Ca Dissolution Of Corporation

Description

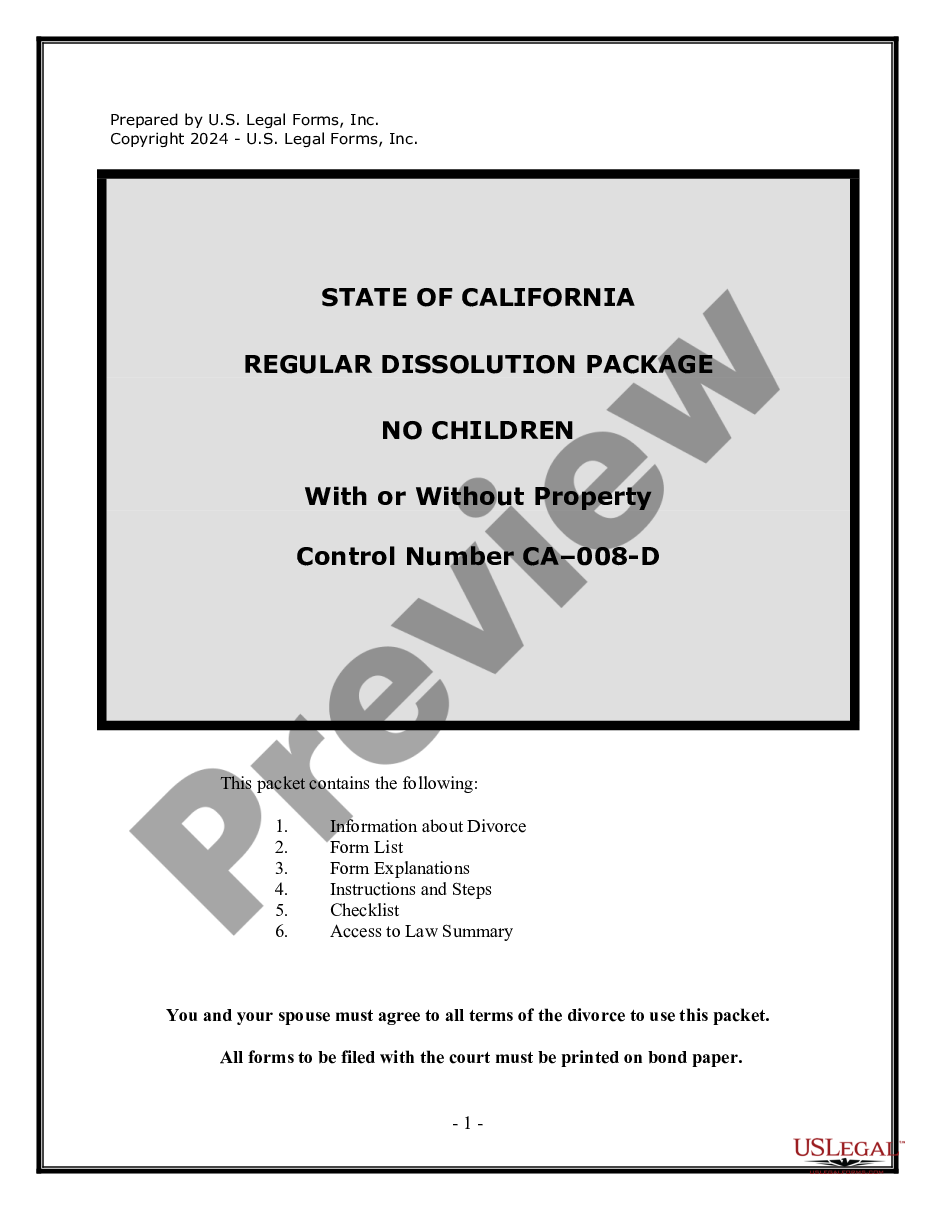

How to fill out California Summary Dissolution Of Marriage Package With No Children - Divorce?

Utilizing legal document examples that adhere to federal and state laws is essential, and the internet provides numerous alternatives to select from.

However, what’s the purpose of spending time searching for the properly constructed Ca Dissolution Of Corporation template online when the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by attorneys for any business and personal situation.

Review the template using the Preview option or via the text outline to ensure it meets your requirements.

- They are straightforward to navigate with all files categorized by state and intended use.

- Our experts stay updated with legislative modifications, ensuring that your documents are always current and compliant when obtaining a Ca Dissolution Of Corporation from our site.

- Acquiring a Ca Dissolution Of Corporation is swift and simple for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document template you need in your desired format.

- If you are new to our site, follow the instructions below.

Form popularity

FAQ

The process of dissolving a corporation involves several key steps. First, obtain approval from your board of directors and shareholders for the dissolution. After that, file the appropriate documents with the state, ensuring all debts are settled. Finally, submit your final tax returns to complete the CA dissolution of corporation and avoid future liabilities.

To initiate the CA dissolution of corporation, start by holding a board meeting to approve the dissolution. Next, file the necessary paperwork with the California Secretary of State, including a certificate of dissolution. Don’t forget to settle any outstanding debts and notify your stakeholders. Finally, submit final tax returns to complete the process.

To file a dissolution of a corporation in California, you need to complete the Articles of Dissolution form and submit it to the Secretary of State's office. Make sure to include all required information and fees. Platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance, making your CA dissolution of corporation experience smoother.

The time it takes to dissolve a corporation in California can vary. Typically, once you submit the Articles of Dissolution, it may take several weeks for the Secretary of State to process the documents. Factors like the complexity of your corporation's affairs can also influence the timeline for the CA dissolution of corporation.

Dissolving a corporation in California involves several key steps. First, convene a board meeting to approve the dissolution. Next, file the necessary dissolution documents with the Secretary of State, and notify creditors and settle any outstanding debts. Lastly, you should distribute any remaining assets to shareholders, ensuring compliance with the CA dissolution of corporation regulations.

To dissolve a corporation in California, you must first hold a meeting with the board of directors to approve the dissolution. After that, you need to file the Articles of Dissolution with the California Secretary of State. Additionally, it's important to settle all debts and obligations of the corporation before completing the CA dissolution of corporation process.

How to Dissolve a Corporation in California Step 1: Shareholders Vote to Dissolve the Corporation. ... Step 2: Prepare and File a Certificate of Election. ... Step 3: Board of Directors Provides Written Notice of Corporation's Dissolution. ... Step 4: Pay Taxes, Settle Debts, and Distribute Remaining Assets to Shareholders.

Requirements for SOS File the appropriate dissolution, surrender, or cancellation SOS form(s) within 12 months of filing your final tax return. Currently, LLCs can submit termination forms online.

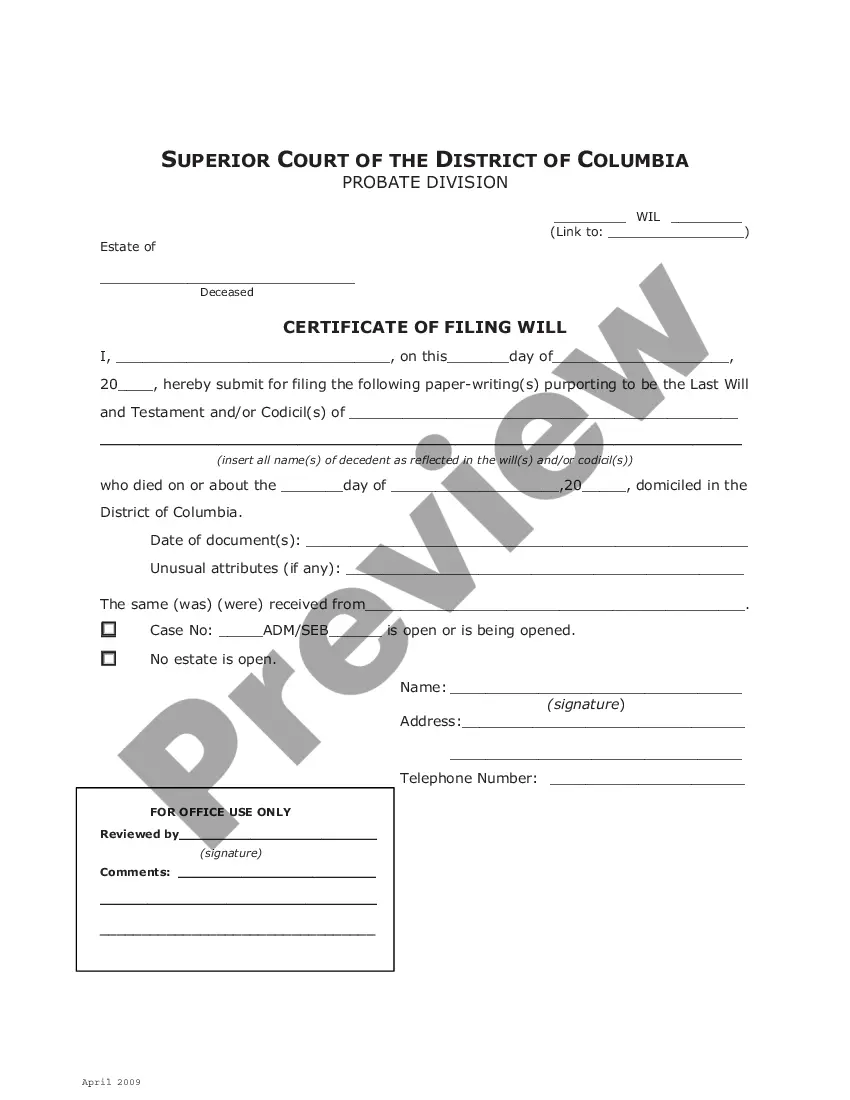

To put all on notice that the corporation has elected to wind up and dissolve, a California stock corporation must complete the Certificate of Election to Wind Up and Dissolve (Form ELEC STK). Before submitting the completed form, you should consult with a private attorney for advice about your specific business needs.

File the appropriate dissolution, surrender, or cancellation SOS form(s) within 12 months of filing your final tax return. Currently, LLCs can submit termination forms online. Online submission for Corporation and Partnership dissolution/cancellation forms is not available at this time.