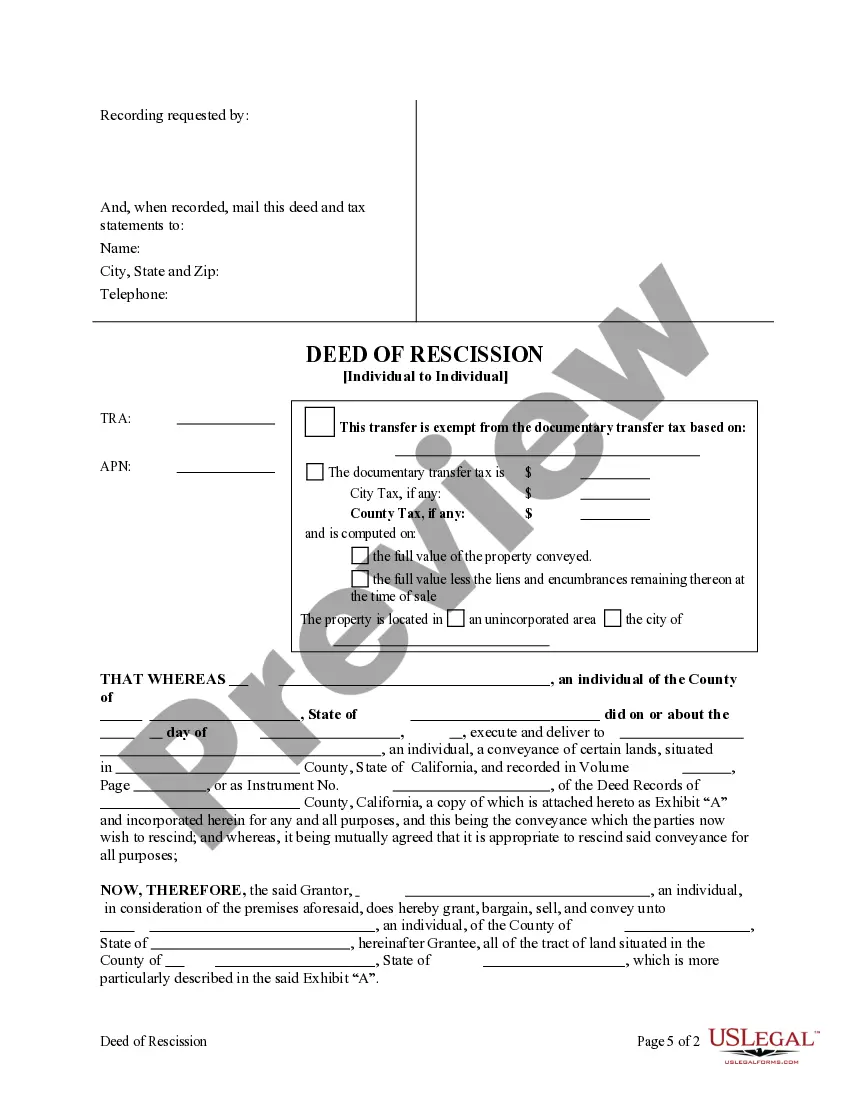

This form is a Deed of Rescission where the Grantor is an individual and the Grantee is an individual. The parties are rescinding or unwinding a prior transfer of the subject property. Grantor conveys and grants the described property to the Grantee. Grantor will defend and warrant the property only as to those claiming by through and under him and not otherwise. This deed complies with all state statutory laws.

Ca Deed With Right Of Survivorship

Description

How to fill out California Deed Of Rescission - Individual To Individual?

Managing legal documents can be exasperating, even for the most proficient professionals.

When you seek a California Deed With Right Of Survivorship and lack the opportunity to invest time in finding the correct and current version, the process can be challenging.

US Legal Forms accommodates all requirements you might possess, ranging from personal to corporate documents, all in one centralized location.

Make use of sophisticated tools to fill out and manage your California Deed With Right Of Survivorship.

Here are the steps to follow after acquiring the form you need: Confirm it is the right document by previewing it and reviewing its description.

- Access a valuable repository of articles, guidance, and manuals related to your circumstances and requirements.

- Conserve time and effort searching for the documents you require, and utilize US Legal Forms’ advanced search and Preview feature to locate your California Deed With Right Of Survivorship.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Visit the My documents section to review the documents you have previously downloaded and manage your files as you prefer.

- If it's your initial experience with US Legal Forms, create an account and gain unrestricted access to all the benefits of the library.

- Utilize comprehensive online form repositories for anyone wishing to handle these matters effectively.

- US Legal Forms stands as a frontrunner in the domain of online legal documentation, boasting over 85,000 jurisdiction-specific legal forms accessible at any time.

- Leverage state- or county-specific legal and business documentation.

Form popularity

FAQ

The dormancy periods vary depending on the type of property, but for most types, the dormancy period is three (3) years. There are some exceptions, the most notable is payroll and commissions, which is two years. The property dormancy matrix can be found on Treasury's website.

This law governs who will ultimately own and control abandoned funds. The law also requires businesses holding unclaimed property to turn over, or escheat, the unclaimed property to the state, which then holds the property in trust for the rightful owner.

Anyone can claim unclaimed funds by submitting a claim form along with proof of ownership. Unclaimed property staff will assist you throughout the claims process and are available to answer your questions. Contact a representative now at: 1 (800) 222 2046.

Under state law, unclaimed property is turned over to Treasury after three years of dormancy. Unclaimed property includes things like dormant bank accounts, uncashed checks, forgotten stocks and bonds, insurance policies, contents of abandoned safe deposit boxes, and more.

Most property types in Pennsylvania have a dormancy period of three years. Accounts are considered dormant if the owner of a property has not indicated any interest in the property or if no contact has been made for the allotted dormancy period for that property.

Pennsylvania Treasury's Vault is used to maintain the custody of tangible property reported to the Bureau of Unclaimed Property. Tangible property is physical assets such as collectible coins, jewelry, military medals, stamps, antiques, savings bonds or other physical items.

Pennsylvania Treasury's Vault is used to maintain the custody of tangible property reported to the Bureau of Unclaimed Property. Tangible property is physical assets such as collectible coins, jewelry, military medals, stamps, antiques, savings bonds or other physical items.

If property has a known owner, the dormancy period is three (3) years. If property does not have a known owner, the dormancy period is one (1) year.