California Limited Liability With Example

Description

How to fill out California Limited Liability Company LLC Formation Package?

Regardless of whether it is for professional reasons or personal issues, everyone must confront legal matters at some stage in their life.

Filling out legal paperwork requires meticulous care, starting from selecting the correct form template.

With a vast US Legal Forms collection available, there is no need to waste time searching for the right template online. Utilize the library's easy navigation to find the appropriate form for any situation.

- For example, if you choose an incorrect variant of a California Limited Liability With Example, it will be rejected when submitted.

- Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

- If you need to acquire a California Limited Liability With Example template, follow these straightforward steps.

- Locate the template you require by using the search bar or through catalog browsing.

- Review the description of the form to ensure it aligns with your situation, state, and county.

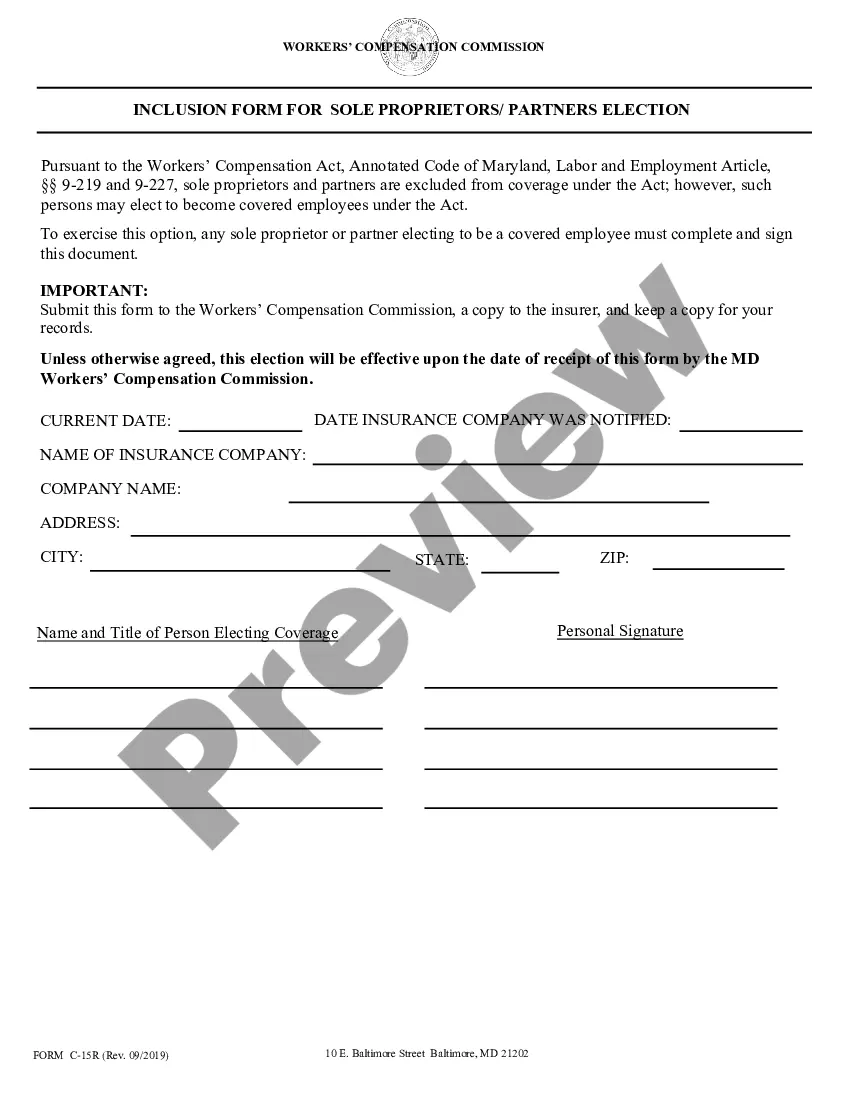

- Click on the preview of the form to examine it.

- If it is the wrong document, return to the search feature to find the California Limited Liability With Example template you need.

- Obtain the template when it suits your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the desired file format and download the California Limited Liability With Example.

- After downloading, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Limited liability refers to a legal structure that protects business owners from being personally liable for their company's debts. For example, if 'Tech Innovations LLC' faces a lawsuit, the owner’s personal savings and property remain untouched. In California, this concept is crucial for entrepreneurs as it allows them to take risks and grow their businesses confidently. Understanding California limited liability with example can help you make informed decisions about your business structure.

The acronym LLC stands for Limited Liability Company, a popular business structure in California. It provides owners with limited liability protection, meaning they are not personally responsible for the company's debts or liabilities. The symbols 🕊 💔 might represent the freedom and security that comes with this structure, allowing business owners to focus on growth without the fear of losing personal assets. Through California limited liability with example, you can see how this structure supports entrepreneurial aspirations.

life example of a limited liability company in California is a local bakery named 'Sweet Treats LLC.' This bakery operates under the limited liability structure, which protects the owner's personal assets from business debts. If Sweet Treats LLC were to face financial difficulties, the owner's home and personal savings would remain safe. This illustrates how California limited liability with example helps entrepreneurs mitigate personal risk while pursuing their business dreams.

To get a California limited liability company (LLC), you need to prepare several key documents and fulfill certain requirements. First, you must select a suitable name that meets California’s regulations, and file the Articles of Organization with the state. You also need an EIN for tax identification and to open a business bank account. US Legal Forms can help you navigate these requirements by offering easy access to the forms and instructions you need to successfully set up your LLC.

To start a California limited liability company (LLC), you need to choose a unique name that complies with state naming requirements. Then, you must file the Articles of Organization with the California Secretary of State. Additionally, you should obtain an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes and opening a business bank account. Using platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance.

When writing an LLC example, begin by clearly stating the name of the business, such as 'XYZ Innovations, LLC.' Follow this with a brief description of the business activities or services provided. Include information on the members of the LLC and how profits and losses will be allocated. This California limited liability with example offers a clear framework for potential members and helps guide business operations.

To form a California limited liability company, start by choosing a unique name that complies with state regulations. Next, file the Articles of Organization with the California Secretary of State, either online or by mail. After that, create an Operating Agreement to outline the management structure and operating procedures of your LLC. Finally, obtain any necessary licenses and permits, ensuring your business is compliant with local regulations.