California Grant Deed Document With Name

Description

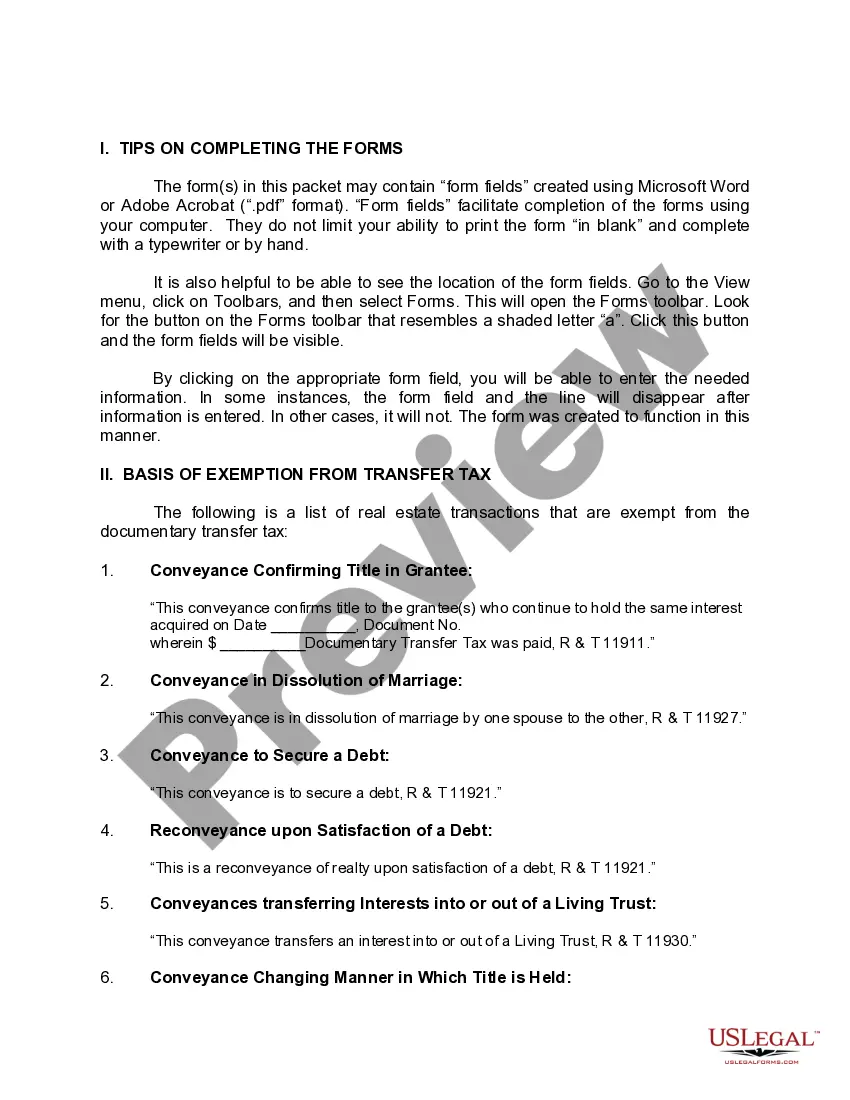

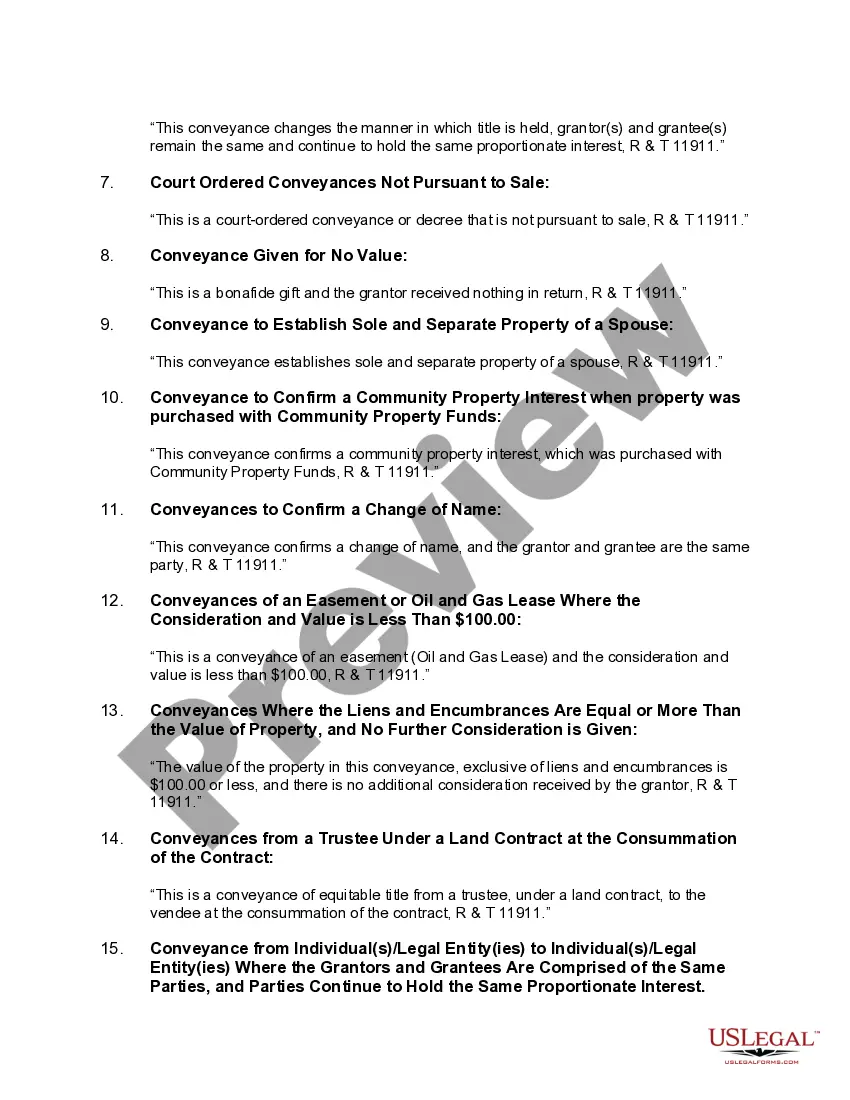

How to fill out California Grant Deed From Individual To Two Individuals As Tenants In Common?

Using legal document samples that meet the federal and state regulations is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time searching for the right California Grant Deed Document With Name sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all documents arranged by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a California Grant Deed Document With Name from our website.

Obtaining a California Grant Deed Document With Name is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the instructions below:

- Take a look at the template using the Preview option or through the text outline to ensure it fits your needs.

- Look for a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your California Grant Deed Document With Name and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

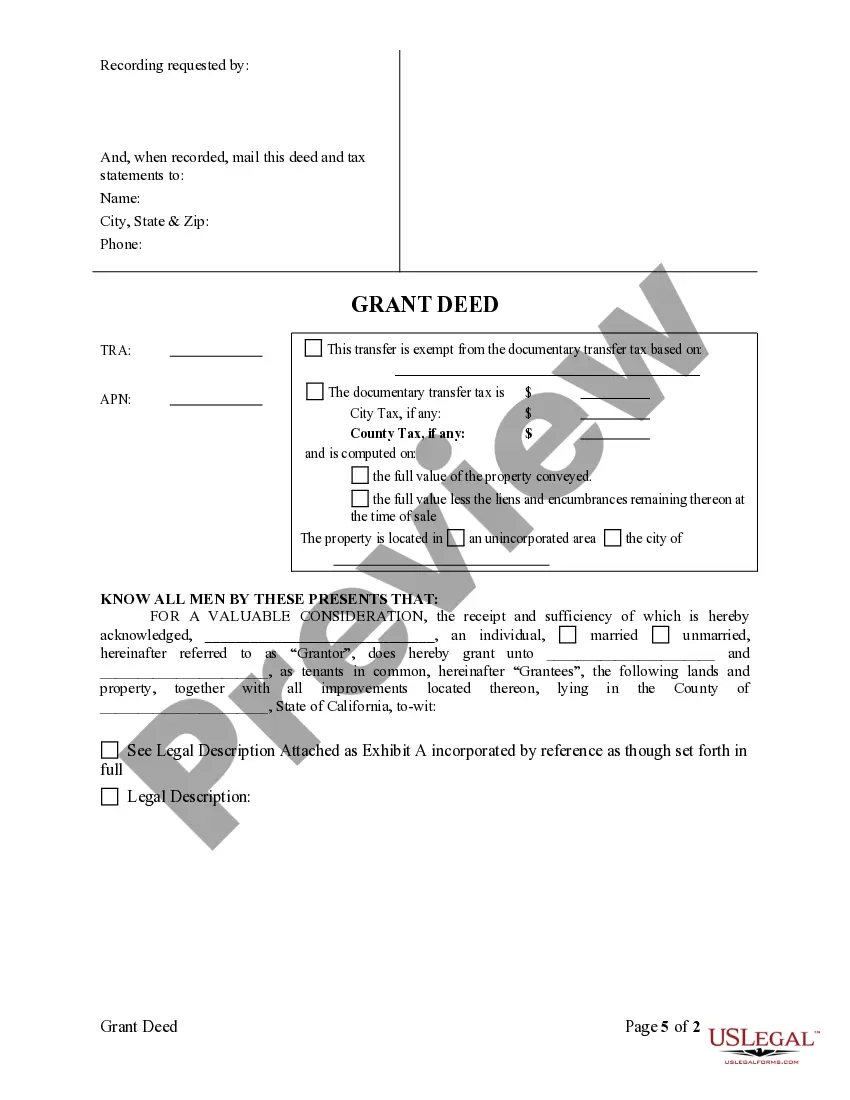

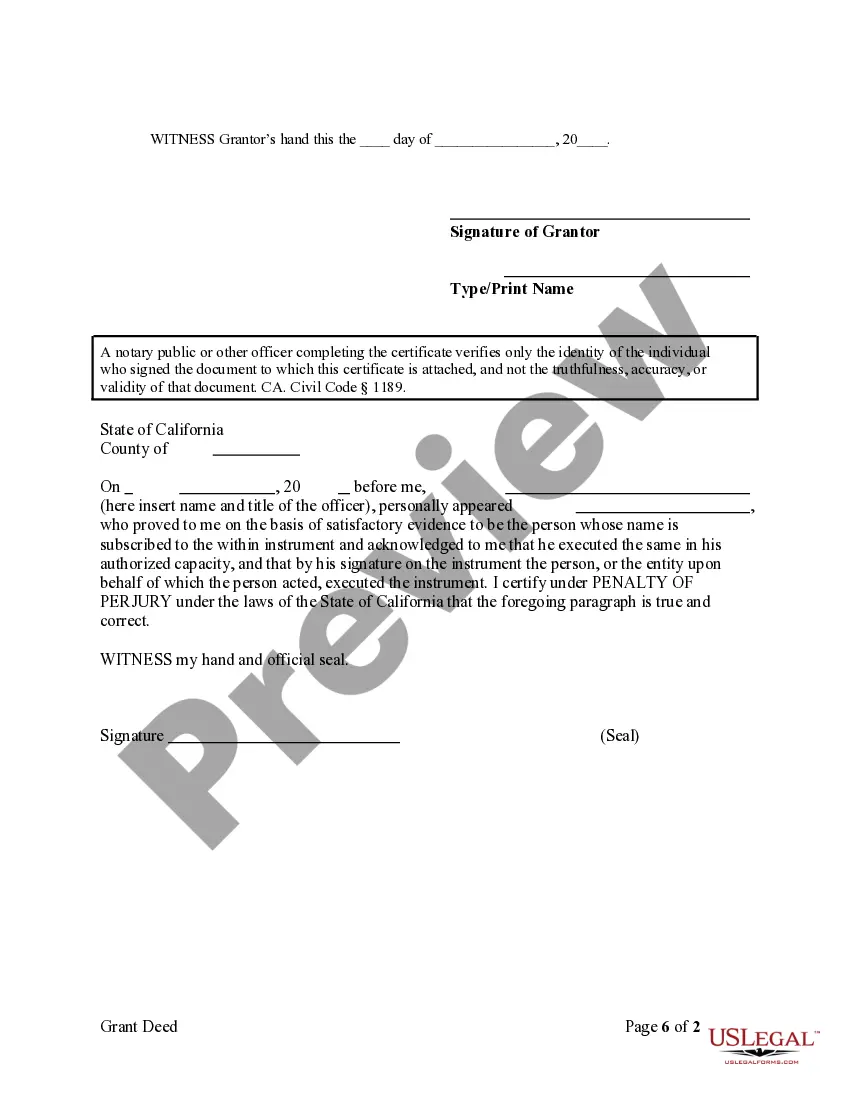

The Grant Deed (also purchasable at most office supply or stationery stores) is completed and signed by the grantor, whose signature must be notarized. If you determine there is no documentary transfer tax required, an exemption statement must appear on the document.

Adding A Family Member To A Property Title Choose the most appropriate deed. Prepare the deed. Complete the deed with accurate information about the property and the person being added. Sign the deed in the presence of a notary public. File the deed with the county recorder's office. Update the property records.

While recording a deed does not affect its validity, it is extremely important to record since recordation protects the grantee. If a grantee fails to record, and another deed or any other document encumbering or affecting the title is recorded, the first grantee is in jeopardy.

For example, a typical grant deed warranty statement is: "The Grantor warranties that the Grantor is lawfully seized in fee simple of said property, and that said property is free and clear from all liens and encumbrances incurred during the period of the Grantor's ownership, except as herein set forth, and except for ...

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.