California Grant Deed Form Template

Description

How to fill out California Grant Deed From Individual To Two Individuals As Tenants In Common?

Creating legal papers from the beginning can frequently be intimidating.

Some situations might entail hours of investigation and significant financial expenditure.

If you’re searching for a more straightforward and economical method of preparing the California Grant Deed Form Template or any other documentation without unnecessary complications, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal documents covers nearly every element of your financial, legal, and personal matters.

However, before directly proceeding to download the California Grant Deed Form Template, please follow these instructions: Verify the form preview and descriptions to confirm you are on the correct document you need. Ensure that the form you choose adheres to the statutes and regulations of your state and county. Select the most appropriate subscription option to purchase the California Grant Deed Form Template. Download the form, then complete, sign, and print it. US Legal Forms has an excellent reputation and more than 25 years of experience. Join us today and transform document completion into a simple and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can easily locate and download the California Grant Deed Form Template.

- If you’ve previously created an account with us, simply Log In to your account, choose the template and download it, or re-download it anytime from the My documents section.

- If you don't have an account, no worries. It takes just a few minutes to register and browse the library.

Form popularity

FAQ

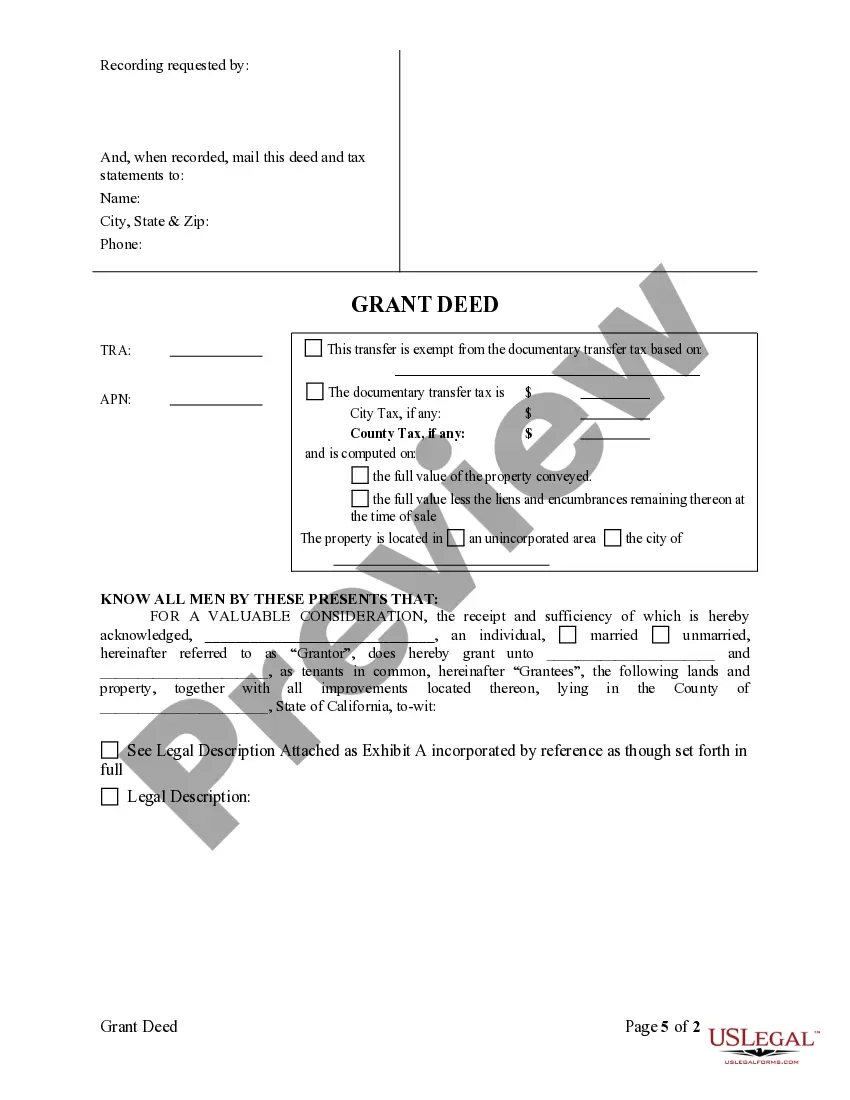

Filling out a grant deed form in California involves providing essential details such as the names of the parties involved, the property description, and appropriate signatures. It is beneficial to use a California grant deed form template for added convenience and accuracy. Make sure to review the completed form to ensure all information is correctly filled out before submission.

The fundamental difference is that a Grant Deed ensures the grantor has a legal interest in the property, while a Quitclaim Deed releases only the potential interest one might have in a property without any warranties.

A grant deed is a form of deed common in California, which contains implied warranties to the effect that the grantor has not previously conveyed or encumbered the property.

For example, a typical grant deed warranty statement is: "The Grantor warranties that the Grantor is lawfully seized in fee simple of said property, and that said property is free and clear from all liens and encumbrances incurred during the period of the Grantor's ownership, except as herein set forth, and except for ...

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

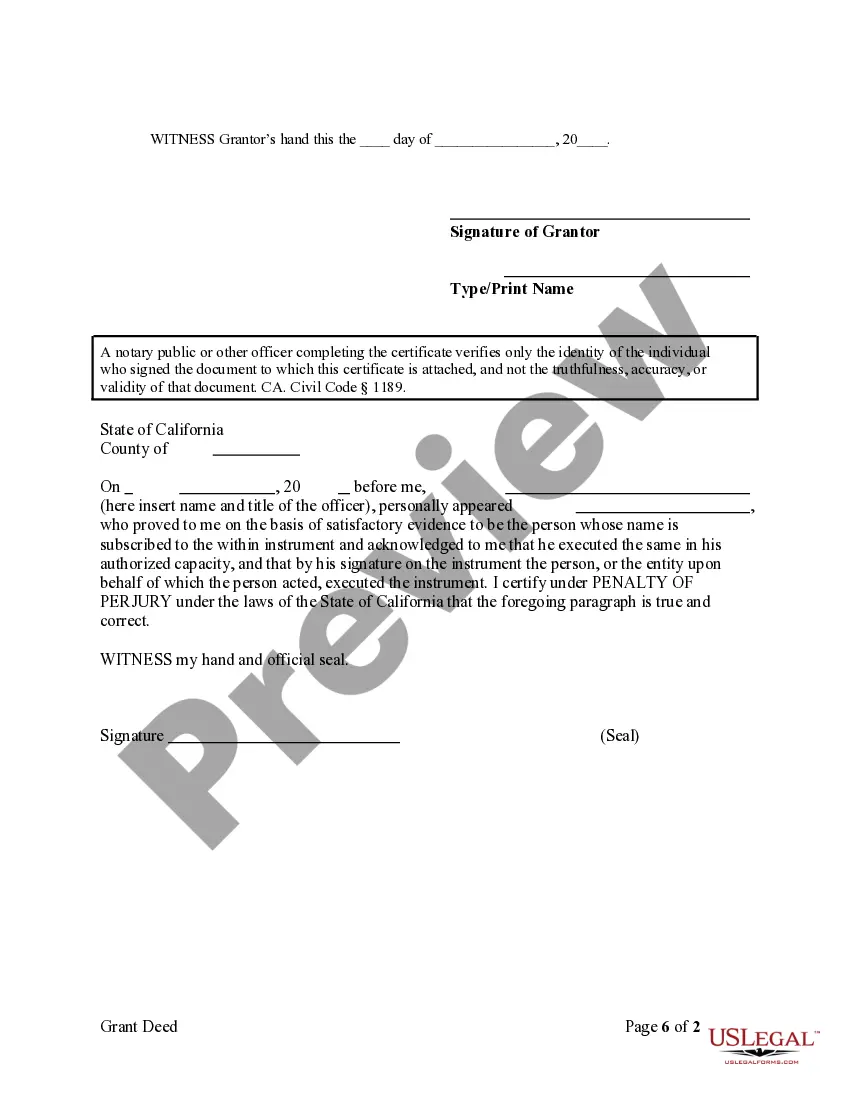

Step 1: Locate the Current Deed for the Property. ... Step 2: Determine What Type of Deed to Fill Out for Your Situation. ... Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign) ... Step 5: Grantor(s) Sign in Front of a Notary. ... Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)