Estate Quitclaim Deed With Power Of Attorney

Description

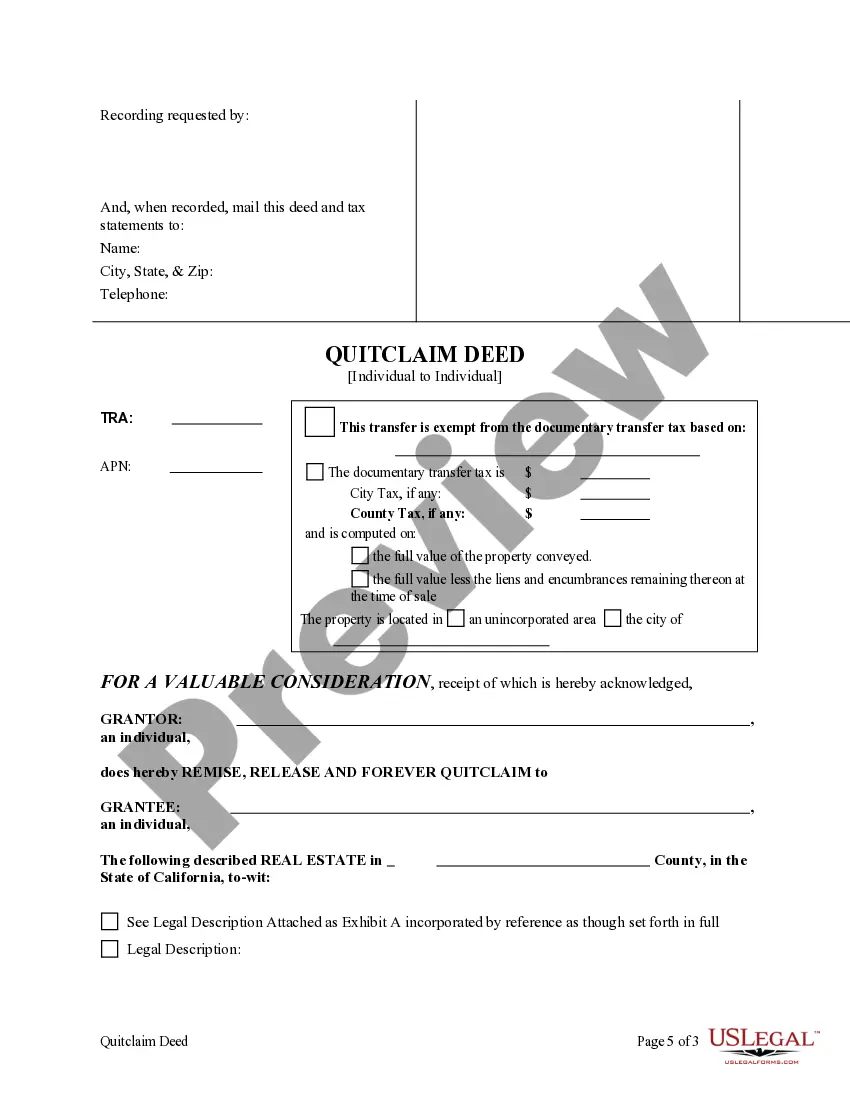

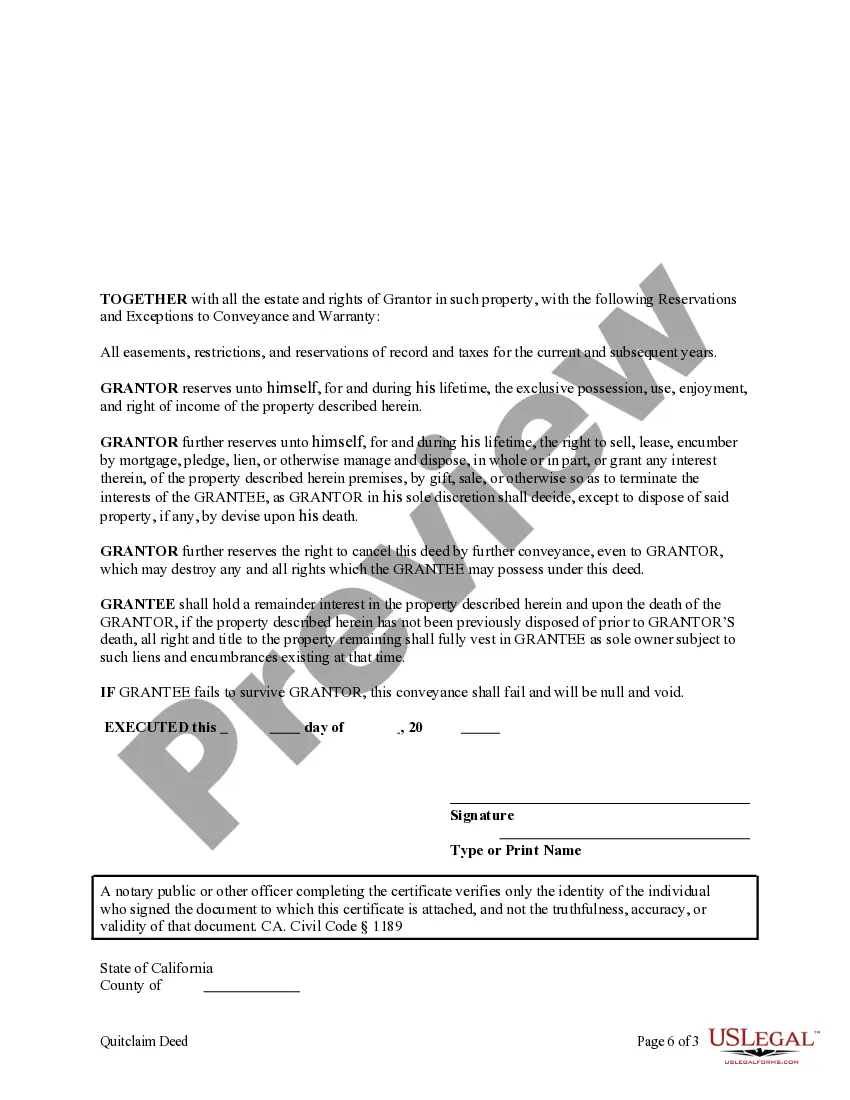

How to fill out California Enhanced Life Estate Or Lady Bird Quitclaim Deed From Individual To Individual?

There's no longer a requirement to invest time looking for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in a single location and enhanced their availability.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and purpose. All forms are properly drafted and verified for accuracy, giving you assurance in obtaining an up-to-date Estate Quitclaim Deed With Power Of Attorney.

Select the preferred subscription plan and register for an account or Log In. Make payment for your subscription with a card or via PayPal to continue. Choose the file format for your Estate Quitclaim Deed With Power Of Attorney and download it to your device. Print your form to fill it out manually or upload the sample if you prefer editing it in an online editor. Creating official documentation under federal and state regulations is fast and simple with our platform. Experience US Legal Forms today to maintain your documentation organized!

- If you are acquainted with our service and already possess an account, ensure your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents anytime by accessing the My documents tab in your profile.

- If you have never used our service before, the process will require a few additional steps to complete.

- Here's how new users can locate the Estate Quitclaim Deed With Power Of Attorney in our catalog.

- Examine the page content carefully to confirm it contains the sample you require.

- To assist with this, use the form description and preview options if available.

- Employ the Search bar above to look for another template if the previous one did not meet your needs.

- Click Buy Now next to the template title when you discover the appropriate one.

Form popularity

FAQ

The deceased co-owner simply 'drops off title' and the surviving co-owner(s) remain on title. For real estate in Ontario, this change in ownership is registered by registering a 'deed of transmission', which requires little more than an original or notarized copy of the death certificate.

Generally speaking, removing a deceased person's name from a deed requires recording in the public records three documents:A certified copy of the deceased property owner's Death Certificate.Tax forms from the State of Florida Department of Revenue (DOR).More items...

The deceased co-owner simply 'drops off title' and the surviving co-owner(s) remain on title. For real estate in Ontario, this change in ownership is registered by registering a 'deed of transmission', which requires little more than an original or notarized copy of the death certificate.

The state of Florida does not allow automatic "transfer upon death" arrangements for deeds of real estate. If a Florida property owner passes away, the property must go through the probate court system for the county the decedent lived in.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.