Ca Deed Withholding

Description

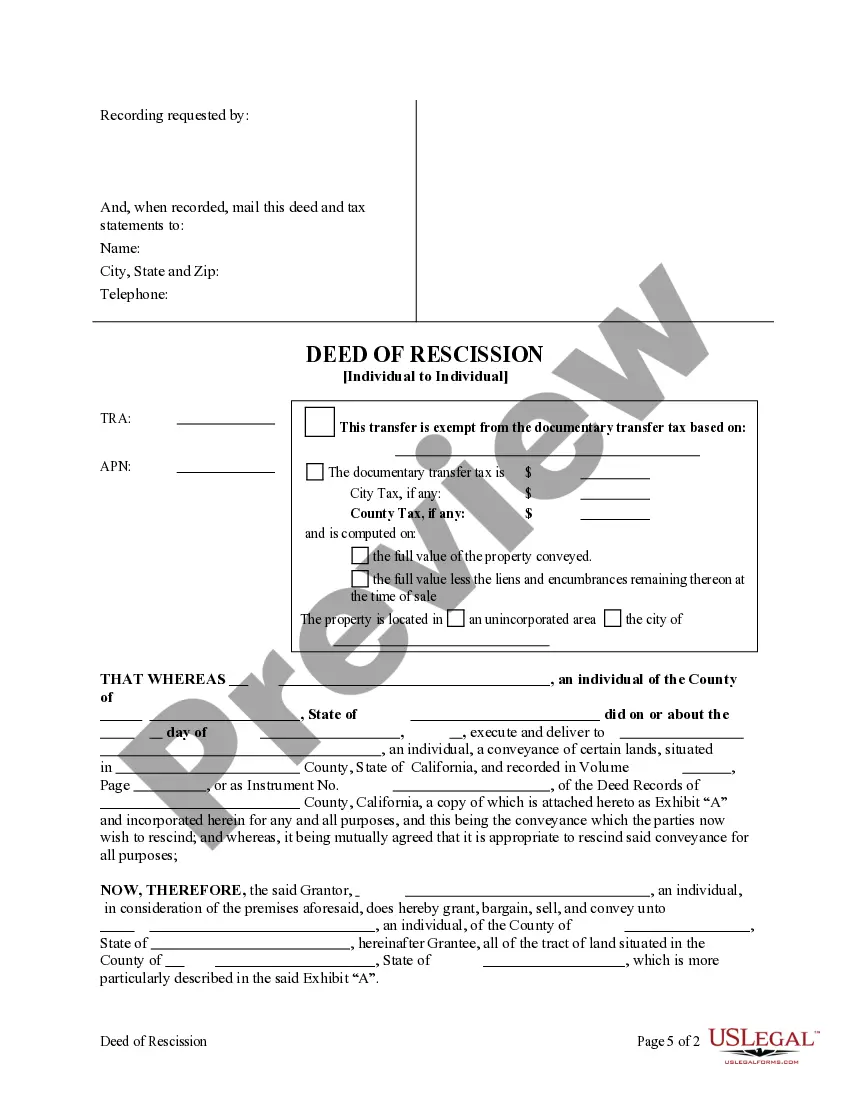

How to fill out California Deed Of Rescission - Individual To Individual?

Creating legal documents from the beginning can occasionally be quite daunting.

Certain situations might require extensive research and a significant financial investment.

If you’re seeking a more uncomplicated and budget-friendly approach to preparing Ca Deed Withholding or any other documentation without excessive hurdles, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms covers nearly all aspects of your financial, legal, and personal matters.

However, before you proceed to download the Ca Deed Withholding, consider these suggestions: Review the document preview and descriptions to confirm that you have located the form you need. Ensure that the template you selected aligns with the requirements of your state and county. Choose the most suitable subscription package to obtain the Ca Deed Withholding. Download the form, then complete, certify, and print it out. US Legal Forms has a strong reputation and more than 25 years of expertise. Join us today and make form completion a straightforward and efficient process!

- With merely a few clicks, you can instantly access forms that comply with state and county regulations, meticulously created for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can swiftly find and download the Ca Deed Withholding.

- If you’re a returning user with an existing account, simply Log In, locate the form, and download it or access it again later in the My documents section.

- Not registered yet? No worries. It takes just a few minutes to sign up and browse the catalog.

Form popularity

FAQ

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft.

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts. The fraud department at your credit card issuers, bank, and other places where you have accounts.

When a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a Form 14039, Identity Theft AffidavitPDF, to the IRS.

The FTC provides online assistance for victims of identity theft through its .Identitytheft.gov website, and operates a call center for ID theft victims where counselors tell consumers how to protect themselves from identity theft and what to do if their identity has been stolen (1-877-IDTHEFT [1-877-438-4338]; TDD: ...

Steps to Recoup from Identity Theft and Credit Card Fraud Note the damages. ... Call your bank or credit agencies. ... Place fraud alerts. ... Freeze your credit. ... Contact any businesses involved. ... Dispute activity on your credit report. ... File case with IdentityTheft.gov. ... Report it to the police.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.