Estoppel Certificate For Lease

Description

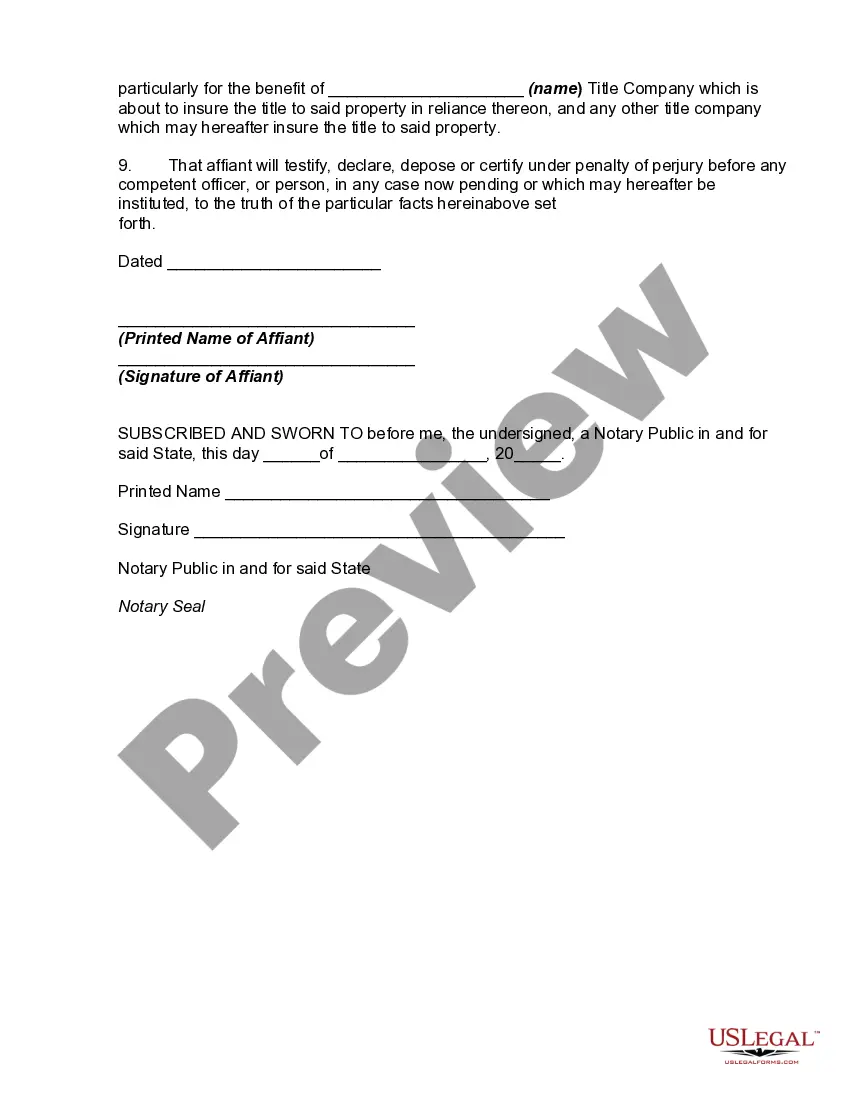

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

The Estoppel Certificate For Lease displayed on this site is a versatile legal template prepared by skilled attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 validated, state-specific documents for various business and personal needs. It is the fastest, most straightforward, and most reliable method to secure the necessary paperwork, as the service ensures bank-grade data protection and anti-malware safeguards.

Complete and sign the document. Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your paper with a legally binding electronic signature. Download your documents again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Enroll in US Legal Forms to have verified legal templates ready for all of life's events.

- Search for the document you require and examine it.

- Peruse the sample you looked up and preview it or check the form description to confirm it meets your needs. If it doesn’t, utilize the search bar to find the correct one. Click Buy Now once you have located the necessary template.

- Register and Log In.

- Choose the pricing option that best fits you and set up an account. Utilize PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Estoppel Certificate For Lease (PDF, DOCX, RTF) and save the document on your device.

Form popularity

FAQ

Flea Markets are required by the MN Dept of Revenue to have a completed Form ST19 for every Seller. This form provides written documentation showing: Seller has a MN Sales Tax ID Number OR. Seller is not required to have one because the items they are selling are non-taxable OR.

Quick Answer: This blog provides instructions on how to file and pay sales tax in Minnesota using form 850. This is the most commonly used form to file and pay sales tax in Minnesota.

Find Your Minnesota Tax ID Numbers and Rates You can find your Withholding Account ID online or on any notice you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (651) 282-9999.

?A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. If you need one, you can apply through Business Tax Registration. You need a Minnesota Tax ID if you: [+] Make taxable sales or leases in Minnesota. Perform taxable services in Minnesota.

Minnesota State Income Tax Forms If you need Minnesota income tax forms: Download forms from the Minnesota Department of Revenue. Photocopy the forms you need at a library. Call 800-657-3676 or 651-296-4444 to place an order.