Interspousal Transfer Grant Deed In Florida

Description

How to fill out California Interspousal Grant Deed From Individual?

Acquiring legal document examples that adhere to federal and state laws is essential, and the internet provides numerous choices to select from.

However, what's the benefit of spending time searching for the appropriately prepared Interspousal Transfer Grant Deed in Florida sample online when the US Legal Forms online library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by lawyers for any business and personal situation. They are user-friendly, with all documents categorized by state and intended use. Our specialists stay informed of legislative changes to ensure that your form is current and compliant when obtaining an Interspousal Transfer Grant Deed in Florida from our site.

- If you already possess an account with an active subscription, Log In and store the required document sample in the appropriate format.

- If you are new to our portal, adhere to the instructions below.

- Review the template using the Preview feature or through the text outline to confirm it fulfills your requirements.

- Seek out another sample using the search tool at the top of the page if needed.

- Click Buy Now after finding the proper form and select a subscription plan.

Form popularity

FAQ

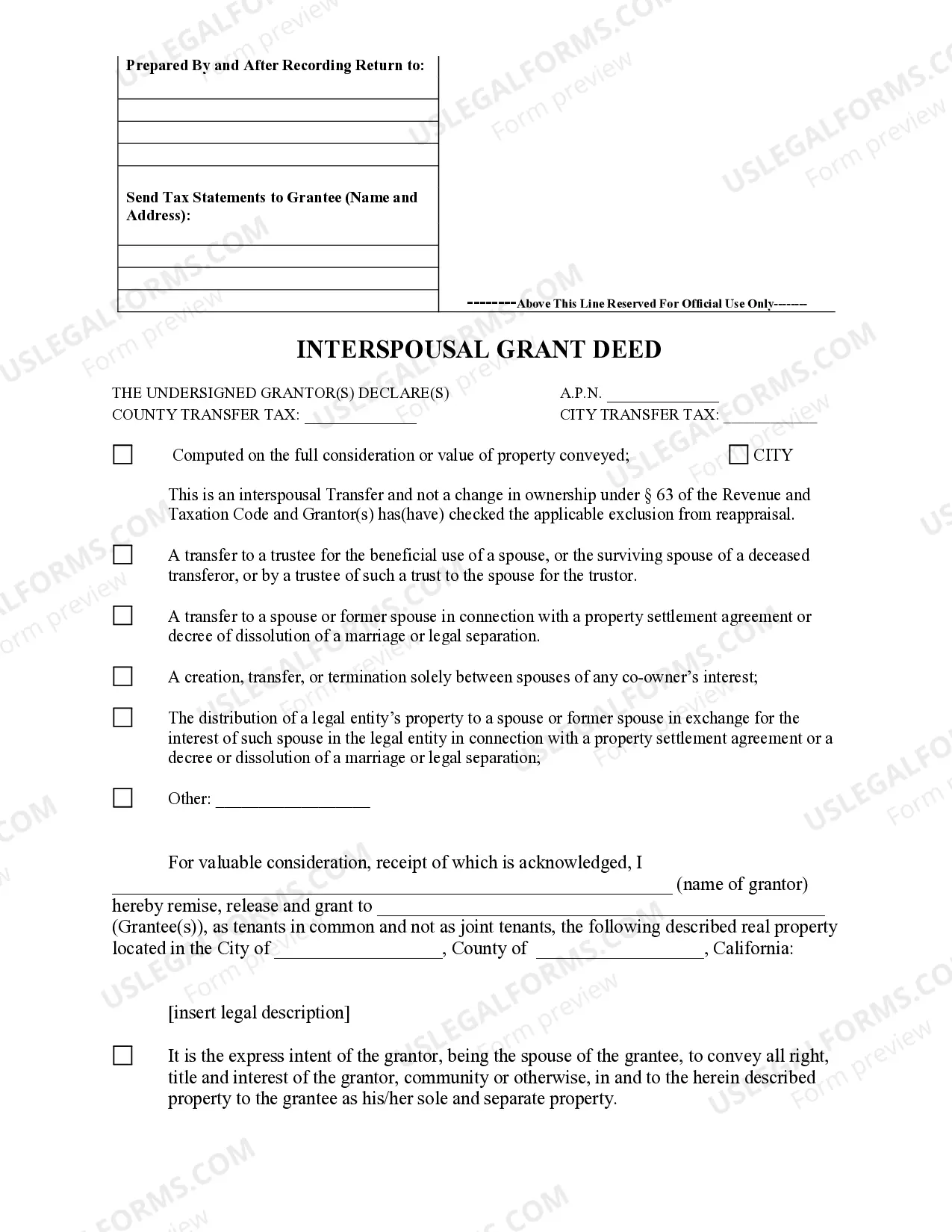

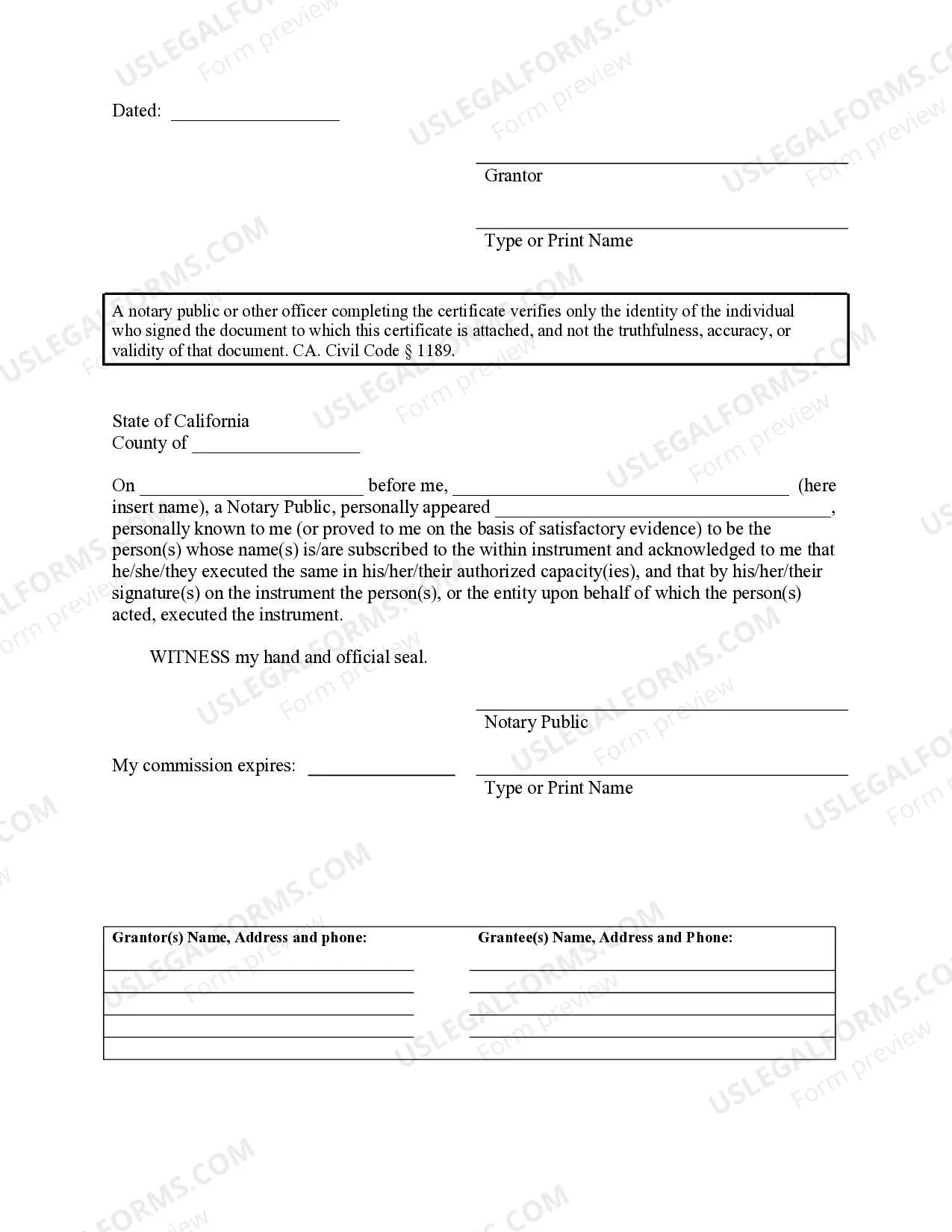

To file an interspousal transfer deed, start by completing the deed form, which outlines the details of the property transfer between spouses. Ensure that the deed is signed and notarized to verify its validity. Next, you will need to submit the completed document to your local county recorder’s office for official recording. If you find the process overwhelming, US Legal Forms can offer easy-to-follow guides and templates to simplify your experience.

An interspousal grant deed and an interspousal transfer deed are similar, but they serve distinct purposes. A grant deed generally conveys ownership rights from one spouse to another, while a transfer deed is specifically designed for transferring property ownership between spouses, often to avoid probate. Understanding these differences is crucial for utilizing the appropriate form in the process. For clarity, consider utilizing resources like US Legal Forms.

To file an interspousal transfer deed in California, you must complete the appropriate paperwork, including the deed itself, which specifies the transfer of property between spouses. After filling in the necessary details, you should sign the deed in front of a notarizing official. Finally, you can submit the signed document to the county recorder's office for recording. If you desire more assistance, platforms like US Legal Forms can provide tailored resources.

No, hiring a lawyer to transfer a deed is not a requirement, but it is often recommended for clarity and proper documentation. A knowledgeable professional can guide you through the intricacies of the interspousal transfer grant deed in Florida. If you feel confident handling the paperwork and requirements on your own, you can proceed without legal help. Nonetheless, always ensure you understand the implications of the transfer before proceeding.

You do not necessarily need a lawyer to transfer a deed in Florida, including an interspousal transfer grant deed. However, having legal expertise can ensure that the process is done correctly and efficiently. It's beneficial to consult a lawyer if you have specific questions or complex situations regarding the deed transfer. Ultimately, consider your comfort level with legal procedures when making this decision.

An interspousal transfer grant deed in Florida specifically refers to a legal document used to transfer ownership of property between spouses. This deed simplifies the process of changing ownership while providing certain tax benefits. Understanding the nuances of this deed can help ensure that both spouses are well-informed and protected in their property dealings.

While grant deeds provide a straightforward way to transfer property, they come with certain disadvantages. For instance, an interspousal transfer grant deed in Florida may not offer the same level of comprehensive protection as a warranty deed. Additionally, this type of deed does not guarantee clear title because it does not disclose any potential liens or claims against the property.

To complete an interspousal transfer grant deed in Florida, you must first obtain the appropriate form and fill in the required details, such as the property description and names of both spouses. Next, both parties should sign the deed in the presence of a notary public. Finally, file the deed with the county clerk's office to ensure the transfer is officially recorded.

While this question specifically pertains to California, understanding its implications can provide useful context for Florida residents. An interspousal transfer grant deed generally allows for the easy transfer of property without triggering the reassessment of property taxes. It's essential to note that laws can differ, and consulting a legal expert familiar with Florida's regulations will ensure a smooth transaction.

The interspousal transfer grant deed in Florida is primarily used to transfer property between spouses without incurring a change in property tax assessment. It allows spouses to move ownership for various reasons, including estate planning or gifting. This deed promotes seamless property transfer while ensuring that both parties retain certain legal rights.