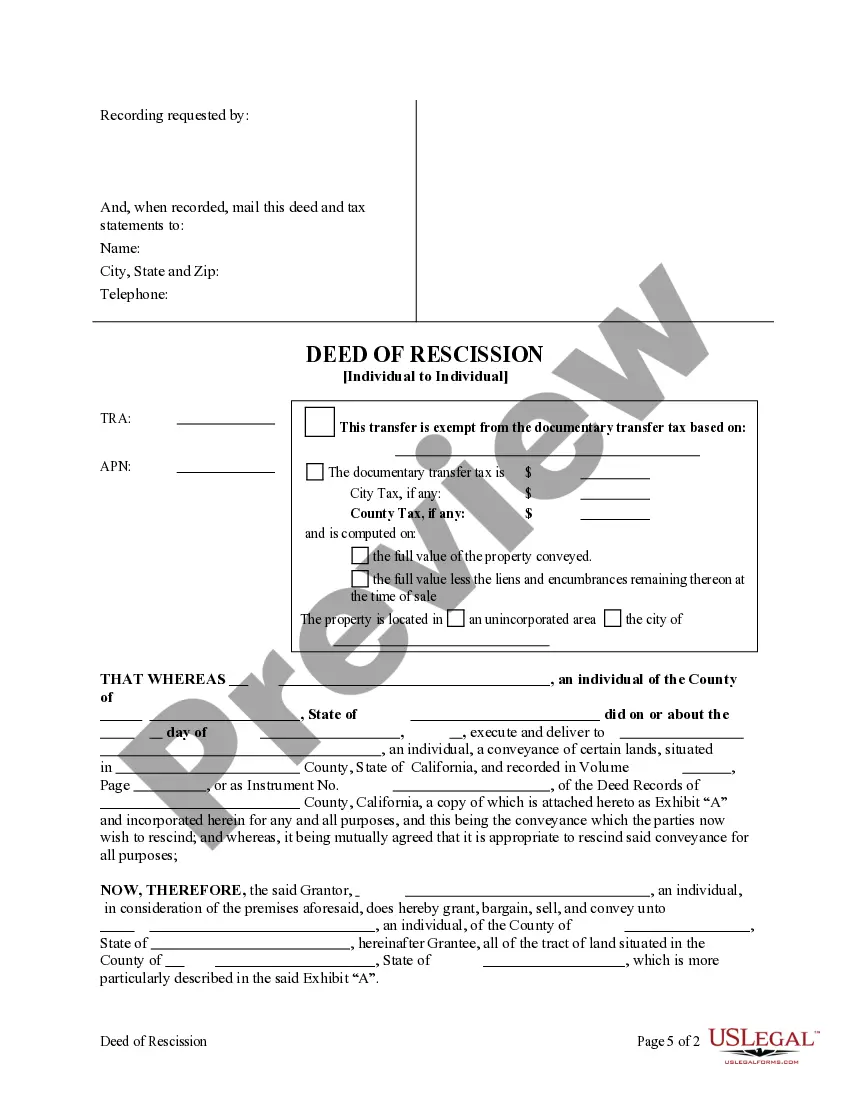

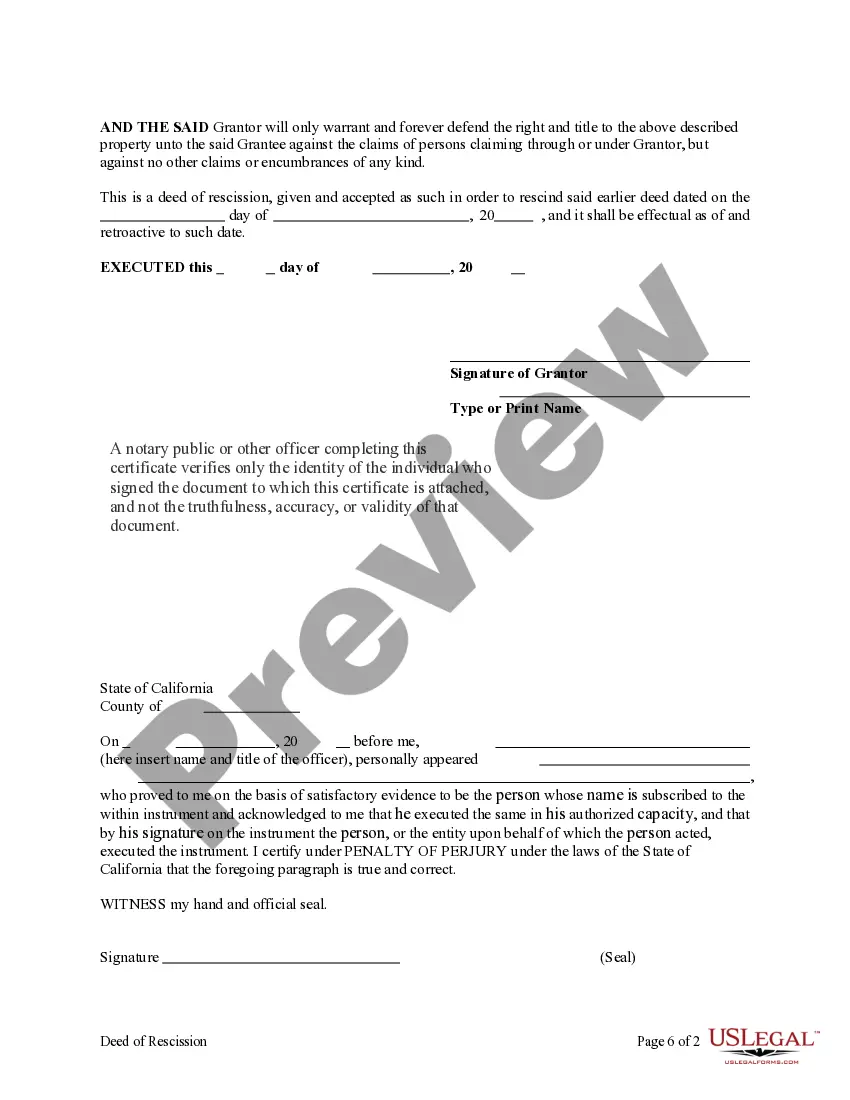

How to fill out California Deed Of Rescission - Individual To Individual?

Whether for commercial objectives or for personal matters, everyone must confront legal circumstances at some point in their life.

Filling out legal documents requires meticulous care, starting with choosing the correct form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms library available, you won't have to waste time searching for the appropriate sample across the web. Utilize the library's straightforward navigation to find the right form for any situation.

- Identify the sample you need by using the search bar or browsing the catalog.

- Review the form's description to confirm it is appropriate for your situation, state, and county.

- Select the form's preview to assess it.

- If it is not the correct document, return to the search feature to locate the Ca Partnership Deed Format sample you need.

- Download the template if it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you have yet to create an account, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the registration form for the account.

- Choose your payment method: you can utilize a credit card or a PayPal account.

- Select the document format you want and download the Ca Partnership Deed Format.

Form popularity

FAQ

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

In Pennsylvania, the courts shortcut probate for any estate worth $50,000 or under.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

As a rule, gifts of a set amount of money in a will should be paid out within a year of death. If the executor isn't able to pay the legacy within that time, the beneficiaries will be entitled to claim interest.

In all but a few narrow exceptions, property that was titled in the deceased's name at the time of death must go through probate. Title to most assets, such as real estate and bank investment accounts, cannot be changed without going through probate.

Pennsylvania offers a simplified probate process for small estates, which state law defines as estates that contain no more than $50,000 in assets. That total does not include real estate, certain amounts the family can collect without probate, and amounts used to pay funeral expenses. (20 Pa. Cons.

In Pennsylvania, if you are married and you die without a will, what your spouse gets depends on whether or not you have living parents or descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.