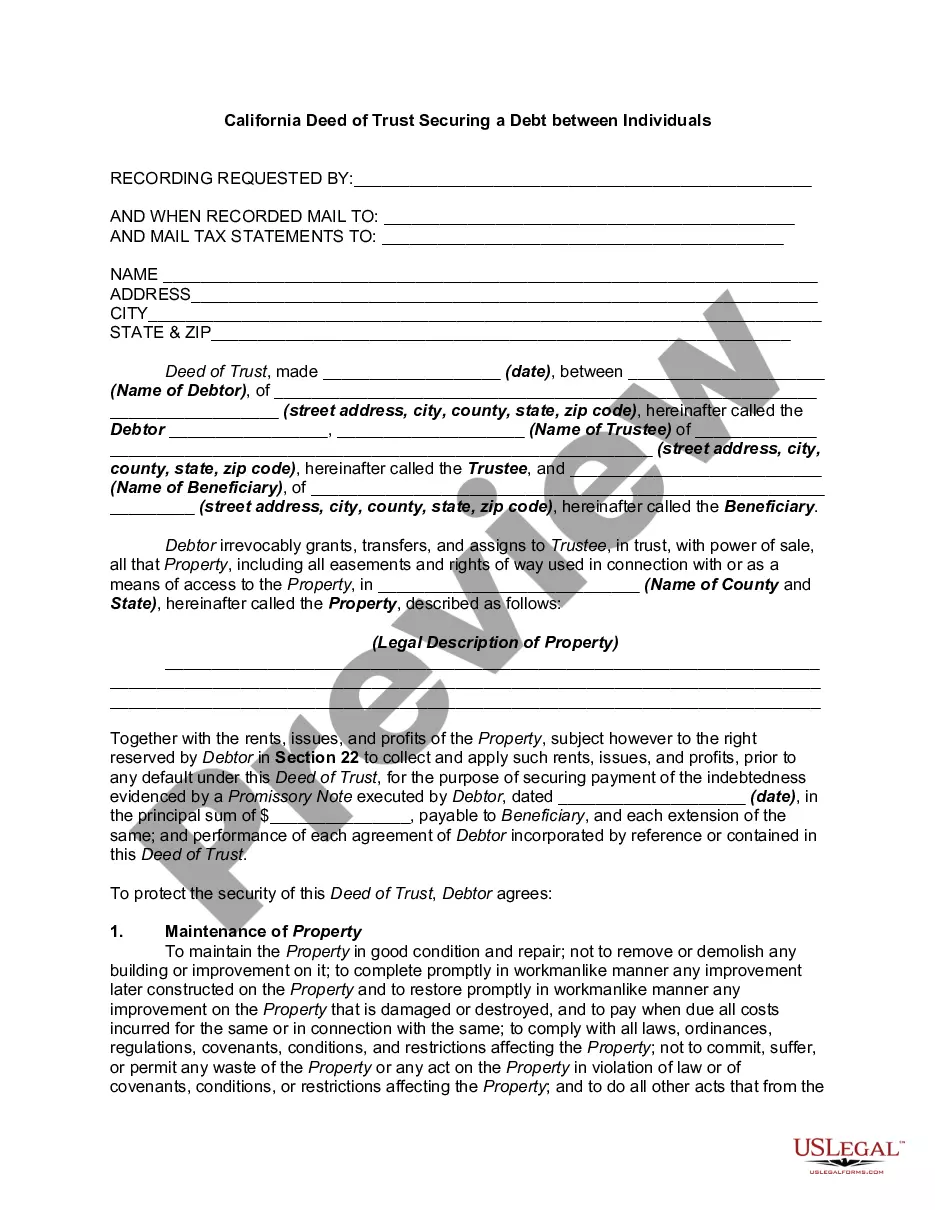

Securing A Debt On Property

Description

How to fill out California Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

The Obtaining A Loan Secured By Property you see on this page is a versatile legal template prepared by experienced attorneys following federal and local statutes.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific documents for various business and personal situations. It’s the quickest, simplest, and most reliable way to acquire the paperwork you require, with the service ensuring the utmost level of data safety and malware defense.

Register with US Legal Forms to have verified legal templates for all of life’s situations available at your fingertips.

- Explore the document you need and evaluate it.

- Search through the file you looked for and preview it or review the form description to confirm it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now when you have located the template you need.

- Register and Log Into your account.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

- Choose the format you prefer for your Obtaining A Loan Secured By Property (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to finish it by hand. Alternatively, use an online versatile PDF editor to promptly and accurately fill out and sign your form with a legally-binding electronic signature.

- Download your documents once more.

- Use the same document again whenever necessary. Access the My documents tab in your profile to re-download any previously acquired forms.

Form popularity

FAQ

Securing a debt on property involves a few essential steps. First, you need to identify the property you wish to use as collateral. Next, approach lenders who offer secured loans and present your property details. Once you establish terms and conditions with a lender, you will need to complete the necessary paperwork and provide any required documentation to finalize the agreement.

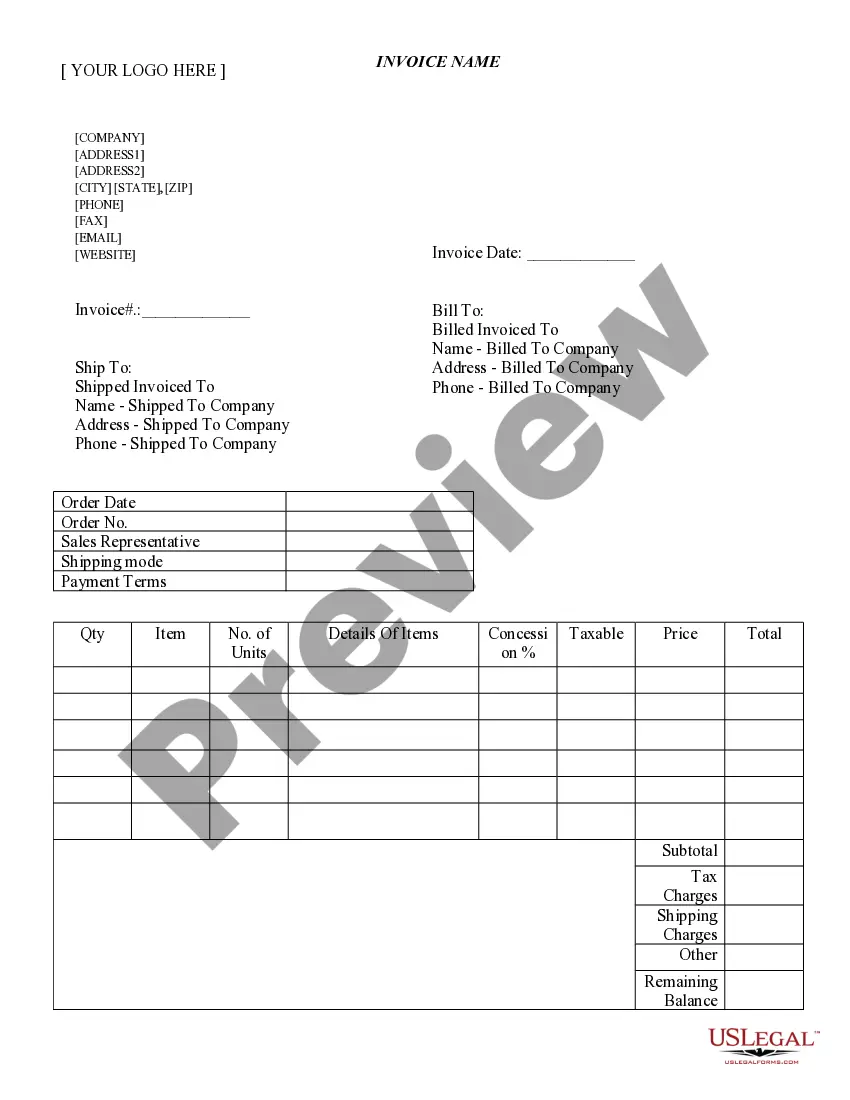

Filling in a proof of debt form template is essential when securing a debt on property. First, gather all relevant details such as the amount owed, debtor’s information, and the property details. Next, carefully complete each section of the template, ensuring accuracy to avoid delays in the process. Using a trusted resource like US Legal Forms can guide you in creating a compliant and precise proof of debt template, enhancing your efforts in securing a debt on property.

Yes, you can file a lien on your own property as a way of securing a debt on property. This process involves documenting the debt and submitting the necessary paperwork to your local government office. By filing a lien, you establish your right to claim the property if the debt remains unpaid. If you need assistance, US Legal Forms provides easy-to-use templates and resources to help you navigate the filing process effectively.

Certain items cannot be used to secure a debt, including intangible assets like intellectual property rights or personal items such as clothing and basic household goods. These items typically fall under exempt categories, protecting them from seizure. When considering securing a debt on property, ensure that you only use tangible assets that lenders recognize as collateral. Platforms like USLegalForms can help you identify what qualifies as acceptable collateral.

Yes, a debt collector can seize your property if the debt is secured by that property. This process typically follows a legal procedure, where the creditor must obtain a judgment before they can claim your assets. Securing a debt on property means that your property serves as collateral, making it essential to stay current on your payments. If you are facing this issue, consider seeking advice through platforms like USLegalForms to navigate your options.

Secured debt is debt that is backed by property, like a car or a house. Should you default on the loan or debt repayment, the creditor can take the collateral instead of opening a debt collection on your record or suing you for payments.

A secured loan is a loan attached to your home. If you're unable to pay the debt, the lender can apply to the courts and force you to sell your home to get their money back. If your circumstances change and you miss payments to a secured loan, you could lose your home. You may have seen adverts for secured loans on TV.

If you're ready to walk away from the property and get out of the secured debt for good, you also have the option of surrendering the collateral to the bank. They get to sell it at auction to the highest bidder and you get to discharge your obligation to pay the debt, no matter how much is left owing.

As it's very unlikely that a lender would write off a secured loan, the only way to get rid of one is to pay it off. There are three main ways to do this: continue making your regular payments as normal. negotiate with the lender and agree a different payment plan.

Collateral. Lenders consider the value of the property and other possessions that you're pledging as security against the loan. In the case of a mortgage, the collateral is the home you 're buying. If you don't pay your mortgage, the mortgage company could take possession of your home, known as foreclosure.