This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Llc Operating Agreement California With Profits Interest

Description

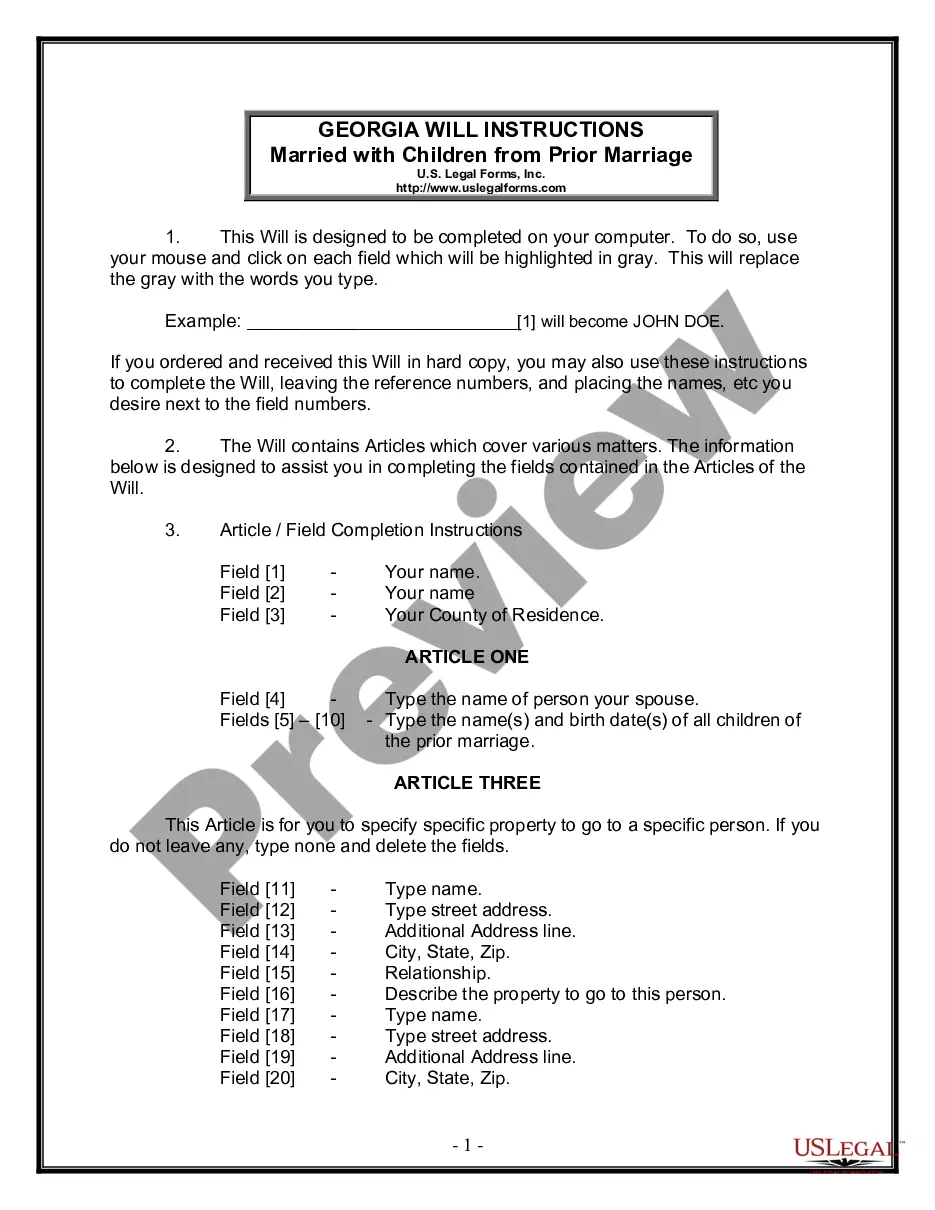

How to fill out California Limited Liability Company LLC Operating Agreement?

Whether you handle paperwork often or you occasionally need to submit a legal document, it is essential to have a helpful source where all the samples are relevant and current.

One task you need to accomplish with an Llc Operating Agreement California With Profits Interest is to ensure that it is the most recent version, as it determines whether it is acceptable for submission.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search menu to locate the form you require. View the Llc Operating Agreement California With Profits Interest preview and outline to ensure it is exactly what you need. After confirming the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card information or PayPal account to finalize the purchase. Choose the desired file format for download and confirm it. Eliminate confusion while dealing with legal documents. All your templates will be neatly organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that features nearly every form sample you might search for.

- Look for the templates you require, verify their applicability immediately, and understand more about their usage.

- With US Legal Forms, you have access to approximately 85,000 document templates across various fields.

- Obtain the Llc Operating Agreement California With Profits Interest samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will allow you to access all the samples you require with ease and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need are readily available, eliminating the need to spend time finding the right template or verifying its authenticity.

Form popularity

FAQ

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

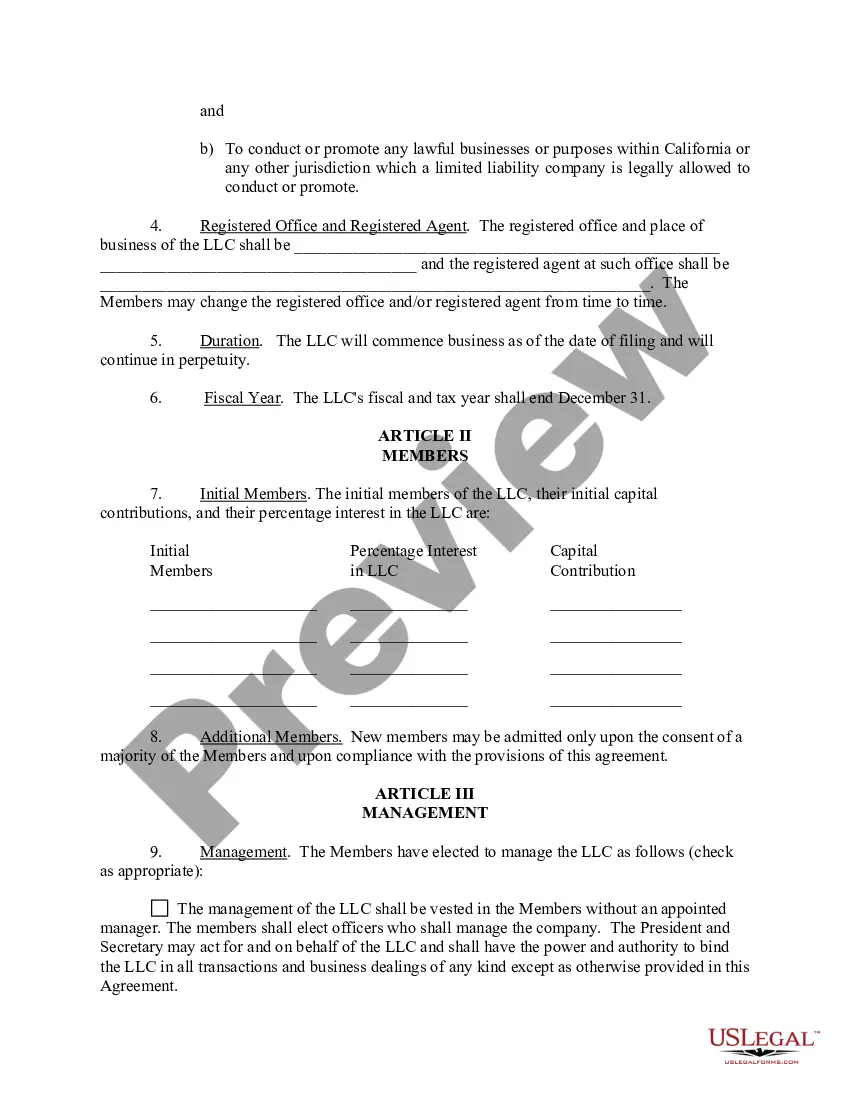

Divide ownership of the LLC by calculating total cash investment by the members. Give each member an ownership stake equal to his cash investment. Four members contributing $25,000 apiece would each receive a 25 percent stake in the company.

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

In most cases, the company will divide profits and losses based on ownership interests. A partner will receive shares of profits and losses depending on their financial contribution. For example, partner A has a 50% membership stake. Meanwhile, partner B has 30%, and partner C holds 20%.

For LLCs that are taxed as partnerships, the closest equivalent to a stock option in a corporation is called a profits interest. If you grant an individual a profits interest in an LLC, that individual is receiving an interest in both the future profits of the LLC, and the appreciation of the assets of the LLC.