Roofing Contractor Form For 1099

Description

How to fill out California Roofing Contract For Contractor?

The Roofing Contractor Document For 1099 displayed on this site is a reusable official template created by skilled attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has delivered individuals, organizations, and legal professionals with more than 85,000 authenticated, state-specific documents for any business and personal needs. It is the fastest, simplest, and most reliable method to obtain the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you seek and examine it.

- Browse through the example you searched and preview it or review the document description to ensure it meets your requirements. If it doesn’t, use the search bar to find the correct one. Click Buy Now once you have found the template you need.

- Subscribe and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the fillable document.

- Select the format you prefer for your Roofing Contractor Form For 1099 (PDF, DOCX, RTF) and download the template to your device.

- Complete and sign the documents.

- Print the document to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a legally binding electronic signature.

- Download your documents again.

- Utilize the same document again as needed. Access the My documents tab in your profile to redownload any previously purchased forms.

Form popularity

FAQ

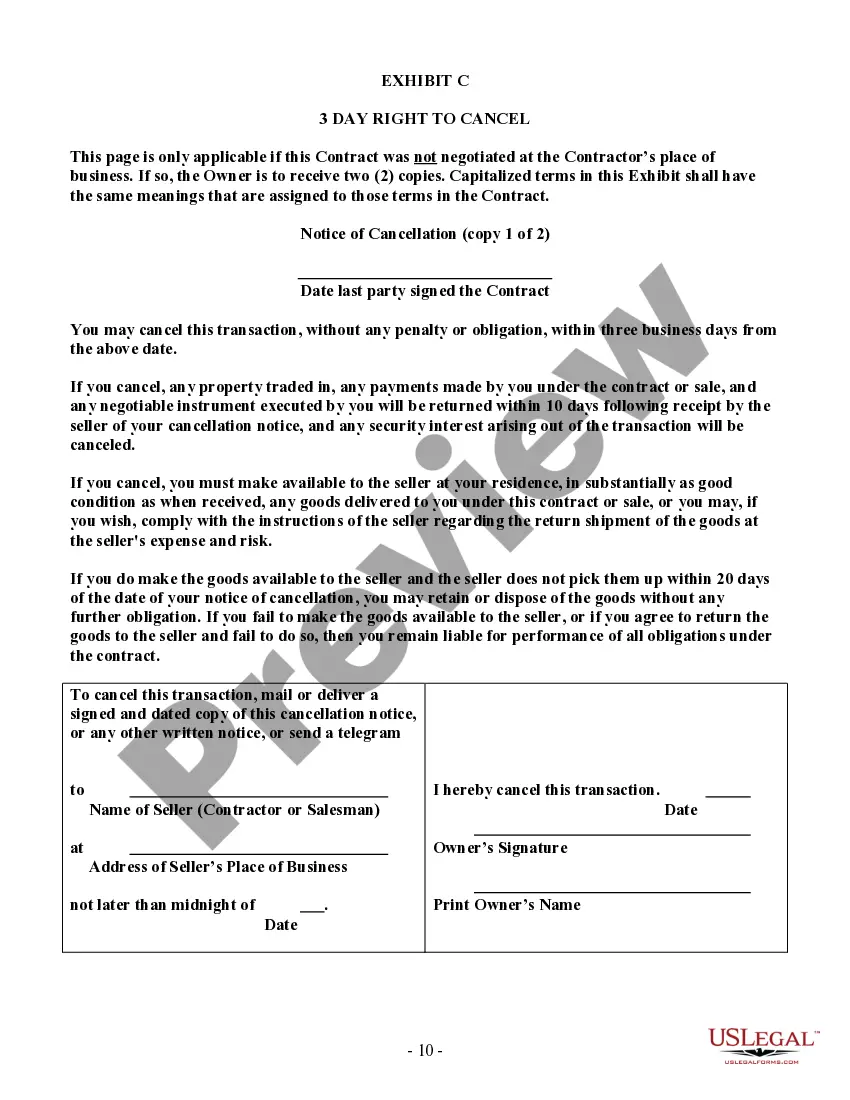

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.

Any time you pay a person over $600 you are supposed to 1099 them. In order to do this you'll need to have them fill out a IRS W-9 form which you can find here. Next time explain to your contractors that you will need to 1099 them and get a W-9 from them before you pay them.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

Basic 1099-NEC Filing Instructions. To complete a 1099-NEC, you'll need to supply the following data: Business information ? Your Federal Employer ID Number (EIN), your business name and your business address. Recipient's ID Number ? The recipient's Social Security number or Federal Employer ID Number (EIN).

If you are a contractor employed by a firm or individual to provide a service, they will almost certainly require you to fill out a W-9 form. You must validate information such as your name, residence, and tax id. The IRS website has all of the W-9 pages available and step-by-step instructions on filling them out.