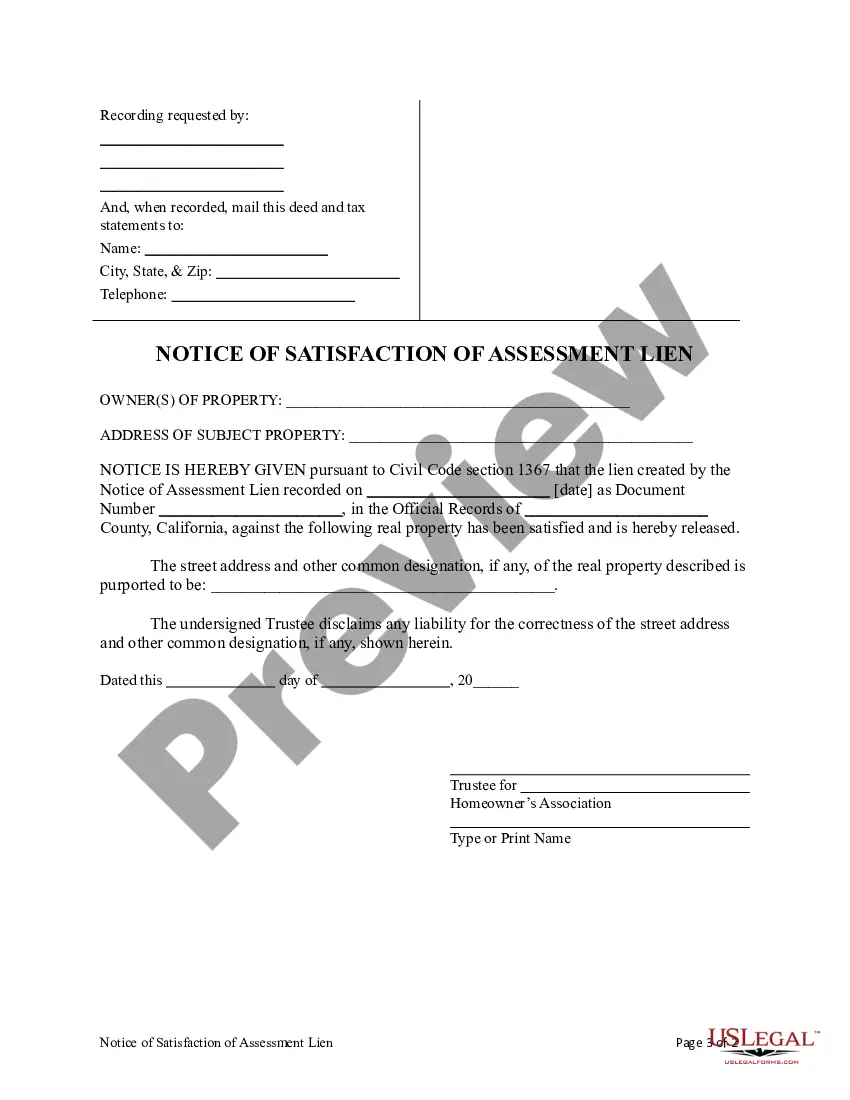

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Satisfaction of Assessment Lien by Home Owners Association, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number CA-01881

California Real Property Lien Form

Description

Form popularity

FAQ

To file a property lien in California, you start by obtaining a California real property lien form, which you can find through legal resources or platforms like US Legal Forms. After completing the form with accurate information about your claim, you must file it with the county recorder. Remember, the timely filing of your lien is crucial to protect your interests in the property. Additionally, consider seeking legal advice to navigate potential complexities.

Filing a lien on a property in California involves several steps. First, you must fill out the correct California real property lien form and detail your claim. Next, you need to file the completed form with the county recorder’s office in the county where the property is located. It is essential to ensure that you follow all statutory requirements to make your lien enforceable.

Yes, you can put a lien on someone's house in California if you have a valid reason, such as unpaid debts or services rendered. To do this, you must complete a California real property lien form to formally document your claim. Recording this form with the county recorder’s office gives public notice of your lien. It is wise to consult a legal professional to understand the implications and process involved.

To perform a title search on property yourself in California, you need to gather specific information, such as the property's address and parcel number. You can then visit the county recorder's office or access their online database. This process allows you to discover any liens or encumbrances associated with the property. Using the California real property lien form can facilitate your understanding of any claims against the property.

Yes, someone can put a lien on your house in California under certain circumstances, typically involving unpaid debts. Common reasons include unpaid loans, taxes, or contractor fees. If you find yourself in this situation, it's crucial to address it promptly. Utilizing the California real property lien form can help you understand the process and safeguard your property rights.

A notice of lien in California is a legal document that establishes a claim against a property due to unpaid debts or obligations. This document serves as a public declaration that a creditor has the right to take possession of the property if the debt remains unpaid. Understanding your rights and obligations related to a notice of lien is vital for property owners. You can utilize the California real property lien form to ensure proper filing and compliance.

A property lien in California serves as a legal claim against a property, typically used to secure the payment of a debt. When a lien is filed, it creates a public record that can affect ownership rights. Familiarizing yourself with the California real property lien form will help you grasp how the lien process provides protection to creditors.

In California, it is possible for someone to place a lien on your house without a signed contract, particularly under certain legal circumstances, such as due to unpaid debts or court judgments. However, the process must follow specific legal guidelines. Understanding how a California real property lien form works can clarify your rights and obligations in such scenarios.

Yes, a house can be sold even if there is a lien on it in California. However, the lien typically must be resolved before or during the sale process. Buyers generally prefer clear title, so presenting a California real property lien form can help negotiate terms and assure potential owners about the property's financial history.

To file a lien on a property in California, you must complete a California real property lien form and submit it to the county recorder's office where the property is located. Ensure the form includes accurate information about the debtor and the amount owed. After filing, the lien becomes a matter of public record, protecting your rights to claim against the property.