Trust Transfer Deed With Mortgage

Description

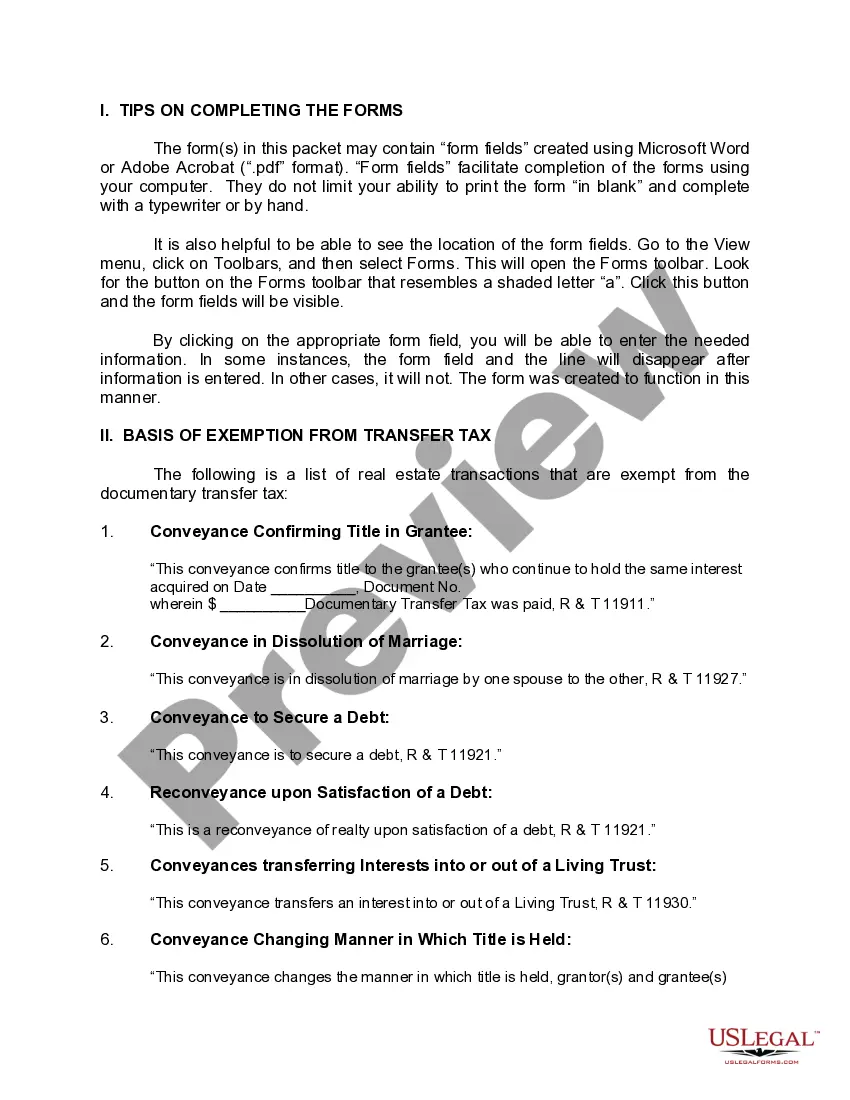

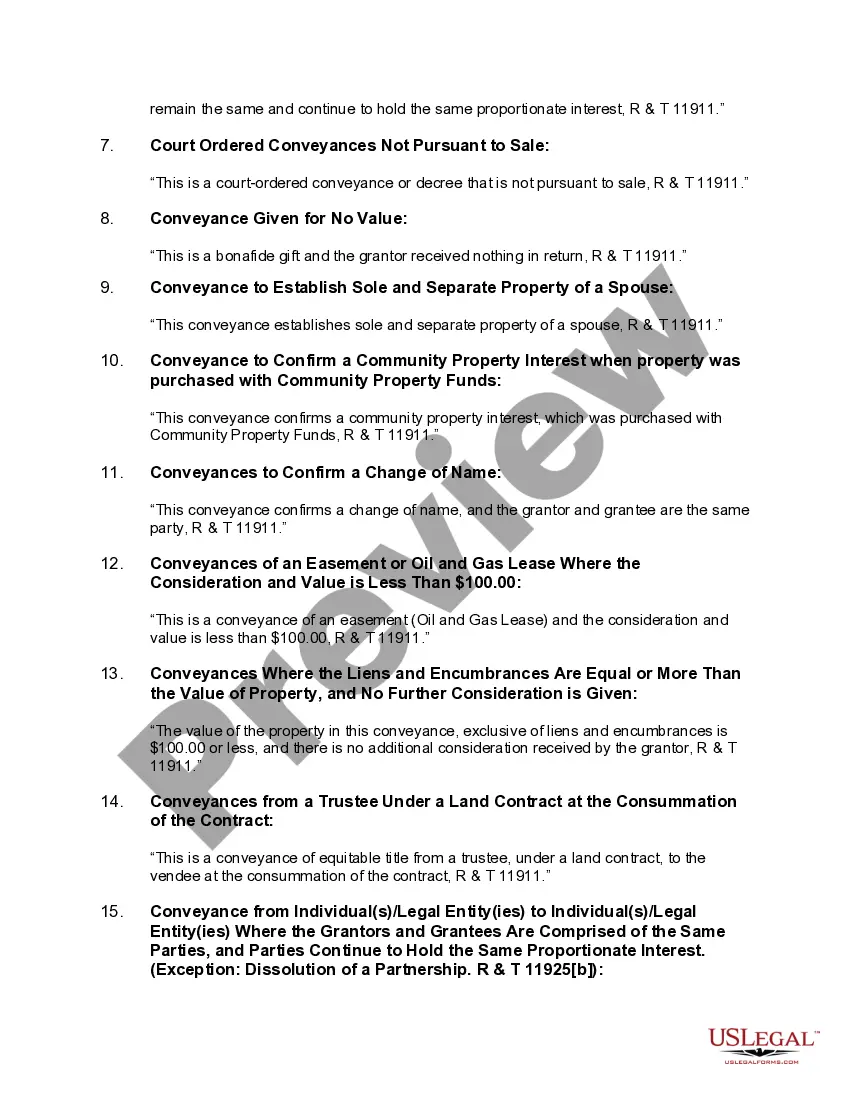

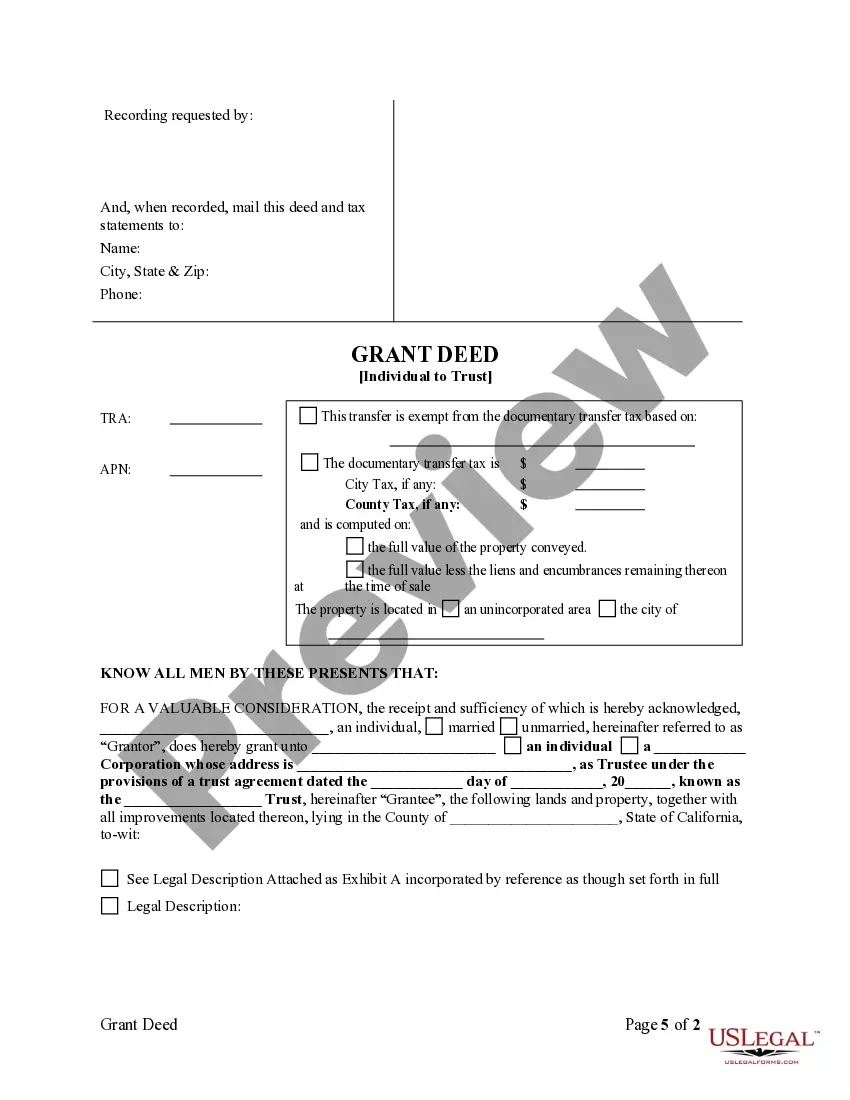

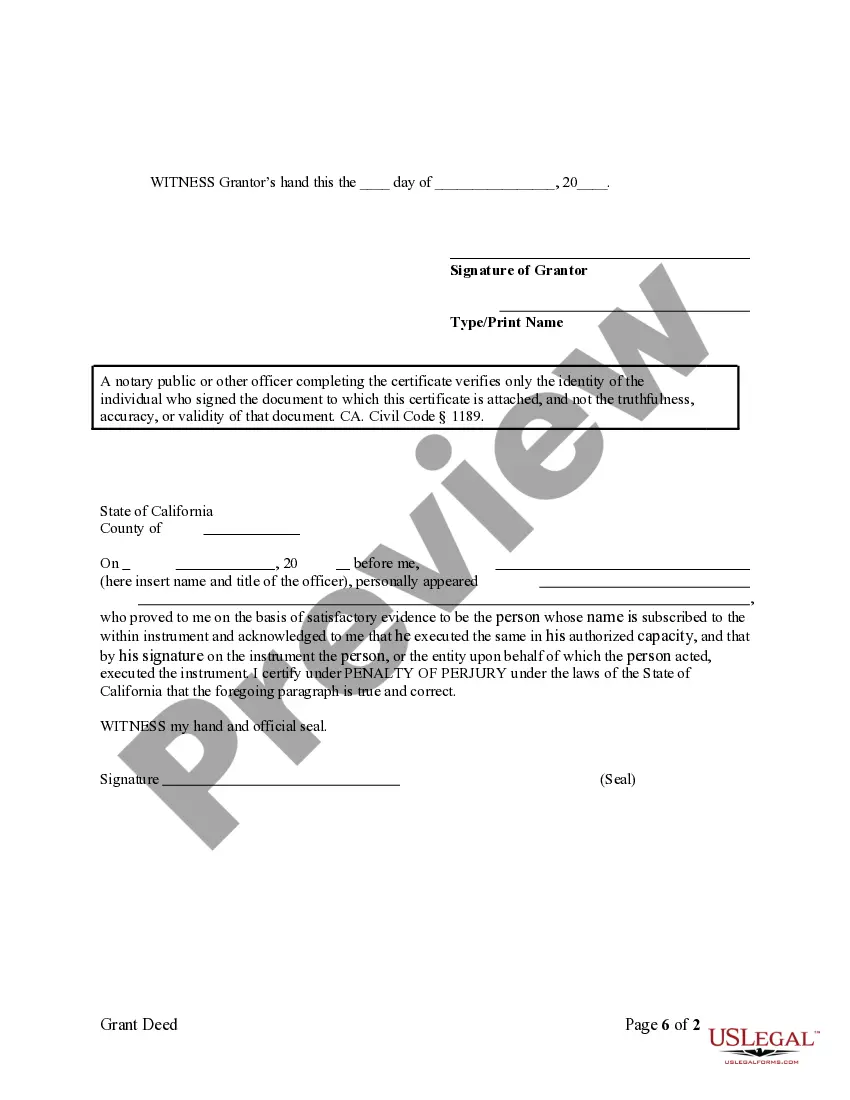

How to fill out California Grant Deed From Individual To Trust?

Legal documents management can be daunting, even for the most seasoned professionals.

When you require a Trust Transfer Deed With Mortgage and lack the time to dedicate to locating the appropriate and updated version, the tasks can be overwhelming.

Obtain a valuable resource library of articles, guides, and documents pertinent to your situation and needs.

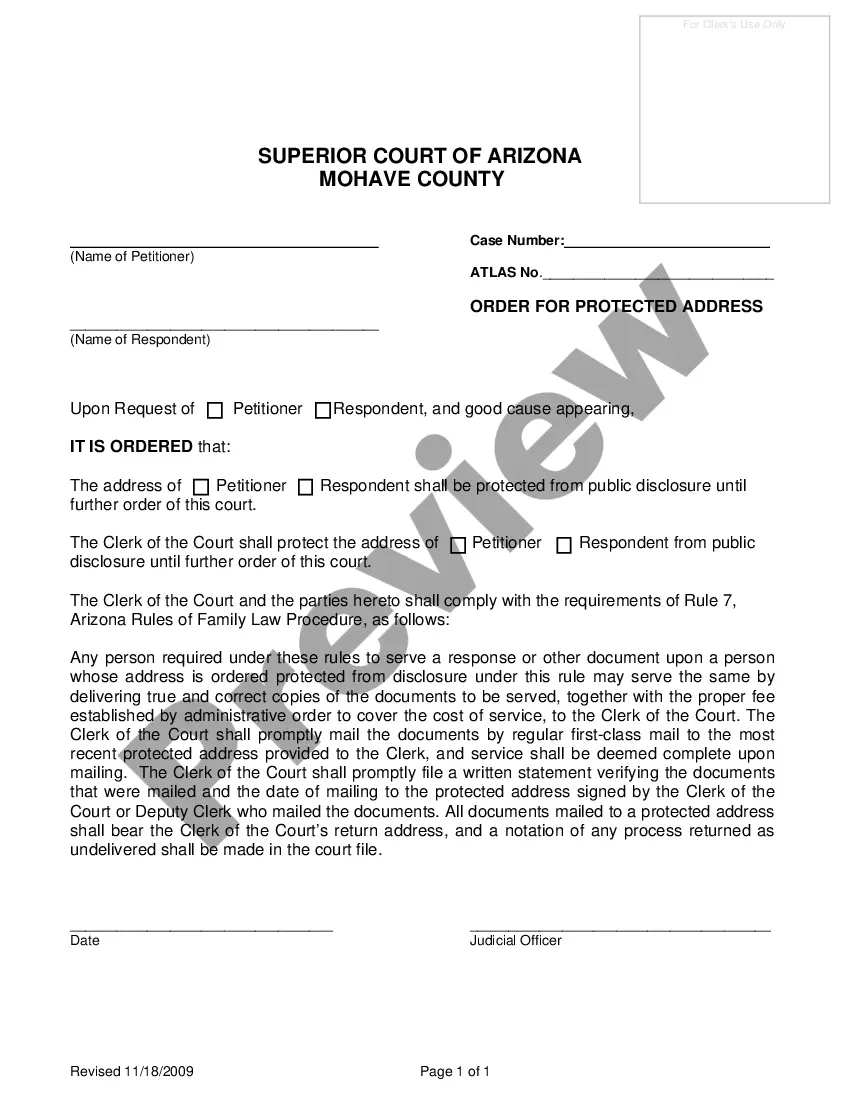

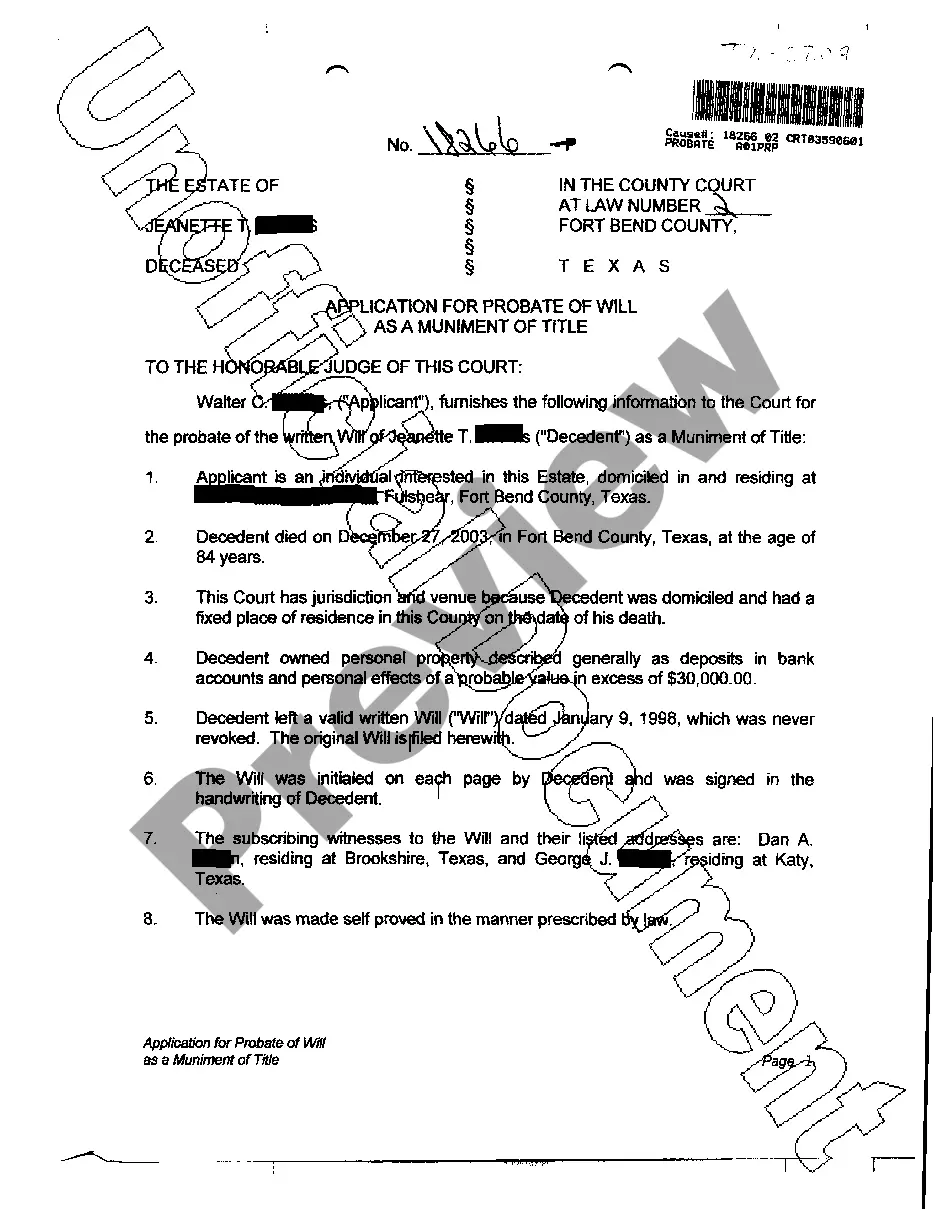

Save effort and time searching for the forms you require by using US Legal Forms’ sophisticated search and Review feature to locate and obtain your Trust Transfer Deed With Mortgage.

Select Buy Now when you are prepared, choose a monthly subscription plan, and find the format you need. Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, supported by 25 years of expertise and reliability. Streamline your daily document management into a straightforward and user-friendly procedure today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to access the documents you've saved and organize your folders at your discretion.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- After acquiring the form you need, verify that it is the correct one by previewing it and examining its description.

- Make certain that the sample is authorized in your state or county.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms addresses any requests you may have, ranging from personal to business forms, all in one location.

- Utilize advanced tools to fill out and oversee your Trust Transfer Deed With Mortgage.

Form popularity

FAQ

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Is an operating agreement required in Utah? Utah doesn't specifically require LLCs to enter into an operating agreement. However, in the absence of one, your LLC will be governed by the Utah Revised Uniform Limited Liability Company Act.

There is no set requirement for what an operating agreement must contain, but it generally governs, at the very least, relations among the members as members and between the members and the company; rights and duties of manager(s); activities and affairs of the company and how they are to be conducted; and how the ...

In Utah, some business entities (including LLCs) must file Annual Reports every year. If you fail to renew your LLC, it will ?Expire? and you'll then have to Reinstate it or file a new LLC altogether.

The filing fee for both in-state and out-of-state entities forming LLCs is $70. Remittance should be made payable to the state of Utah. It costs $75 to expedite the process. You may submit documents online, directly to the Division of Corporations and Commercial Code, or mail them to P.O. Box 146705.

The state of Utah requires all corporations, nonprofits, LLCs, LPs, LLPs, and LLLPs to file an annual report. These reports must be submitted to the Utah Division of Corporations & Commercial Code each year.

By default, a Utah LLC is taxed by the Internal Revenue Service (IRS) based on the number of Members the LLC has. Then the Utah State Tax Commission honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...