Securing Debt With Property

Description

How to fill out California Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

Managing legal documents can be perplexing, even for experienced professionals.

If you're looking into Securing Debt With Property and lack the time to search for the appropriate and up-to-date version, the process can be daunting.

US Legal Forms accommodates any requirements you may have, from personal to corporate documents, all in one convenient location.

Leverage innovative tools to create and manage your Securing Debt With Property documents.

Here’s what to do once you have obtained the form you need: Confirm it is the correct form by previewing it and reviewing its details.

- Tap into a valuable resource hub of articles, guides, and materials pertinent to your circumstances and needs.

- Save time and energy in searching for the documents you require, employing US Legal Forms’ sophisticated search and Review tool to locate and download Securing Debt With Property.

- If you possess a subscription, Log Into your US Legal Forms account, search for the required form, and download it.

- Explore the My documents tab to view previously downloaded documents and manage your folders to your preference.

- If it's your initial experience with US Legal Forms, register for a complimentary account and gain unlimited access to all platform benefits.

- Utilize a robust online form library could revolutionize the way you handle these issues.

- US Legal Forms stands as a frontrunner in the realm of online legal documents, boasting over 85,000 state-specific legal forms readily accessible.

- Access legal and business forms tailored to state or county needs.

Form popularity

FAQ

A claim on a property to secure the payment of a debt is known as a lien. When you secure debt with property, the lien gives the lender a legal right to take possession of the property if you fail to repay the debt. This arrangement provides a level of security for the lender and allows borrowers to access funds based on their existing assets. By understanding liens and how they function, you can make informed decisions about securing debt with property.

Secured debts often include loans backed by collateral. Common examples are mortgages, where the property purchased acts as security, and auto loans, where the car itself secures the debt. When securing debt with property, these arrangements offer lenders assurance, as they can reclaim the asset if the borrower defaults. Understanding these examples can help you make informed financial decisions.

When securing debt with property, certain items are typically excluded. Personal items such as clothing, household goods, and intangible assets like stocks or bonds cannot serve as collateral. Lenders generally seek tangible assets, such as real estate or vehicles, to secure debts. Thus, it's essential to understand what can and cannot be used before entering into any agreement.

Debts secured by property refer to loans or credit agreements where the borrower pledges an asset as collateral. This means that if the borrower fails to repay the debt, the lender can take possession of the property. Common examples of such debts include mortgages and car loans. Securing debt with property offers lenders a level of confidence, as they have a tangible asset to claim in case of default.

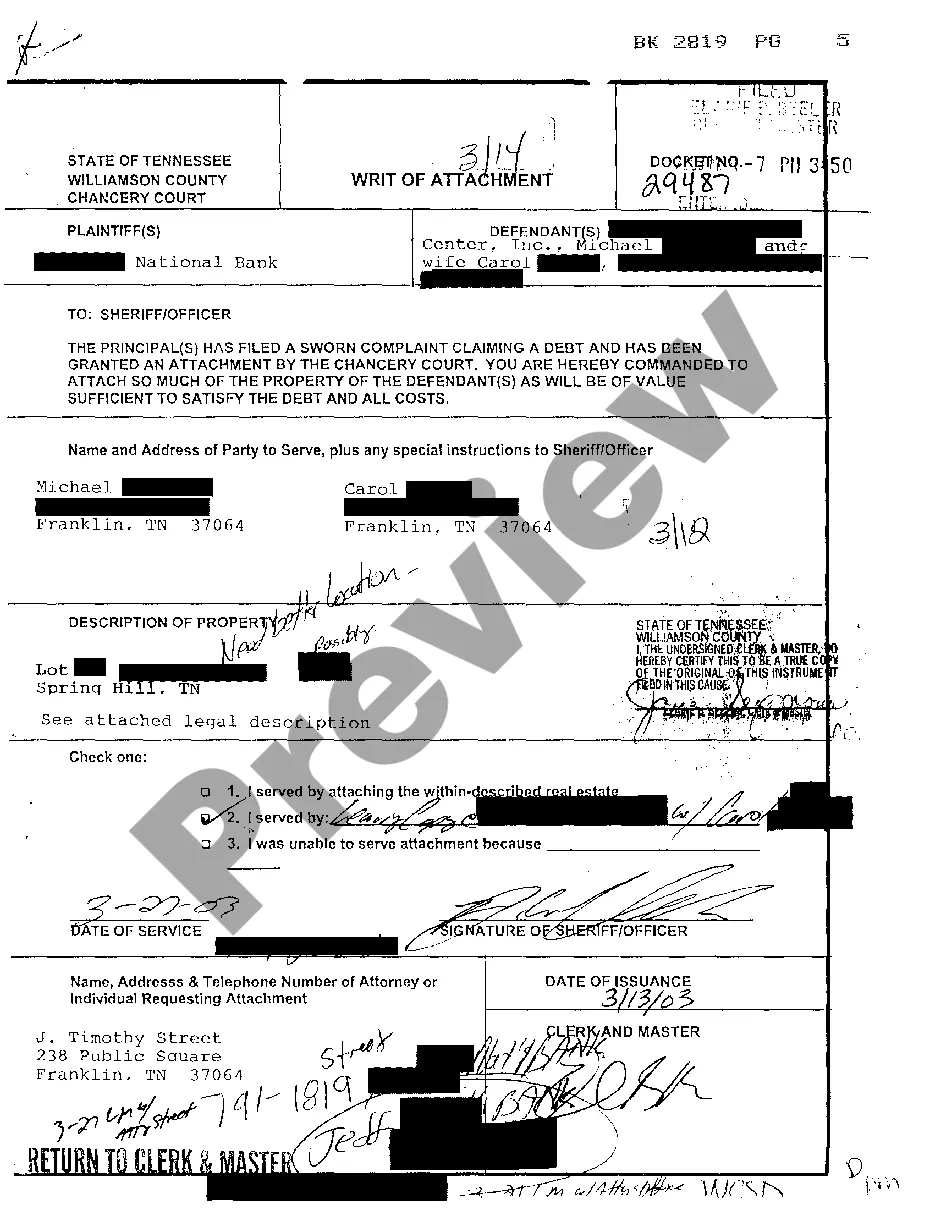

A charging order secures a debt you have with a creditor against your property. This means if you sell or remortgage your home before the debt is cleared the charging order will be paid off from the proceeds. A creditor can only get a charging order if they already have a County Court judgment (CCJ) against you.

Secured loans require some sort of collateral, such as a car, a home, or another valuable asset, that the lender can seize if the borrower defaults on the loan. Unsecured loans require no collateral but do require that the borrower be sufficiently creditworthy in the lender's eyes.

Examples of secured debt include homes loans and car loans. The loan is secured by the car or home, which means that the person you owe the debt to can repossess the car or foreclose on the home if you fail to pay the debt.

When your creditor applies for an interim charging order, they'll also register a charge on your property at the Land Registry. This means you can't sell your property without your creditor knowing about it. If you can pay back the debt in full at this stage, you can get the charge removed from the Land Registry.

Applying for a charging order the name and address of the judgment debtor. details of the judgment or order, including the outstanding balance. names and addresses of other creditors (If known) details of the debtor's interest in the property and the title number.