Deed Lieu Of Foreclosure

Description

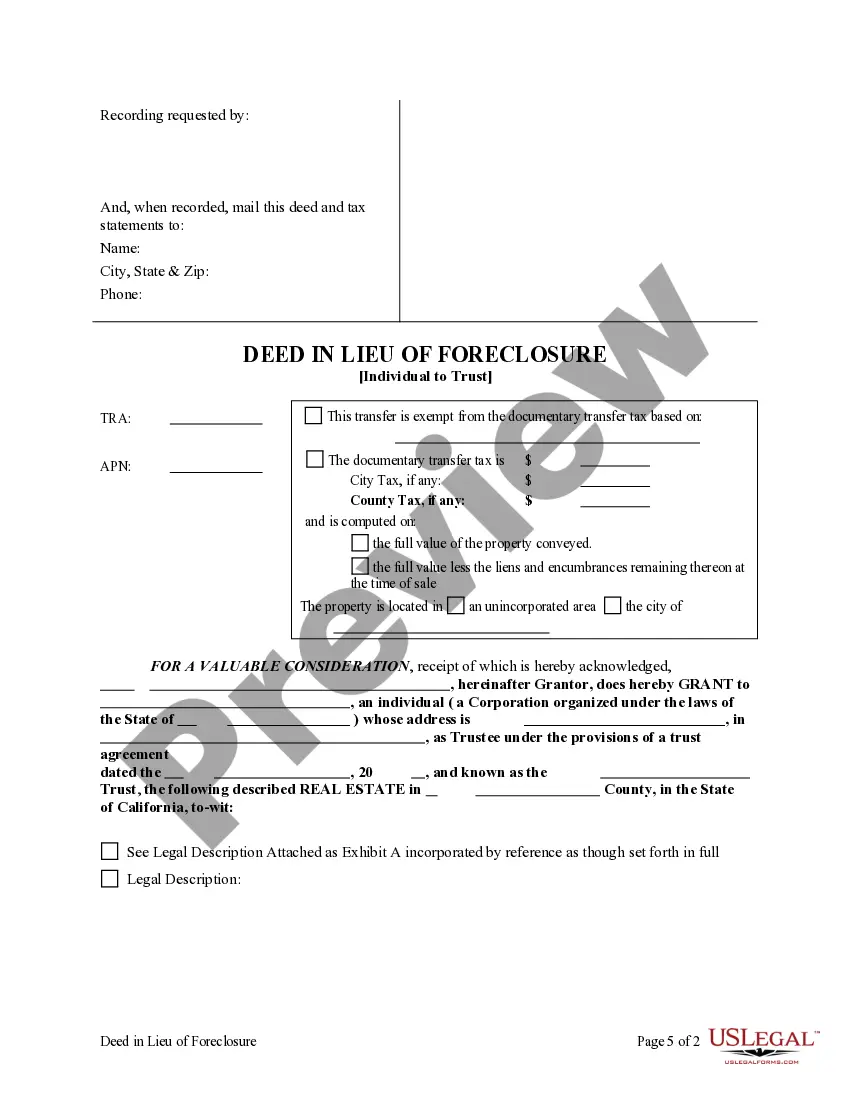

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

The Deed Lieu Of Foreclosure you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Deed Lieu Of Foreclosure will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it suits your needs. If it does not, make use of the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Deed Lieu Of Foreclosure (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your paperwork again. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

Damage to your credit: While less severe than a foreclosure, a deed in lieu of foreclosure damages your credit significantly, and can make it difficult to qualify for another mortgage for several years.

No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process.

Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy. As noted above, the burden of selling your home shifts to someone else, so it may be more appealing than a short sale.